double interview

The start of 2020 saw a massive drop in vehicle sales, a double-digit percentage fall due to Covid. So for example, in the first two quarters an average of 35% fewer vehicles were sold in Europe than in the equivalent quarter in 2019.

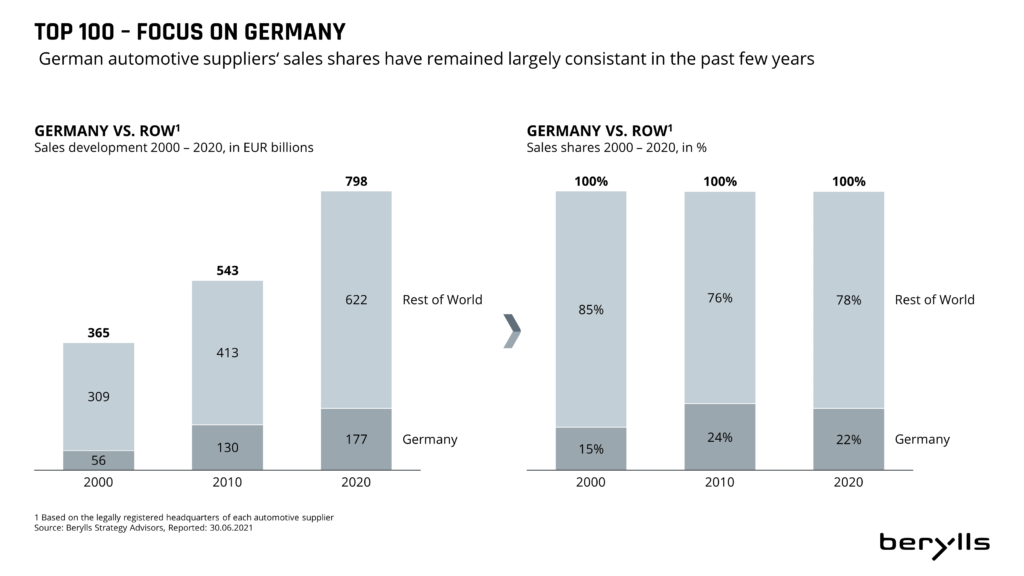

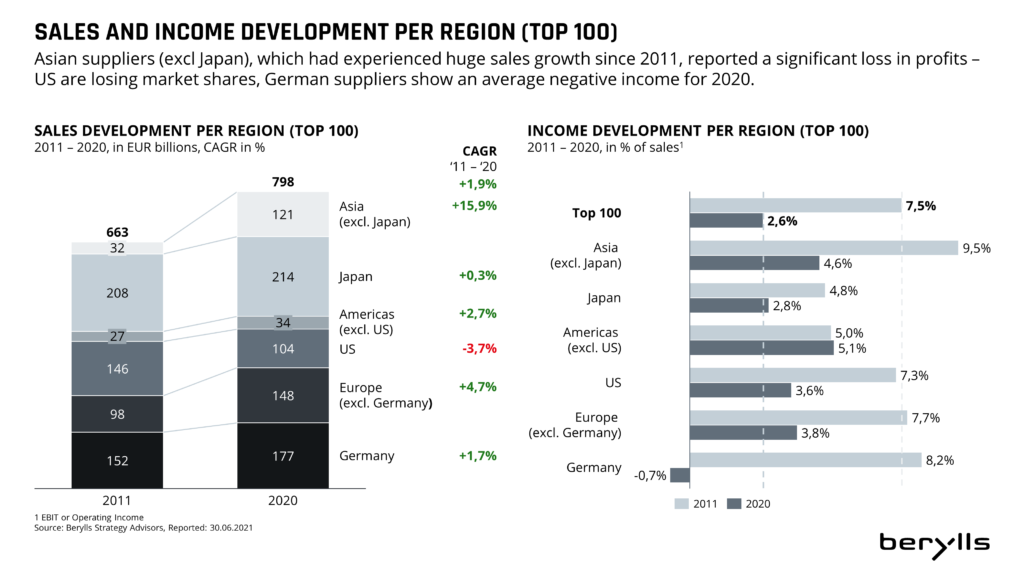

The world’s largest automotive suppliers generated 11% less turnover than in the previous year.

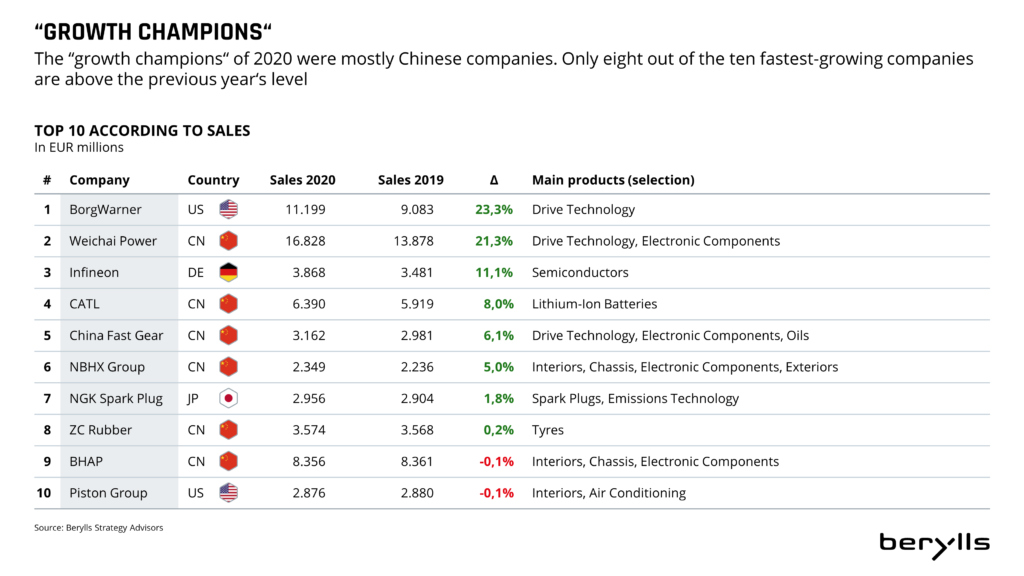

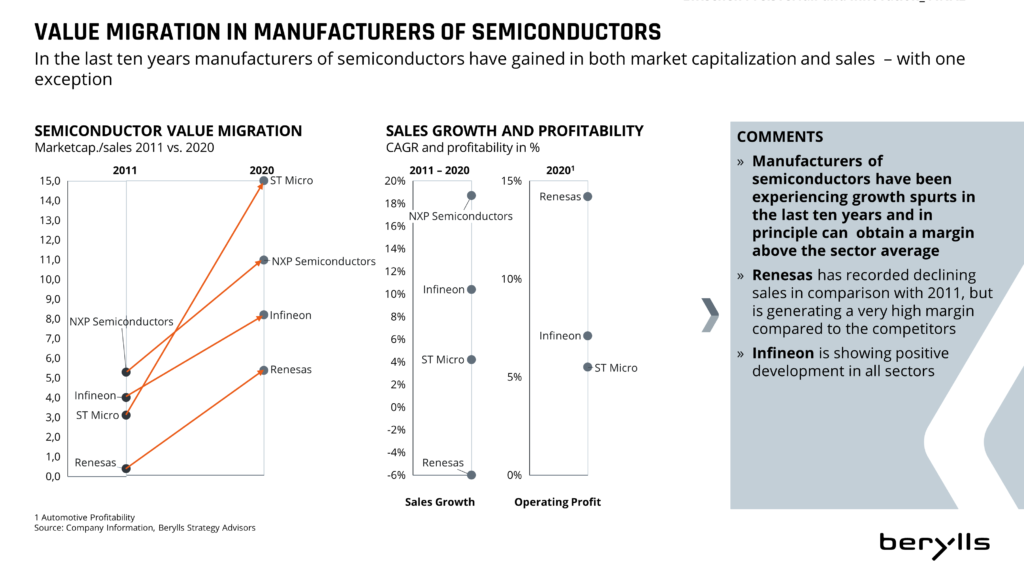

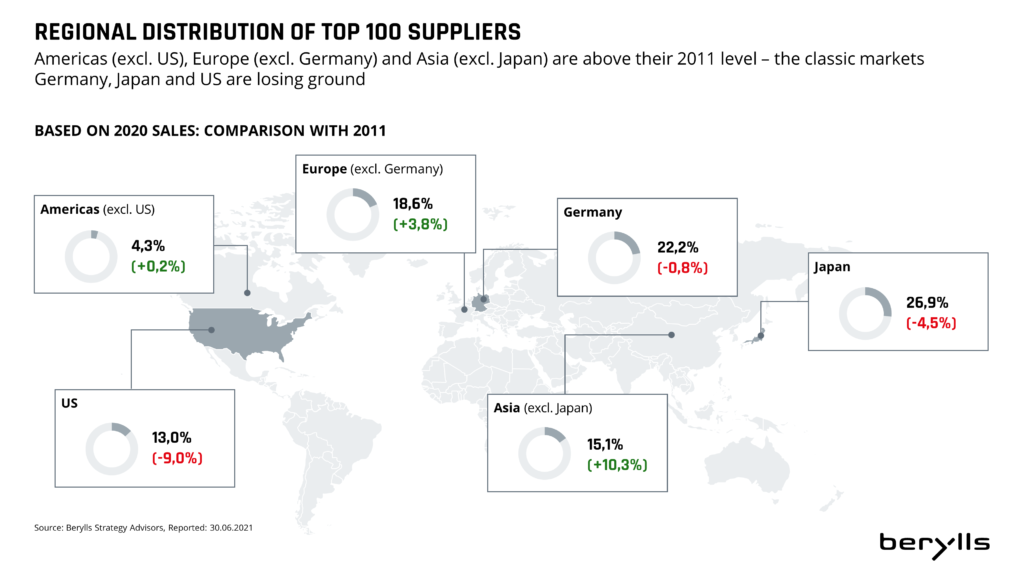

Operative profit also fell substantially and stood at around -8% in the second quarter. OEM business development showed a similar picture during the same period. Since autumn 2020 we have been experiencing marked signs of recovery in the supplier industry. Both turnover and profits were gaining considerable momentum by the end of the year; some profits with a double-digit percentage. We are expecting a recovery for the period between 2023 and 2026, reaching the levels of the pre-crisis years 2018 and 2019, boosted by the growth in South Asian and South American markets. China and Europe will remain the largest markets by far, but with substantially smaller growth rates.

All this has sharpened the trend towards a two-tier society. The big players are quickly returning to their previous profitability and good growth rates, while the mid tiers get left behind.

Indeed. A majority of suppliers reacted early in the first quarter of 2020 when the first signs of the crisis were coming from China, along with the associated falls in sales. Either performance programs which were already running had their requirements sharpened up, or new programs were launched at short notice.

Suppliers’ austerity programs focused mostly on indirect areas and concentrated more on increasing their efficiency. The focus was on optimizing business procedures supported by automation, as well as adapting organizational structures in central areas. Not infrequently, potential efficiencies in double-digit percentages were identified during the crisis and prepared for implementation. We are expecting to see the full effectiveness and visibility of these in the German supplier industry in the next two years.

The pandemic has highlighted global interdependence alongside automotive added value and the importance of robust supply chains. Not infrequently, OEMs have to coordinate more than 10,000 direct suppliers in more than 50 countries, a task which has become considerably more challenging in the context of the past year.

Production stops caused by Covid have severely shaken the OEM’s fragile supply chains, followed by a gradual acceleration lasting several weeks. We are anticipating that OEMs will invest 20 to 30 percent more in their supply chain excellence in the next few years. This will include AI-supported optimization of supply chains in order to improve transparency throughout all stages of the value chain and make a contribution to sustainability. This is becoming more important, as sustainability is a critical factor in the purchasing decisions of more than half of all customers.

The increased use of AI in supply chain management by OEMs also requires active participation on the part of the suppliers, as for example in the carrying out of self-assessments. We are also anticipating that suppliers will make increasing use of tool-supported solutions to master the complexity of global supply chains.

The Best Owner Group is taking an interesting approach to manage the transformation of selected German suppliers in an ordered and structured way. By streamlining activities in the traditional drivetrain area, efficiency and volume models can be realized and this is intended to give both hard hit suppliers and investors potential returns of 12 to 15 per cent.

Unfortunately, for over a year now we have only got as far as announcements. Above all, the tension between investors for the fund and the (IG Metall) employers’ interests is yet to be solved. It is also unclear how a business which suffers from continual market decline is supposed to generate such high long-term returns. Moreover, the structuring of the fund as “evergreen” – so that no companies from the portfolio are sold, is a high risk in such a market field. Who invests money in a sinking ship, even if it is going down very slowly? If the “funding” does not come to fruition in the coming months, the Best Owner Group will get off to a false start.

The big tech players such as Google, Apple, Microsoft or Nvidia, have already installed their software solutions in a large number of vehicles. Interest is continuing to increase due to the growing importance of automotive off-board software. The value of software amounts to just about 700 euros per average vehicle, and by the year 2030 this will rise to over 2,500 euros, three quarters of which will be generated in the off-board field. As well as the Californian tech giants, Chinese players such as Huawei and Baidu, and the Korean electronics entertainment companies Samsung and LG are entering the “software-defined car” market.

However, tax rates are not the problem when it comes to equal opportunity. It is true that in 2020 the three tech players Apple, Alphabet (Google’s parent company) and Microsoft are only paying between 14.4 and 16.5 per cent income tax, whilst Volkswagen, Daimler and BMW are contributing taxes of between 24.4 and 36.8 per cent of their taxable income. The three German OEMs together would have a higher profit of only around 3 billion euros at a tax rate of 15 per cent. The real problem lies in the pre-tax result, i.e. in the profit itself, not in the taxes. The tech giants are simply much more profitable. They draw an almost 6 times higher pre-tax result than the three German OEMs: 28.1 per cent as opposed to 4.8 per cent. Pre-tax profit for Apple alone is more than double that of the three German OEMs put together.

Hitachi Astemo, created from a merger between Hitachi Automotive Systems, Keihin, Showa and Nissin Kogyo, is a new leading supplier which will certainly appear in the top 20 for the year 2020. Its focus is very clearly the Japanese OEMs, above all Honda (which holds a third of the shares), as well as Nissan, Mitsubishi, Mazda and Subaru. European or North American customers are so far hardly represented. However, the new company has good opportunities in the field of e-mobility in Europe (traction motors, lithium ion cells and battery modules, water pumps and inverters) and autonomous driving (ADAS control devices, camera systems incl. object recognition). Hitachi has for example supplied the inverters for both the Audi e-tron and the Porsche Taycan. But beyond that further scope is unknown.

Delphi sold its “Powertrain”/motor business including e-mobility activities to Borg Warner three years ago for around $3.3 billion. Aptiv’s spin-off, completed in 2018, has been an outstanding development: they were able to double their share price, their market capitalization stands at around 40 billion euros, and all financial figures have improved. Aptiv is a success story. And yes, it serves as a role model for other automotive supplier companies. In the same period, Continental’s market capitalization has fallen by 35 per cent, its returns have dropped and Conti has lost its long-standing position as the second-largest supplier in the world to Denso. The legal spinning-off of Vitesco does mean that a first step has been taken; however Vitesco is still a part of Continental.

The German suppliers in particular are going to have to follow suit, in order to separate themselves from the classic combustion engine business, and focus on the forward-looking CASE business. So far the large European supplier companies have been much too hesitant in their transformation. Valeo, Bosch, ZF, Mahle, Faurecia or Benteler ought to tackle this in a similar way to Aptiv: on the one hand a clean break from the powertrain business, and on the other hand a focus on future business.

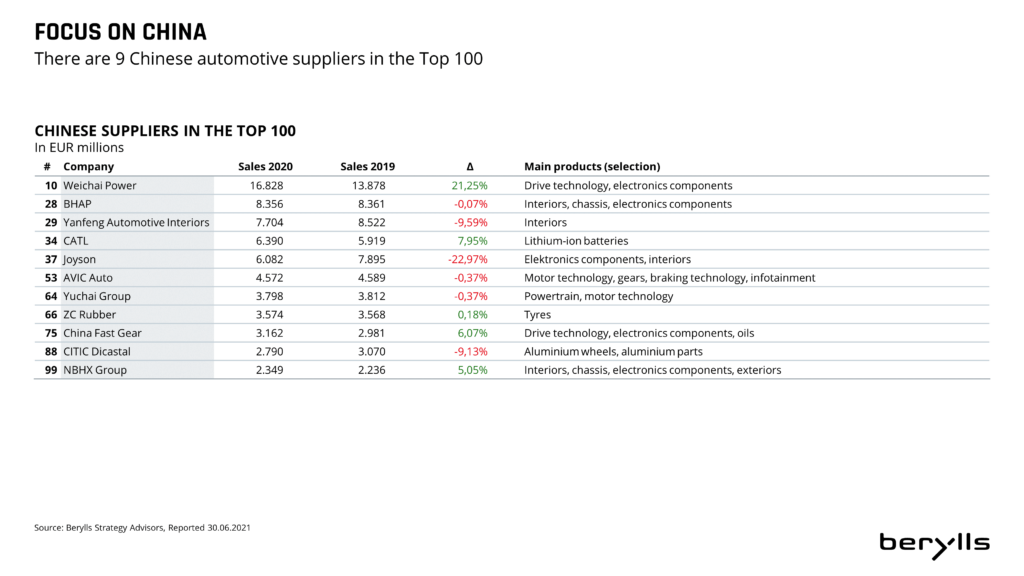

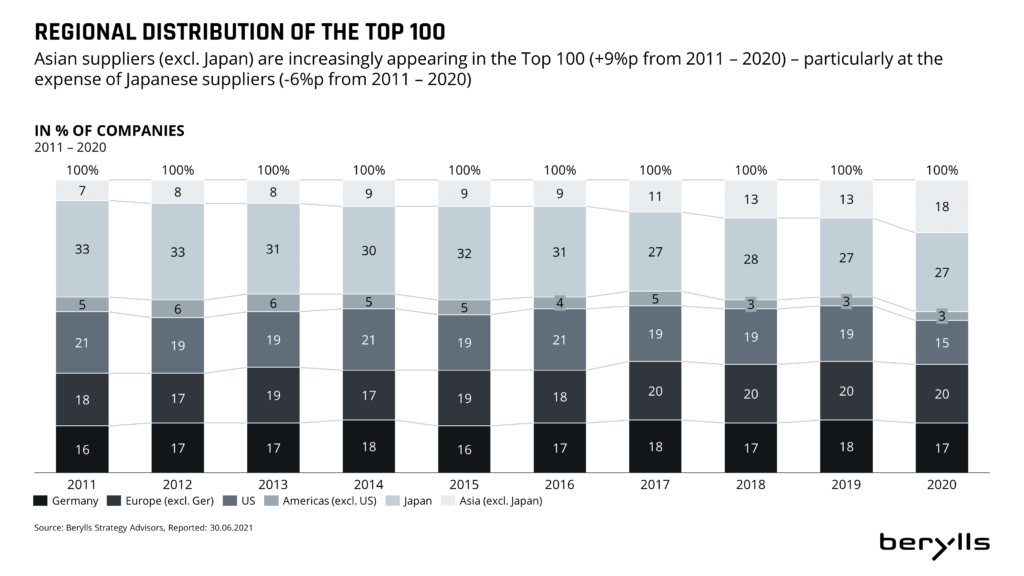

China’s classic players, such as Weichai, Huayu, BHAP, NBHX, Joyson or Yangfeng, will be expanding their European presence step by step in the fields of powertrain, interior or vehicle electronics. However, much more interesting are the new players in the Car OS Operating System (e.g. Huawei Harmony OS), connected services (AliPay and Tencent Integration), autonomous driving (Baidu), e-mobility components, V2X, vehicle platforms and contract manufacturing (Foxconn with the MIH EV platform).

Chinese OEMs will also be increasing their export to (Western) Europe in the coming years and expanding their activities in these markets; how far the Chinese suppliers do the same should be monitored attentively. In China itself, suppliers like Bosch, Conti and ZF must take care not to be overtaken. For this reason they must increase their local activity in the short and medium term and build up local know-how and capacities, especially in the fields of connectivity and autonomous driving. The Chinese government is focusing on “intelligent connected vehicles”, and so interesting opportunities are arising.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.