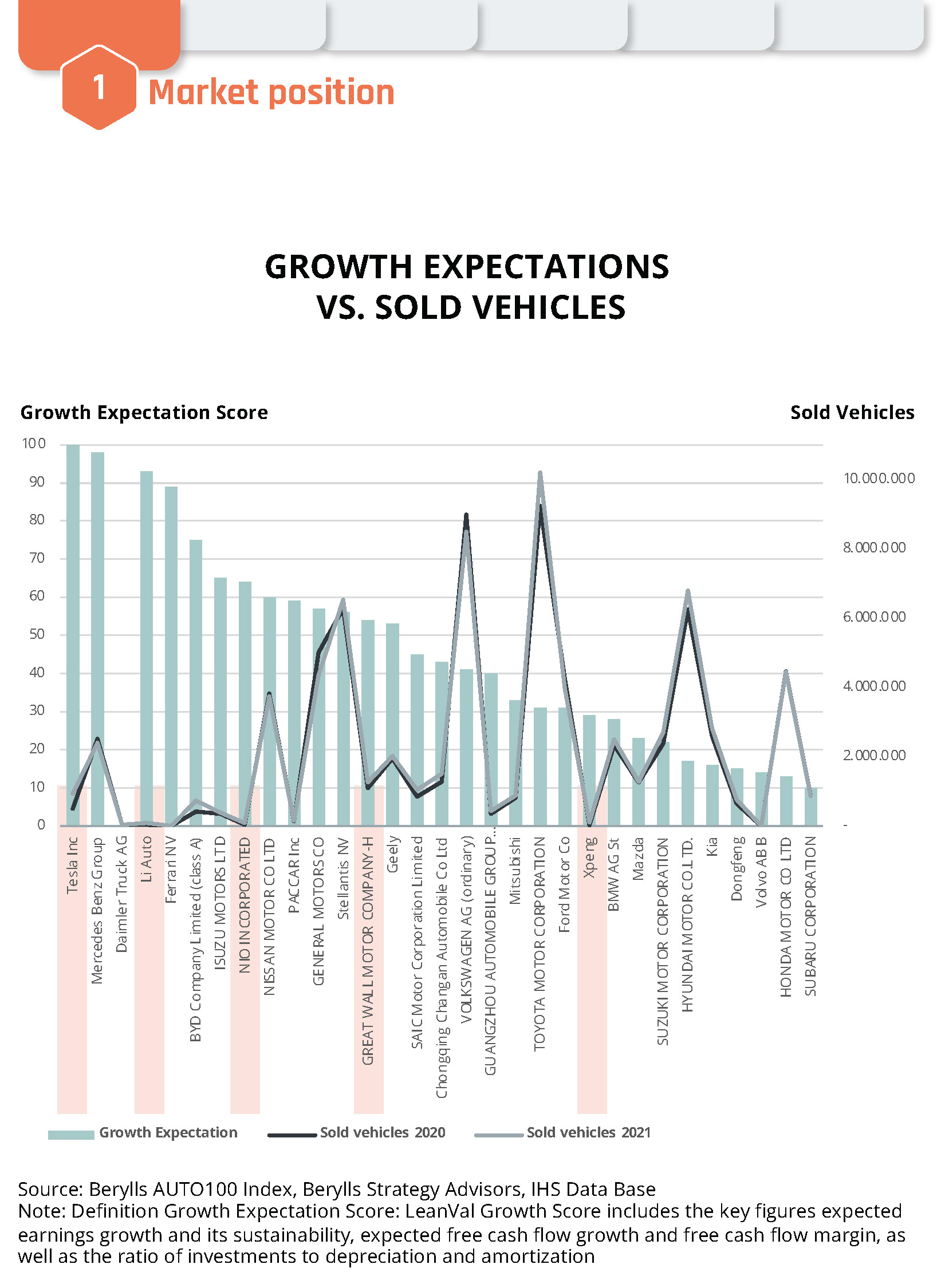

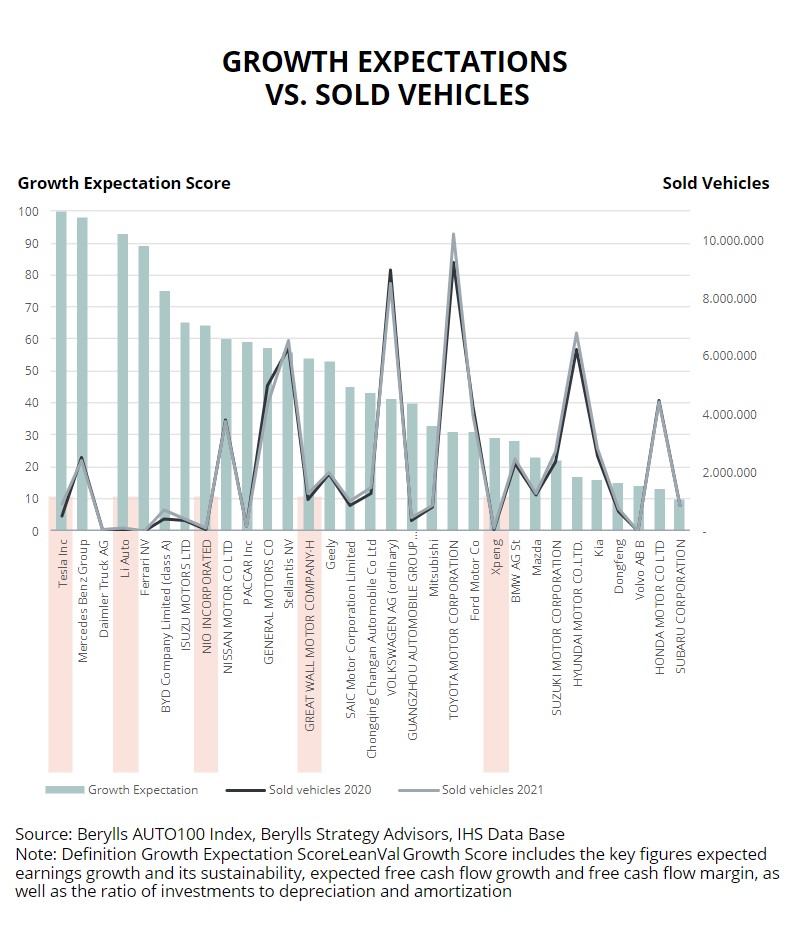

Successful automotive companies understand exactly what their customers value and are willing to pay for. They also have a clear understanding of how they are viewed in relation to competitors.

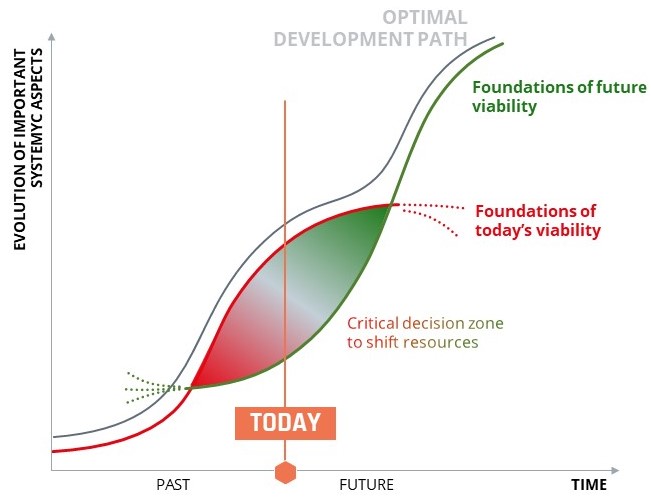

As companies race to keep up with the EV transition, future growth expectations trump past sales records. New players have the ability to adapt, improve and expand their business models at a rapid pace, which leads to high growth expectations. But they still need to build trust and a loyal customer base.

On the other side, traditional players are adept at leveraging their established brand profile and reputation to win and retain customer trust and loyalty. However, their sheer size and market power blurs their customer focus and slows down decision-making.