ow the world’s carmakers can reduce their reliance on China for EV battery supplies. OEMs urgently need to develop alternative battery supply chains and optimize their battery manufacturing processes to ensure a sustainable EV business

European and US car manufacturers are critically dependent on China’s vast automotive market, with German OEMs among the most exposed. For example, in 2020 Volkswagen sold almost half of its cars in China, compared with around one-third of total output for BMW, Mercedes-Benz and Audi.

Clearly, German and other European, US and Asian OEMs rely on Chinese consumer demand and the continued willingness of the Chinese government to provide market access for their vehicles. But their dependency extends further.

In the past decade, China’s mining companies and battery manufacturers have been on a shopping spree to acquire resources around the world that will secure its future supplies of copper, cobalt, lithium and other raw materials. For example, Chinese companies now own most mines in central Africa, which produces around 70% of the world’s cobalt. In 2020, China controlled more than 80% of the world’s raw material refining capacity for battery production, 77% of the world’s battery cell manufacturing capacity, and 60% of the world’s component manufacturing for the lithium-ion battery supply chain.²

Given this current dominance, it is no surprise that BloombergNEF forecasts that China will still be the world leader in 2026 among countries involved in the lithium-ion battery supply chain.³

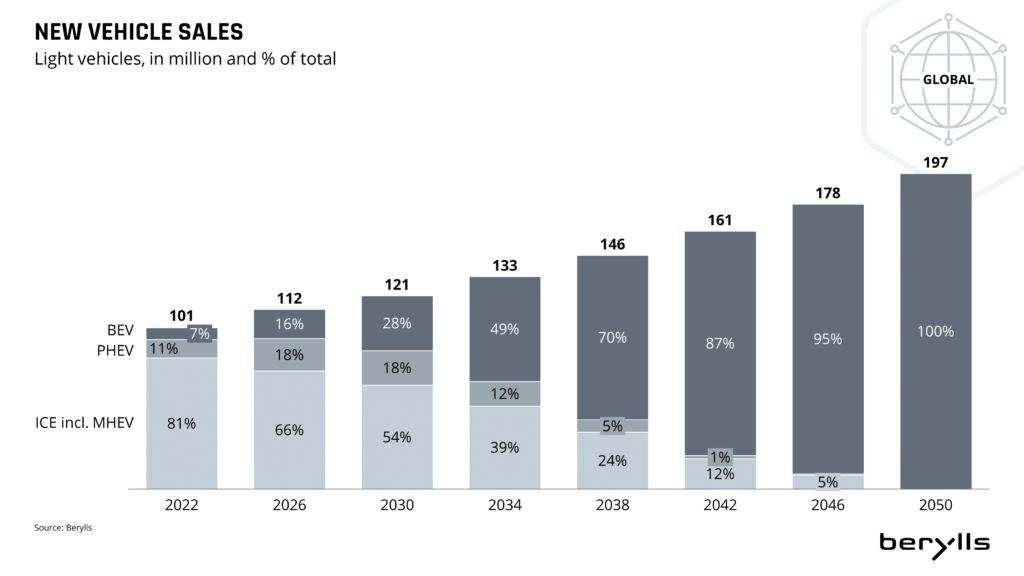

Beijing’s raw materials strategy has been fully vindicated by the accelerating transition to electric transportation. Berylls forecasts that in the next 15 years, over half of all vehicles sold worldwide will be electric, and that on present trends, most of these EVs will have batteries consisting of raw materials owned by Chinese mining corps.

Chart 1: New Vehicle Sales

Furthermore, China has the manufacturing capacity to produce these batteries. According to Benchmark Minerals Intelligence (BMI), 148 of the world’s 200 lithium-ion battery “megafactories”⁴ in the pipeline for 2030 are in China.⁵

Before 2018/19, German automakers believed that it was not worthwhile to produce their own battery cells, because they were too expensive and due to relatively low figures too unprofitable. They are now being forced by the sheer speed of the EV transition to make up for lost time.

The challenge for German OEMs, like other Western car manufacturers, is obvious. As the number of electric cars increases, so does the number of batteries required to make them – and thus their dependence on Chinese suppliers. German OEMs urgently need to develop alternative battery supply chains and optimize their battery manufacturing process to mitigate this China-dependency risk and ensure a sustainable EV business.

The encouraging news is that German manufacturers are starting to rethink their battery strategies, in a rapidly growing EV market where “green” mobility, new drive systems and sustainable transportation featured as the main topics at the 2021 IAA international motor show. For example, in September 2021 Daimler joined the Automotive Cells Company (ACC) battery alliance with Peugeot, Fiat and Opel owner Stellantis and France’s TotalEnergies.⁶ The alliance aims to ensure these partners’ EV market independence.

An alternative strategy for reducing reliance on Chinese battery suppliers is battery recycling, where Volkswagen Group is an example worth watching. The company has set an ambitious long-term target to recycle 97% of all the raw materials in its EV batteries⁷, and at the start of 2021 it set up a pilot plant for recycling in Salzgitter.⁸ The coveted raw materials in the cells are recycled, along with the outer shell, the wiring and the packaging of the modules.

Profitable and sustainable battery recycling depends on not too much capital and labor being expended in the process. To this end, the battery must be designed and built in such a way that it can later be easily disassembled and recycled.

Another important avenue that OEMs should explore to reduce their EV battery dependence on China is increased investment and research into new battery generations with advanced technology. Many major battery cell manufacturers have already announced that they will begin production of cobalt-free batteries within the next years. Meanwhile, a number of leading automakers, including VW and BMW, have high hopes for solid-state batteries, which are expected to have a higher energy density and be cheaper to produce, faster to charge, and safer. BMW is eager to develop its first solid-state battery prototype within the next two to three years.

The goal for German OEMs, like other non-Chinese car manufacturers, must therefore be to secure their battery supply chain while researching and developing new battery technologies. As German OEMs have belatedly begun to realize, any manufacturer outside China that wants to succeed in the EV market will need a battery supply strategy in addition to a product strategy.

Willy Lu Wang (1981) joined Berylls Strategy Advisors in 2017. He started his career participating in the graduate program of Audi focusing on production planning. After stations at another strategy consultancy as well as being the strategy director for a German Tier-1 supplier, he is now responsible for the China business at Berylls. He has a broad consulting focus working for all clients in China, whether they are JVs, WOFEs or pure local players. He is also responsible for the development of AI and Big Data products dedicated towards the Chinese market further strengthening the Berylls End-to-End strategy and product development capabilities.

Wang studied Electronics & Information Technology with focus on Systems and Software Engineering and Control Theory at Karlsruhe Institute of Technology.