WANT TO DISCOVER MORE?

SEARCH

WANT TO DISCOVER MORE?

SEARCH

he Chinese government has backed EV development for two decades, but the number of ICE cars on the roads will still be increasing in 2030

By every measure, China is the world’s most important car market – this year 29 million vehicles are expected to be sold in the country, compared with 21 million in the US and 20 million in the EU. China will further eclipse these two regions in the coming decade: by 2030, Berylls expects 38 million new vehicles to be registered annually in China, equivalent to 31% of the global market, compared with 20% and 18% market share in the EU and US respectively.

The country is also the world’s biggest xEV market, with around 3 million of what the Chinese government calls ‘new energy vehicles’ (NEVs) sold in 2021. Will it retain this leading position over the next decade, as European and US carbon emissions commitments drive the xEV transition in those regions?

NEW ENERGY VEHICLES SOLD (in 2021)

At the UN Climate Change Conference (COP26) in Glasgow in 2021, China committed to the 2015 Paris Climate Agreement to limit global warming by 1.5 °C, and the country (the world’s biggest greenhouse gas emitter) has set a goal of being carbon neutral by 2060. Around 10% of China’s emissions come from the transport sector, and one of the key milestones en route to 2060 is the Chinese Communist Party (CCP)’s target for NEVs to account for 40% of all new vehicle sales by 2030.

In this report, we will look at China’s plans for decarbonizing road transport and how realistic its goal is, in light of the following market dynamics:

China will be the biggest xEV producer worldwide, making 13 million battery electric vehicles (BEVs) a year by 2029

The country will more than triple its battery cell production capacity by 2030

Customer sentiment seems to have fully embraced electrification, and Chinese OEMs such as NIO are ranked more highly than international brands

However, the number of internal combustion engine (ICE) vehicles sold will still be rising in 2030, and make up the largest proportion of cars on China’s roads

China has had a systematic NEV strategy for decades: the target of reaching 40% of new vehicle sales from NEVs by 2030 is not a hurried concession to the growing international pressure to address climate change. Even before the turn of the millennium, the country had a goal to become the world’s leading automotive nation, and new electric drivetrains were a potential route to overtaking established leading markets such as Germany and the US.

NEV development was first funded in the CCP’s tenth Five-Year Plan in 2001, and up to 2008 the focus was on developing pilot vehicles with electric drivetrains. From 2009 to 2016, NEVs were sold to the local market with significant government subsidies and purchase incentives.

Since 2017, subsidies have been much more strictly linked to technical specifications such as range. The current funding program will finish at the end of 2022, however, as has happened in the past, subsidies may be extended, with stricter requirements for eligible EVs. The NEV market is also supported by the “dual credit policy”, a form of carbon market, where OEMs have to meet quotas for NEV production (16% in 2022).

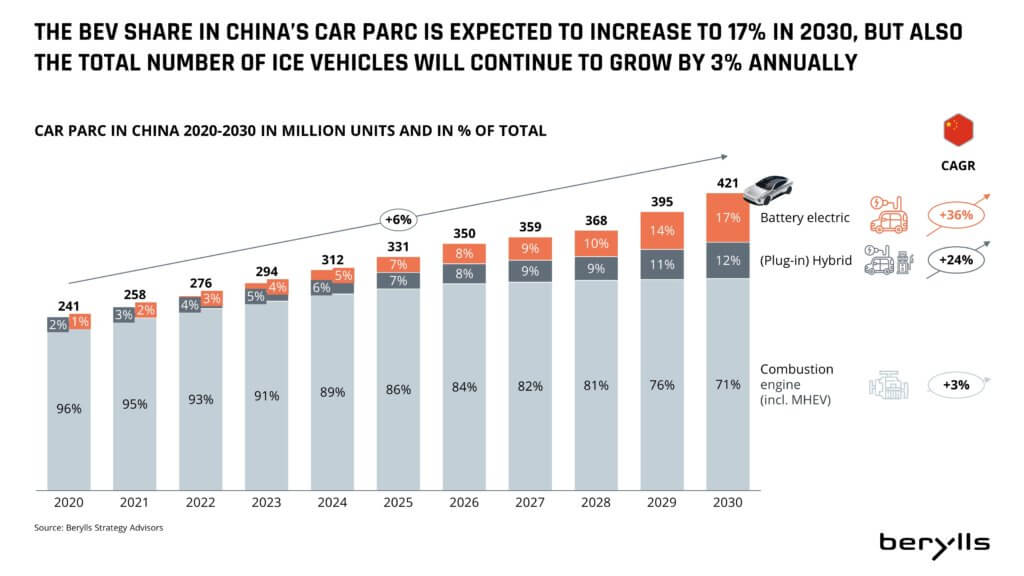

However, despite two decades of government support for e-mobility as a means to close the gap between Chinese and foreign OEMs, our analysis shows that the total number of ICE vehicles on the road in China will continue to increase by 3% a year out to 2030, even if the target quota of 40% NEVs is reached.

As the chart below shows, traditional drivetrains (including mild hybrid vehicles) will account for 71% of cars on the road, the equivalent of 300 million vehicles, at the end of the decade. China’s current NEV targets therefore do not go far enough to cut the number of carbon-emitting vehicles on the road.

Figure 1

While the task of cutting the number of polluting vehicles on the road is far from complete, in several key areas China’s long-term NEV strategy has put it far ahead of Europe and the US.

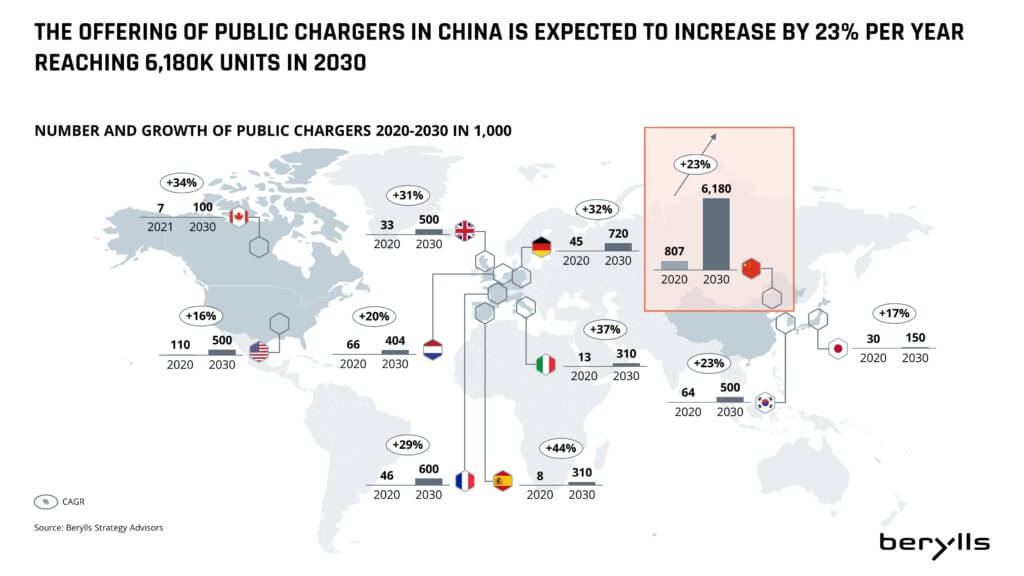

The CCP recognized early on, for example, that the success of NEVs would depend heavily on the availability of charging points. Government programs have subsidized the building of public charging stations since 2014, and approximately 1 million have now been installed.

This means China has by far the largest network of EV charging infrastructure worldwide, with a ratio of 8 BEVs to one charging station. That compares with a ratio of 20:1 in the EU, and sets the global benchmark. Progress is not stopping – as Figure 2 shows, the number of public charging points is expected to increase by 23% a year to reach 6.18 million by 2030.

Figure 2

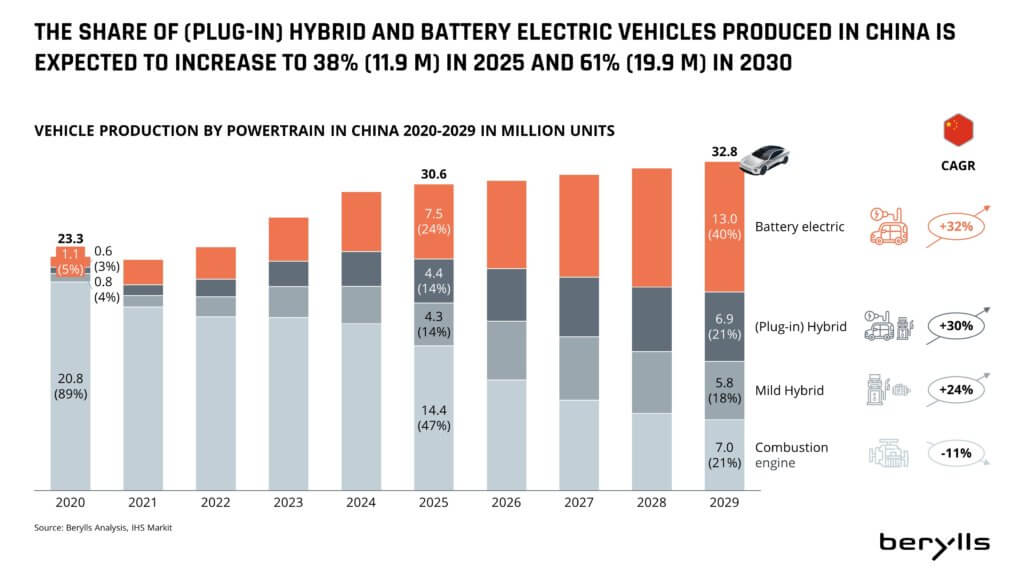

BEV production is also ramping up – today the segment accounts for around 5% of vehicle production, and plug-in hybrids (PHEVs) for another 3%. However, we expect BEV production to accelerate significantly, growing by 32% a year to reach 13 million vehicles annually in 2029 – the equivalent of 40% of all car production (Figure 3). By comparison, we expect the US to produce 4 million BEVs a year in 2029, or 36% of total production volume.

Figure 4

China’s long-term strategy for NEVs also means it has built up a world-leading advantage, in the critical area of battery supply.

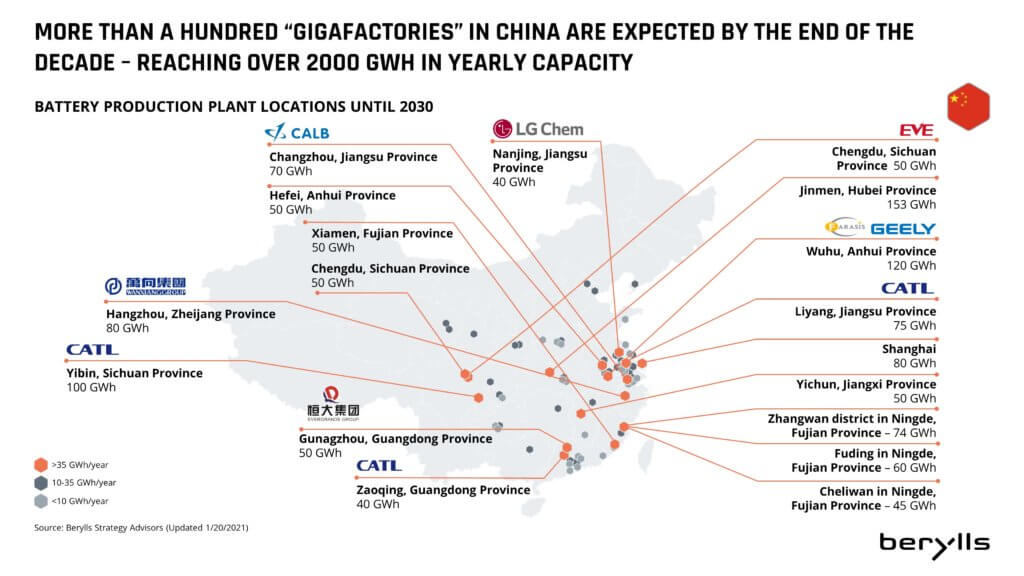

At present, about 80% of the world’s EV batteries are made in China, and OEMs worldwide are heavily dependent on exports from the country: around 70 percent of the battery cells needed for cars manufactured in Europe, for example, come from China. China’s CATL is now the global market leader in lithium-ion EV batteries, along with LG Energy Solution (South Korea) and Panasonic (Japan).

Today’s installed production capacity in China is about 650 GWh/year; we expect capacity to increase more than three-fold to 2,260 GWh by 2030, equivalent to a compound annual growth rate (CAGR) of 16.5%.

Assuming an average capacity of 90 kWh (BEV) / 15 kWh (PHEV), we expect domestic demand in 2029 to be around 1,300 GWh a year, so China will still have plenty of capacity to export battery cells.

Highlighting the scale of China’s battery cell production advantage in comparison with other large automotive markets, there are already several dozen “gigafactories” for Li-ion cells in the country, whereas in the US there are just five. By the end of this decade, there will be more than 100 gigafactories in China, while in the US, 17 have been announced (Figure 5).

Local production of battery cells is a key advantage for Chinese OEMs, and a vital enabling factor in making the country a leading automotive nation. A key question in the years ahead is whether the country can maintain its pioneering role, not only in terms of quantity, but also in terms of battery technology.

Figure 4

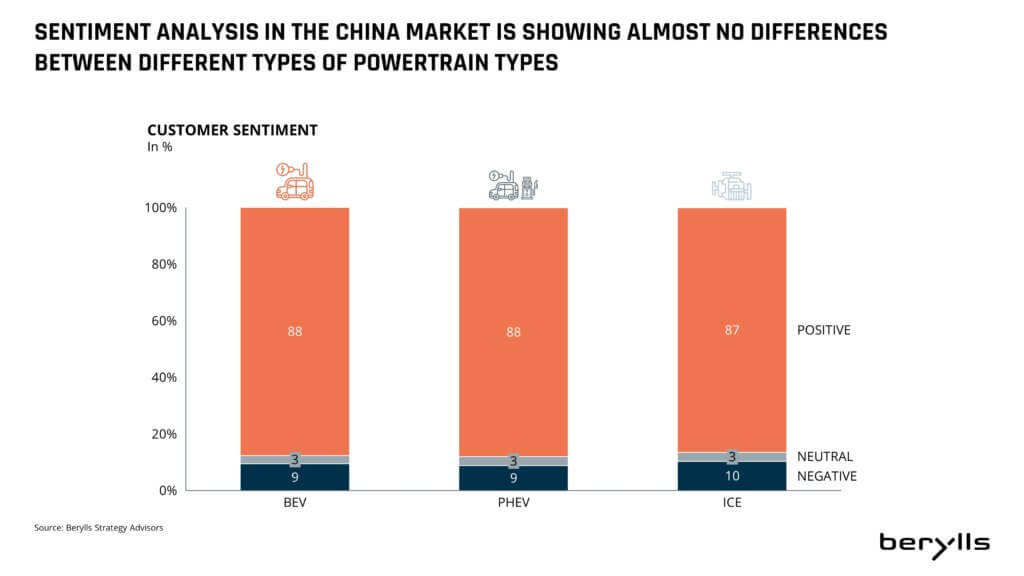

Customers in China seem to have fully embraced electrification. Our analysis of customer sentiment in the country showed almost no differences between the various powertrain types (Figure 6). In fact, the differences between their positive or negative feelings about individual models are significantly greater than between BEV, PHEV or ICE groups.

Figure 5

Reasons for this include the fact that a high proportion of driving happens in urban areas in China (compared to the US for example) and BEVs and PHEVs have a clear advantage in that environment. Other advantages are being able to drive NEVs on days when ICE vehicles are banned due to high pollution levels, and government subsidies for NEVs. An appealing range of NEVs in the lower price segments made by Chinese OEMs also firmly established BEVs and (P)HEVs in the Chinese volume market at an early stage.

Figure 6

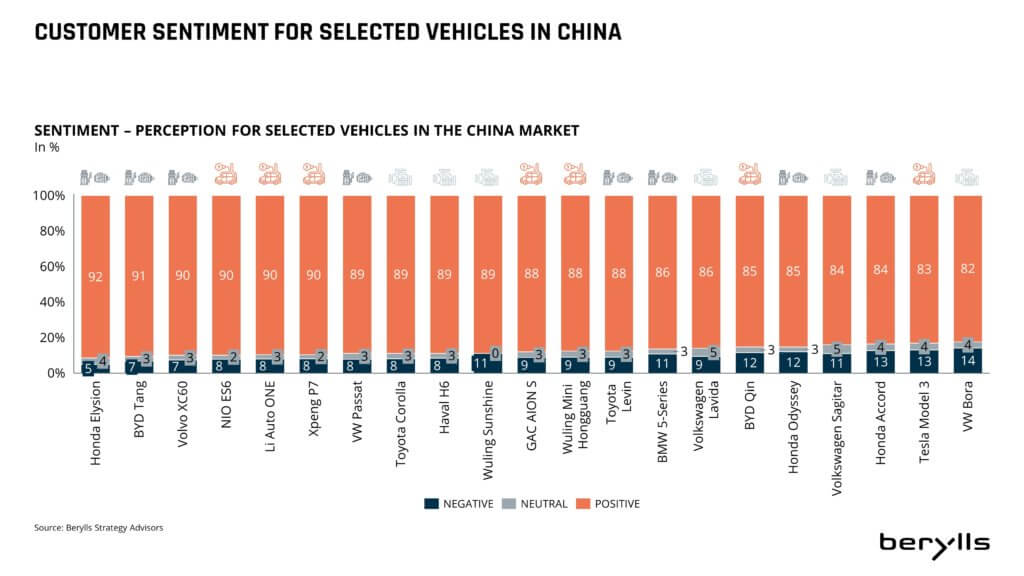

Chinese OEMs also know their customers: the NIO ES 6 performs significantly better in customer sentiment scores than a Tesla Model 3, for example, and a BYD Tang PHEV ranks significantly higher than a BMW 5 Series PHEV (Figure 7).

Driving performance and technical details are not as relevant to NEV customers in China as in other markets, whereas cars with a modern aesthetic and a spacious interior win positive ratings.

The driving range of NEVs has a big impact when it comes to negative sentiment, particularly any difference between real daily range and available range as displayed in the vehicle. Range anxiety is still an important issue for China’s NEV customers, but for different reasons than in the US and Europe – in regions with very high or very low temperatures, heating or cooling can lower the range significantly, and being stuck in traffic also significantly drains the car’s battery. However, the growing number of charging stations in China means drivers are less concerned about being unable to charge when they need to, or during a long journey.

China has vital first-mover advantages in battery cell production and NEV charging infrastructure, as well as NEV production. Customers accept EV engine technology and Chinese OEMs are well liked. Yet if China is serious about decarbonizing road transport, it must go further to ensure the number of carbon-emitting ICE vehicles on the roads are reduced. Currently, there will be 300 million of them on the road in 2030, compared with 257 million this year.

Extending the subsidies due to expire at the end of 2022 would encourage greater NEV adoption, although we would expect the government to make future subsidies smaller and add more requirements for the NEVs they apply to. A more intensive dual credit policy for OEMs, with higher quotas for NEV production, would also drive the market forward.

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market. Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer.

In October 2011, he became a founding partners of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group. After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

ew things shape modern life as much as individual mobility. Be it as an expression of freedom and individuality, or as an economic driver.

To reflect this, we have developed the Solactive Berylls LeanVal Automobility Leaders 100 Index – the AUTO100. It tracks the performance of the 100 most relevant publicly listed automobility players worldwide. By design, the AUTO100 covers the industry’s entire value chain – from vehicle manufacturers and suppliers, to dealer groups, and providers of mobility services or infrastructure.

Due to Chinese New Year and the associated bank holidays, the timing of this second rebalancing of AUTO100 has been slightly adjusted and took place on 07.02.2022.

After a bullish market throughout October and November, December 2021 was quite volatile and fore-shadowed a market correction. In January 2022 global equities experienced their worst monthly overall performance since March 2020.

Nonetheless, the automobility industry’s performance has been received largely positive by investors: Driven by for example electromobility-related activities, the index has achieved a performance of 89.3% since its start (31.12.2018), totaling an active return (market) of 28.5%.

Can’t wait to read more? Download the Insight now!

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market. Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer.

In October 2011, he became a founding partners of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group. After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

hina’s Year of the Tiger began on February 1 with the government determined to demonstrate the country’s strength and stability. So what does this overriding priority signify for China’s automobility industry in the year ahead?

Berylls can make several broad economic forecasts with reasonable confidence: China’s Producer Price Index (PPI) fell for two consecutive months at the end of 2021, suggesting that the policy of maintaining supply and price stability will continue to be effective. New construction projects increased significantly in December, adding weight to other evidence that the economy is strengthening.

At the same time, don’t expect runaway growth in 2022: the consensus among economists inside and outside China is that GDP will increase year-on-year by 5 to 6 percent. There is one last point of particular interest to carmakers. Carbon neutrality by 2060 is now a major policy priority, as China gets closer to its first national target of ensuring that rising emissions peak by 2030.

Against this background, foreign carmakers and suppliers in China confront a series of challenges and opportunities that demand answers now. They include whether China is still a safe bet for making a profit, especially for premium OEMs; what are the right price points; and whether there are any hidden gems that OEMs have overlooked. For example, we think it’s time to enter China’s rapidly expanding and increasingly mature used car market.

If you are curious, download our Insight now!

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market. Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer.

In October 2011, he became a founding partners of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group. After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

arket dynamics have created a sweet spot and OEMs must position themselves to capture their share of the growth story.

US automakers have typically seen the fleet segment as a volume driver, rather than treating it as a strategic channel to pursue. This is mainly due to its relative importance to the overall car market – in the US, fleet vehicles accounted for 12 percent of total light vehicle sales in 2020¹. By comparison, in Europe the share was around 55 percent, driven by tax incentives for companies supplying vehicles to their employees.

Supply challenges resulting from Covid-19 and vehicle shortages have certainly clouded the medium-term outlook. However, we believe there are two significant drivers of growth that will make the fleet segment significantly more attractive to OEMs in the coming years. The first is the transition to electric vehicles (EVs) in both corporate and government fleets. The second is the M&A wave among fleet management companies, which will further consolidate the access to corporate fleets.

So how can OEMs capitalize on this period of transformation? Below we look in detail at the market opportunities created by the two forces of change, and three possible business models for OEMs and their captive financing arms to pursue.

In the US, the vehicle market is dominated by light trucks, which accounted for 75.6 percent of new vehicles sold in 2021 (see Figure 1). Best-selling models include the Ford F-150, RAM 1500, and the Chevrolet Silverado. The light vehicle category, which includes cars as well as light trucks, made up 97 percent of the vehicle market last year.

Figure 1

As described above, corporate fleets account for a smaller share of the overall vehicle market in the US compared with Europe. However, with 1.68 million light vehicles sold to corporate fleets in 2020, it’s still an important market segment for OEMs².

Pre-pandemic, the fleet segment was also growing ahead of the overall market, and we expect that trend to resume as the US vehicle industry overall recovers from the ca. 15 percent decline in sales in 2020. In 2019, the last full year unaffected by Covid-19 disruption, fleet sales grew by 8.6 percent compared with 2018, while overall vehicle sales fell by 1.8 percent. Within the fleet market, we expect a particularly strong recovery in commercial and government fleet vehicles. In 2020, around 887,000 vehicles were sold in those two strands of the fleet segment (see Figure 2).

Figure 2

We expect growth to be driven by the Biden administration’s commitment at the end of last year to accelerate the transition to electric vehicles (Berylls’ detailed insights into the EV revolution in the US are set out in this recent study). Both commercial and government fleets will need to replace internal combustion engine vehicles with new zero emissions models. Under an executive order signed in December 2021, all light duty vehicles purchased by federal government agencies must be zero emissions by 2027, and the entire fleet by 2035³. To give a sense of the scale of the change that is coming, in 2021 the federal government bought 643 EVs, equivalent to less than 1 percent of its total vehicle stock⁴.

Meanwhile, commercial fleets will be impacted by the EV targets set by states and large corporations. California, for example, has set a target that only zero-emissions new cars and light-duty trucks will be sold by 2035⁵, while Walmart has pledged to reach zero emissions from its operations by 2040⁶.

Fleets account for an average of 10 percent of OEMs’ sales in the US, but for the big three US automakers, that proportion increases to closer to 20 percent: fleets accounted for 18 percent of Ford’s US sales in December 2021, 17 percent for GM, and 19 percent for Stellantis, the parent company of Chrysler. In absolute unit terms, Ford is the largest fleet supplier, followed by GM and then Stellantis (see Figure 3).

Figure 3

In line with the US vehicle market overall, fleet sales are currently dominated by light trucks such as the F-150, Silverado and RAM 1500. Electric vehicles are still a very low proportion of total vehicles produced in the US, at between 4 and 5 percent⁷. However, we expect the mix to change significantly as a result of the legislative changes and targets described above. 90% of a group of 300 fleet managers surveyed by Wakefield and Samsara believe that electric is the inevitable future of commercial vehicles⁸.

We believe electrification will transform the US fleet segment, and the new EV-only players are betting the same: car rental chain Hertz has ordered 100,000 Teslas for its fleet, electric SUV and pick-up maker Rivian plans to supply delivery vehicles to Amazon and Cox Automotive has set up a new mobility division to provide data, insights and technical expertise for fleet services and operations, and EV battery solutions. A further notable fleet opportunity in future will be self-driving electric cabs, already being trialed in San Francisco, for example.

Two of the biggest incumbent players, Ford and GM, also have ambitious EV fleet expansion plans:

Ford aims to grow its fleet revenues from $27bn in 2019 to $45bn by 2025, through sales of both commercial vehicles and related services including charging points. The automaker’s strategy is to build on its 40 percent market share in the vans and light trucks segments with the Transit and F-150, and its existing 125,000 fleet customers, through a separate business unit called Ford Pro⁹.

Ford Pro will supply commercial vehicles and offer charging, telematics and aftersales services, as well as financing and fuel cards. The division also plans to roll out 120 additional service hubs and 1,200 fleet service vehicles by 2025. To persuade small and medium-sized businesses to switch over to electric minivans and the electric F-150, due to come to market in 2022, Ford Pro aims to work with customers along the electrification journey, from identifying incentives to charging installation consultation.

Ford’s Pro software for managing EV fleet charging can also be used for non-Ford vehicles. A look across the pond may provide some indication of where Ford’s fleet plans are heading. In Europe, Ford has a partnership with ALD to offer full leasing and fleet management solutions.

Ford aims to grow its fleet revenues from $27bn in 2019 to $45bn by 2025, through sales of both commercial vehicles and related services including charging points. The automaker’s strategy is to build on its 40 percent market share in the vans and light trucks segments with the Transit and F-150, and its existing 125,000 fleet customers, through a separate business unit called Ford Pro⁹.

Ford Pro will supply commercial vehicles and offer charging, telematics and aftersales services, as well as financing and fuel cards. The division also plans to roll out 120 additional service hubs and 1,200 fleet service vehicles by 2025. To persuade small and medium-sized businesses to switch over to electric minivans and the electric F-150, due to come to market in 2022, Ford Pro aims to work with customers along the electrification journey, from identifying incentives to charging installation consultation.

Ford’s Pro software for managing EV fleet charging can also be used for non-Ford vehicles. A look across the pond may provide some indication of where Ford’s fleet plans are heading. In Europe, Ford has a partnership with ALD to offer full leasing and fleet management solutions.

GM is similarly embracing the promise of commercial vehicle growth as a result of electrification. The company is particularly focusing on the delivery segment with its Brightdrop commercial EV startup, and fleet tracking (telematics) with OnStar. Both ventures seek to capitalize on the macro trend of increasing home delivery.

Through Brightdrop, GM is also helping fleet customers to go electric with a commercial vehicle charging service called Ultium. As well as charging facilities, Ultium’s services include helping customers from the start of their EV decision-making, including choosing utility providers¹⁰). Like Ford, GM aims to offer its services beyond its own vehicle customers – OnStar’s telematics can also be used with non-GM vehicles using an adapter, for example.

GM is similarly embracing the promise of commercial vehicle growth as a result of electrification. The company is particularly focusing on the delivery segment with its Brightdrop commercial EV startup, and fleet tracking (telematics) with OnStar. Both ventures seek to capitalize on the macro trend of increasing home delivery.

Through Brightdrop, GM is also helping fleet customers to go electric with a commercial vehicle charging service called Ultium. As well as charging facilities, Ultium’s services include helping customers from the start of their EV decision-making, including choosing utility providers¹⁰). Like Ford, GM aims to offer its services beyond its own vehicle customers – OnStar’s telematics can also be used with non-GM vehicles using an adapter, for example.

Managing large vehicle fleets made up of many different models and brands, plus vehicle financing, is complex, and is treated as a non-core part of the business by many US corporates. As a result, they frequently outsource the task to specialized fleet management companies (FMCs).

These companies typically make around 50 percent of their profit from financing and the other 50 percent from vehicle and driver-related services such as procurement, maintenance, and telematics. Economies of scale are key, with the US market dominated by a few large players (Figure 4). The biggest, including ARI, Enterprise and Donlen, typically have links to dealerships or rental companies, or like Element, have been created by large mergers.

Similarly, the European market is also dominated by a small number of FMCs. Some have ties to financial institutions, such as ALD, partly owned by Société Générale, and Arval, part of BNP Paribas, and some are owned by OEMs, such as Alphabet, part of BMW, and Athlon, owned by Daimler. Consolidation among FMCs is further ahead in Europe than in the US, where (as we set out below) a new wave of mergers has begun.

We believe US OEMs and their captive financing arms should consider the fleet management market as a future key capability in a world of autonomous vehicles. With the current round of consolidation, the hurdles for OEMs to enter this market as late followers might become even higher:

Figure 4

In October 2021, two significant deals were announced in the US fleet management sector: Donlen, previously owned by Hertz, announced it was merging with Wheels Inc. The same month, ALD said it was planning to merge with LeasePlan, giving ALD direct access to the US market. Before the mergers were announced, Donlen had been the partner of Athlon in North America, while Wheels had partnered with ALD in the region. In Europe, ALD and Athlon are rivals.

We believe these two mergers will put further pressure on Element in North America and Arval in Europe to build up their scale. Both are among the top three players in their home territories. They have a contractual relationship for Arval to work with Element’s customers with business in Europe, and vice versa in North America. Facing a competitor that is directly active in both markets, as ALD will be, will present both companies with new challenges.

In addition to consolidation, fleet management companies are joining the likes of Ford and GM and gearing up their EV capabilities: Wheels and Donlen will add EVs to their merged fleet¹¹, while ARI and Element are partnering with a range of EV vehicle and infrastructure suppliers. These include Electrada, a developer and operator of EV charging infrastructure, and Ayro, which supplies last-mile delivery EVs¹². Enterprise Fleet Management is using data analytics to assess the cost-saving opportunities of potential EV deployment within its clients’ fleets¹³.

OEMs in the US have traditionally had diverse views on the fleet market. For some, it was very important, particularly manufacturers specializing in mass-market vehicles perfectly suited to most fleet users’ needs. Others have avoided the segment because it was perceived as offering volume at the expense of profit and margins. Discounts are typically steep and vehicles low spec; fleet cars are often homogenous, down to the same color.

We believe the market changes identified above, in particular the transition to EVs and the need to renew the stock of fleet vehicles, mean all OEMs should look again at their fleet strategy. Fleet management services, for example, are a good fit for OEMs expanding their “Vehicle as a Service” business, where cars are no longer sold to one owner but leased or offered on short-term contracts to a number of users over time, while the car remains the property of the OEM (see Figure 5).

Our detailed thinking on integrated VaaS models for OEM groups is available in our recent study “From vehicle sales to customer & vehicle lifetime value management”.

Figure 5

The expected growth in the US fleet segment as commercial and government customers replace traditional vehicles with EVs is a transformational moment that OEMs cannot afford to ignore. Rivals will step in to take market share from the automakers that are not ready with vehicle and service offerings, including charging or fleet management technology.

The merger activity that started in late 2021 also looks set to continue as fleet management companies build even greater scale. For OEMs and their captive financing arms, this is the moment to consider building their own dedicated FMCs, as European OEMs have done. Whatever OEMs decide, their access to fleet owners will change as a result of the market’s consolidation. Fleets are entering uncharted waters, and OEMs must have their strategic options ready.

Christopher Ley (1984) joined Berylls in October 2021 as Principal. He has over twelve years of top management consulting experience with focus on new business models and market expansions within the automotive & mobility industry. He is an expert around Vehicle-as-a-Service, comprising vehicle finance & leasing, fleet management and mobility services. Christopher Ley is advising OEMs, Captives, Financial Services Companies & Investors, Leasing & Rental Companies, Fleet Managers and Mobility Startups around the transformation from one-time sales towards use-based multi-cycle business models on a global level.

Prior to joining Berylls, Christopher Ley has been working for other international management consulting firms, amongst others Monitor Deloitte and Alvarez & Marsal. He holds a diploma degree in business administration from Johannes Gutenberg-Universität in Mainz and an MBA from Colorado State University.

Featured Insights

erylls’ five-step software excellence framework enables OEMs and suppliers to combine their automotive expertise with best practices from Big Tech

Software is the key component driving innovation in modern cars, from electric engines to increasing levels of vehicle automation and infotainment systems. Yet while it is pulling the industry forward, software is also increasingly a source of problems for OEMs. Carmakers are being forced to recall vehicles already on the road, or postpone the start of production and sales, due to issues with new software.

Last year, one German OEM had to issue a recall affecting 1.3 million vehicles in the US and 2.6 million vehicles in China, due to defective emergency call software. A second German OEM had to stop production of one of its highest volume models for a few weeks due to software problems in 2019, again in the mandatory emergency call function.

Such problems don’t just impact carmakers’ reputations for reliability and custo- mer service – we estimate that for a premium model, the cost of a single week of lost production around the launch date could range from €34 million to as much as €101 million.

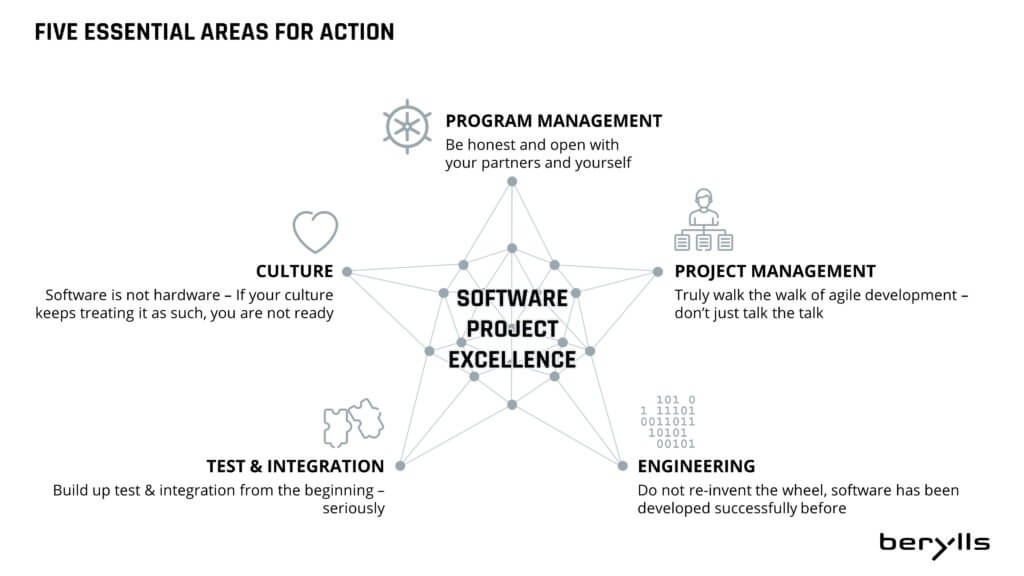

To avoid such additional costs, and to successfully tackle the challenges raised by future projects, we have developed a software project excellence framework around five essential areas for action (Chart 1):

Timo Kronen (1979) is partner at Berylls Group with focus on operations. He brings 17 years of industry and consulting experience in the automotive industry. His focus is on production, development and purchasing as well as supplier task forces. Some of his recent projects include Restructuring of the Procurement Function (German Sports Car OEM), Supplier Task Force for an Onboard Charger (German Premium OEM) and Strategy Development for the Component Production (German Premium OEM).

Before joining Berylls, Timo Kronen worked at PwC Strategy, Porsche Consulting Group and Dr. Ing. h.c. F. Porsche AG. He holds a diploma degree in industrial engineering from the Karlsruhe Institute of Technology (KIT)

ES 2022 has just showcased why this year will see the EV transition gather pace, says Berylls’ Martin French

You can’t beat actually seeing and touching the latest products for proof that consumer and automotive technologies are converging at speed. My tour of the floor at the latest CES 2022, held in Las Vegas earlier this month, brought home just how rapidly this blurring of boundaries is driving the automobility industry into new, exciting territory.

Despite some high-profile vendor pull-outs due to Covid-19, the show still offered plenty of its famous pre-pandemic razzmatazz. Among that, three main themes for the auto industry stood out for me, offering plenty of pointers about trends to watch in the year ahead.

Partnerships are coming to the fore in vehicle software development, as OEMs balance the trade-off between internal development and building external networks with companies that already have the core competencies they need. CES 2022 offered real-life examples in abundance.

Consider the news that Stellantis will collaborate to develop cars and trucks with Amazon’s STLA Smart Cockpit software in the dashboards. Meanwhile, Amazon will deploy “a significant number” of Ram ProMaster electric vans on Amazon’s delivery network, according to Stellantis’s CEO Carlos Tavares.

Amazon’s hook-up with Stellantis is clearly a sign of its efforts to get more traction in the transportation industry by adding a back-up to its minority stake in the California EV maker Rivian. As for Stellantis, this partnership could help it close the gap when it comes to developing vehicles with more sophisticated, software-powered infotainment and other connected vehicle technology.

Meanwhile, Intel’s self-driving systems subsidiary Mobileye announced plans to work with Geely’s Zeekr electric vehicle brand to launch an EV, an operating system and an EV solutions brand in China, Geely’s home market. The new EV will have level 4 autonomy and will use six of Mobileye’s “EyeQ5” chips, as well as employing Mobileye’s road-mapping data. Mobileye’s own eyes are not just focused on China. At CES 2022, it also committed to deepening its relationship with Ford and VW, both of which will use elements of Mobileye’s road-mapping data technology.

Last but not least, Volvo and the US self-driving sensor maker Luminar Technologies unveiled a hands-free driving system called “Ride Pilot”, due to be trialed soon in California, before featuring in a new all-electric SUV later this year. Ride Pilot will also be offered as a subscription upgrade for existing vehicles that go on sale from 2023, underlining Volvo’s belief that a large portion of future revenue will come from software.

Concept cars are always among the highlights of traditional auto shows, and some of the vehicles that caught my attention at CES 2022 offered good indicators of where the EV market is heading.

Showcasing its Airflow EV Concept, Chrysler announced that the brand will be all-electric by 2028. Chrysler has just received a massive new lease of life, after years of playing second and third fiddle to other Stellantis subsidiaries in the US, namely Jeep and Ram.

The OEM has got the message that having an all-electric brand offers a level of flexibility for the rest of the portfolio. As for the other brands in the Stellantis stable, Berylls’ expects to see all-electric Jeeps and RAM pick-ups soon, delivering more flexibility in the powertrains on offer for these vehicles.

Sony Mobility’s good-looking concept car, the Sony VISION-S 02 SUV, leverages the tech giant’s global scale and deep experience in consumer electronics. Yet it is one thing to have the know-how and vision to design an electric SUV, quite another to develop and manufacture it, as Tesla’s gruelling experience a few years ago and Rivian’s problems in 2021 demonstrate. Launching EVs can be a brutal drain on manufacturing and financial resources. If Sony enters the EV market in earnest, we expect it to join forces with a Tier 0.5 supplier with experience of manufacturing for tech companies that are new to automotive R&D and production.

Hot on the heels of last year’s electric vertical takeoff and landing (EVTOL) concept vehicle, Cadillac brought its InnerSpace concept car to the 2022 show. It was a refreshing confirmation that there’s still room for a sleek EV two-seater, in an automobility world dominated by SUVs, trucks and pod cars. InnerSpace is Cadillac’s take on what it thinks personal, self-driving mobility will look like in the coming decades – in essence, a visually impressive, luxury lounge on wheels.

Chevrolet also had a very interesting new vehicle to reveal at the show – its Silverado electric SUV, with a high-level trim and 650-plus horsepower. It won’t grace customers’ driveways until 2023 – but that will give them extra time to save for the $105,000 price tag! Chevy also announced two more electric SUVs, the Blazer and the Equinox, and GM’s CEO Mary Barra said the company is targeting a $30,000 starting price for the Equinox. If that happens, then it could be a real game changer in terms of kick-starting mass EV adoption in the USA, via an already-popular model of SUV.

CES 2022 came hot on the heels of the Biden administration’s decision to make accelerating EV adoption an official US government priority. At the show, three of America’s most renowned companies – GM, Walmart and John Deere – put their weight behind the proposition that the humble commercial delivery van and tractors are also ready for the electric revolution.

The GM-owned tech start-up BrightDrop announced that Walmart has signed up for 5,000 of BrightDrop’s EV600 and smaller EV410 electric vans to support the retailer’s growing last-mile delivery network. It’s all part of Walmart’s goal to operate a zero-emissions fleet by 2040. Meanwhile, BrightDrop is also expanding its relationship with FedEx.

Out on the farm – or rather, the CES 2000 parking lot – I certainly wasn’t expecting to see an autonomous tractor in the middle of all the glitz in Las Vegas. Never mind its farming capabilities, this huge beast is a tech geek’s paradise. Even before including the self-driving capabilities, John Deere says one of its typical e-tractors has more than 300 sensors and 140 controllers, and can process 15,000 measurements per second per machine. The self-driving technology adds on six stereo cameras, 360-degree obstacle detection, AI and machine learning capabilities, plus real-time data sharing for remote monitoring and management.

Full disclosure: Berylls recently invested in the Austrian software startup Kontrol, which has developed technology to ensure that autonomous driving systems comply with national regulations worldwide. So I was interested to find out more about other start-ups on show in Las Vegas, which address the key connected, autonomous and EV industry challenges.

One of the most interesting was Voltaiq, a California battery software intelligence start-up. The company’s Enterprise Battery Intelligence (EBI) platform gathers data from batteries and translates it back to the OEM and/or battery manufacturers in a way that makes it easy for them to troubleshoot for health issues. The platform can also perform random checks on battery systems being delivered by suppliers. Voltaiq’s aim is to work with the next generation of EVs to avoid mass battery and vehicle recalls.

Even with all of the new technology and new BEV products coming our way in 2022, a lot of consumers still want to see, feel and test before they buy. That’s why this year’s CES was especially worthwhile, after the virtual events that Covid has forced on the industry. Following Las Vegas, I’m looking forward to attending some of the rescheduled in-person events and moderating the panels on startups and VC, and I look forward to sharing the insights from those discussions with you.

Martin French - Why CES in person is worth the effort

Martin French has over 20 years of experience in automotive OEM and tier 1 suppliers with various high-profile international leadership, product development, operational, program management, strategic & business development roles. In 2012, after holding various senior management positions, he was appointed Global Vice President Customer Group at Webasto where he led the global business transformation for their US based customers.

Martin joined Berylls Strategy Advisors as Managing Director in 2019 and leads the Berylls office in Detroit, USA. His consulting focus is Automotive Suppliers & OEMs, Corporate Strategy & Business models, M&A, Restructuring & New Business Development.

Martin studied Production & Mechanical Engineering at Oxford Brookes University. He has lived in Michigan, USA, since 2012.

he automotive industry is going through the greatest period of transformation in its history with two disruptive forces impacting at the same time: Radical product innovation with electric and autonomous vehicles and new customer demands fundamentally changing the sales model.

The automotive industry is the last major sector whose underlying business and sales model hasn’t been disrupted by digitization – until now. The Vehicle-as-a-Service (VaaS) model allows customers to use vehicles for a variety of time periods ranging from years to minutes, via products such as vehicle leasing, subscriptions, and short- and mid-term rentals. As a result, VaaS will turn on its head the decades-old model of cars being sold to one owner through a dealership.

For this study, we have conducted representative survey of 2,040 private customers in the age group of 16-56 years (GenX – Z) in Germany to understand where, how and why they are going to buy/ order vehicles. The survey sample covers new, used & non-car customers for all brands (premium & volume) and regions (rural vs. metropolitan). The objective is to listen to the voice of the younger generations to analyze the changes in vehicle usage & ownership needs of tomorrow’s automotive customers.

Christopher Ley (1984) joined Berylls in October 2021 as Principal. He has over twelve years of top management consulting experience with focus on new business models and market expansions within the automotive & mobility industry. He is an expert around Vehicle-as-a-Service, comprising vehicle finance & leasing, fleet management and mobility services. Christopher Ley is advising OEMs, Captives, Financial Services Companies & Investors, Leasing & Rental Companies, Fleet Managers and Mobility Startups around the transformation from one-time sales towards use-based multi-cycle business models on a global level.

Prior to joining Berylls, Christopher Ley has been working for other international management consulting firms, amongst others Monitor Deloitte and Alvarez & Marsal. He holds a diploma degree in business administration from Johannes Gutenberg-Universität in Mainz and an MBA from Colorado State University.

ow the world’s carmakers can reduce their reliance on China for EV battery supplies. OEMs urgently need to develop alternative battery supply chains and optimize their battery manufacturing processes to ensure a sustainable EV business

European and US car manufacturers are critically dependent on China’s vast automotive market, with German OEMs among the most exposed. For example, in 2020 Volkswagen sold almost half of its cars in China, compared with around one-third of total output for BMW, Mercedes-Benz and Audi.

Clearly, German and other European, US and Asian OEMs rely on Chinese consumer demand and the continued willingness of the Chinese government to provide market access for their vehicles. But their dependency extends further.

In the past decade, China’s mining companies and battery manufacturers have been on a shopping spree to acquire resources around the world that will secure its future supplies of copper, cobalt, lithium and other raw materials. For example, Chinese companies now own most mines in central Africa, which produces around 70% of the world’s cobalt. In 2020, China controlled more than 80% of the world’s raw material refining capacity for battery production, 77% of the world’s battery cell manufacturing capacity, and 60% of the world’s component manufacturing for the lithium-ion battery supply chain.²

Given this current dominance, it is no surprise that BloombergNEF forecasts that China will still be the world leader in 2026 among countries involved in the lithium-ion battery supply chain.³

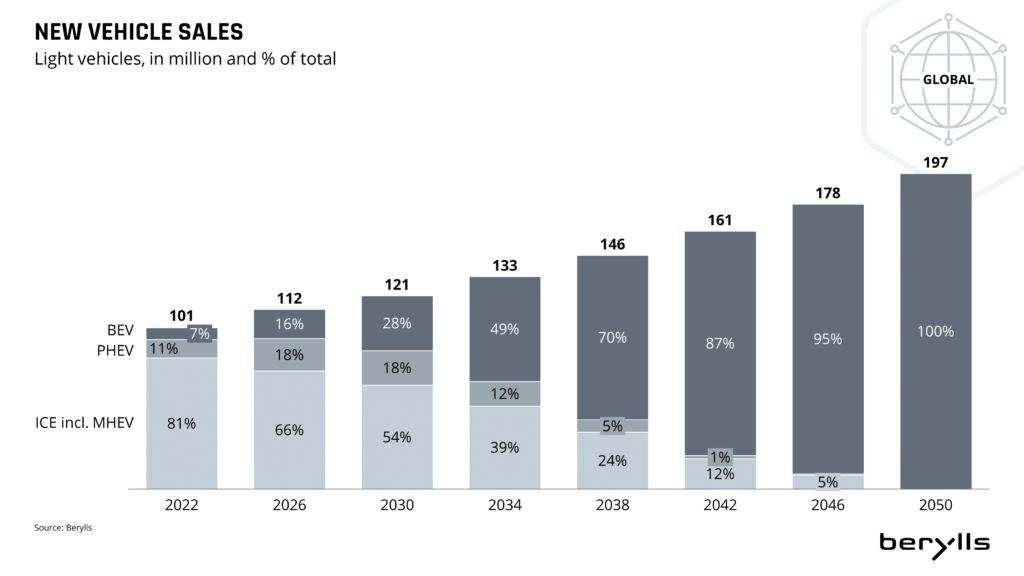

Beijing’s raw materials strategy has been fully vindicated by the accelerating transition to electric transportation. Berylls forecasts that in the next 15 years, over half of all vehicles sold worldwide will be electric, and that on present trends, most of these EVs will have batteries consisting of raw materials owned by Chinese mining corps.

Chart 1: New Vehicle Sales

Furthermore, China has the manufacturing capacity to produce these batteries. According to Benchmark Minerals Intelligence (BMI), 148 of the world’s 200 lithium-ion battery “megafactories”⁴ in the pipeline for 2030 are in China.⁵

Before 2018/19, German automakers believed that it was not worthwhile to produce their own battery cells, because they were too expensive and due to relatively low figures too unprofitable. They are now being forced by the sheer speed of the EV transition to make up for lost time.

The challenge for German OEMs, like other Western car manufacturers, is obvious. As the number of electric cars increases, so does the number of batteries required to make them – and thus their dependence on Chinese suppliers. German OEMs urgently need to develop alternative battery supply chains and optimize their battery manufacturing process to mitigate this China-dependency risk and ensure a sustainable EV business.

The encouraging news is that German manufacturers are starting to rethink their battery strategies, in a rapidly growing EV market where “green” mobility, new drive systems and sustainable transportation featured as the main topics at the 2021 IAA international motor show. For example, in September 2021 Daimler joined the Automotive Cells Company (ACC) battery alliance with Peugeot, Fiat and Opel owner Stellantis and France’s TotalEnergies.⁶ The alliance aims to ensure these partners’ EV market independence.

An alternative strategy for reducing reliance on Chinese battery suppliers is battery recycling, where Volkswagen Group is an example worth watching. The company has set an ambitious long-term target to recycle 97% of all the raw materials in its EV batteries⁷, and at the start of 2021 it set up a pilot plant for recycling in Salzgitter.⁸ The coveted raw materials in the cells are recycled, along with the outer shell, the wiring and the packaging of the modules.

Profitable and sustainable battery recycling depends on not too much capital and labor being expended in the process. To this end, the battery must be designed and built in such a way that it can later be easily disassembled and recycled.

Another important avenue that OEMs should explore to reduce their EV battery dependence on China is increased investment and research into new battery generations with advanced technology. Many major battery cell manufacturers have already announced that they will begin production of cobalt-free batteries within the next years. Meanwhile, a number of leading automakers, including VW and BMW, have high hopes for solid-state batteries, which are expected to have a higher energy density and be cheaper to produce, faster to charge, and safer. BMW is eager to develop its first solid-state battery prototype within the next two to three years.

The goal for German OEMs, like other non-Chinese car manufacturers, must therefore be to secure their battery supply chain while researching and developing new battery technologies. As German OEMs have belatedly begun to realize, any manufacturer outside China that wants to succeed in the EV market will need a battery supply strategy in addition to a product strategy.

Willy Lu Wang (1981) joined Berylls Strategy Advisors in 2017. He started his career participating in the graduate program of Audi focusing on production planning. After stations at another strategy consultancy as well as being the strategy director for a German Tier-1 supplier, he is now responsible for the China business at Berylls. He has a broad consulting focus working for all clients in China, whether they are JVs, WOFEs or pure local players. He is also responsible for the development of AI and Big Data products dedicated towards the Chinese market further strengthening the Berylls End-to-End strategy and product development capabilities.

Wang studied Electronics & Information Technology with focus on Systems and Software Engineering and Control Theory at Karlsruhe Institute of Technology.

overnments all over the world have made clear statements: There is no future for Diesel trucks. Batteries have won the race for the future powertrain technology of cars. Yet, the hurdles are much higher for batteries to be used in trucks: Payload is much more critical, range and recharging times strongly impact costs, chargers which could supply enough power for truck charging are not yet developed, and multiple charge cycles per day drastically decrease battery longevity.

Therefore, many industry experts are certain: Hydrogen will be the energy source that trucks of the future will use. Its high energy density, combined with the comparably easy and speedy refueling make it the ideal fuel for heavy long- haul trucks.

After decades of hydrogen truck development and numerous test vehicles on the roads, there is a last decisive question to be solved: Should the hydrogen distributed by truck refueling stations be gaseous or liquid? Standards must be defined, and technologies developed further. Parallel investment in both scenarios must be avoided. The choice depends on user requirements, truck technology, infrastructure build- out, and the sourcing of hydrogen.

To find out more, download our in-depth analysis!

Steffen Stumpp (1970) joined the Berylls Group in October 2020 as Head of Business Unit Commercial Vehicles. At this point, he already looked back on extensive professional and leadership experience in the commercial vehicle industry. Stumpp started his career in an OEM and went through different roles in research, marketing, product planning and after-sales service. When he switched to the automotive supplier industry, he took over the responsibility for worldwide sales and marketing of a medium-sized tier 1 supplier. After another step as head of sales he decided to join Berylls, where he is now responsible for the commercial vehicle business.

Stumpp is a graduate engineer and has studied industrial engineering at the KIT in Karlsruhe and the Technical University of Berlin with focus on logistics.

NO TIME TO READ THIS WEBSITE?