Featured Insights

ie chinesischen Automobilhersteller drängen mit Nachdruck auf den europäischen Markt – und nehmen dabei auch verstärkt den deutschen Markt ins Visier.

Mit wettbewerbsfähiger Technologie, attraktiver Preisgestaltung und starkem Fokus auf Elektromobilität zielen Marken wie BYD, MG, Great Wall Motors (GWM) mit den Marken ORA & WEY und Chery auf eine schnelle Expansion. Doch wie sieht ihre tatsächliche Präsenz im deutschen Handel aus? Eine Analyse der drei Absatzstärksten Marken in Deutschland (BYD, MG und GWM) zeigt den Status Quo der Handelsintegration und wie die Marken – sich zumindest digital – im Portfolio wiederfinden.

Zur Untersuchung der aktuellen Marktabdeckung chinesischer OEMs in Deutschland hat Berylls by AlixPartners die offiziellen Händlerlisten der Marken BYD, MG und GWM ausgewertet. Dabei lag der Fokus auf quantitativen Kennzahlen (Händleranzahl, gelistete Fahrzeuge) sowie qualitativen Mustern (Marken-Mix, weitere Marken im Portfolio). Die drei ausgewählten Marken stehen in den letzten 3 Jahren für 95% der zugelassenen privaten chinesischen Neuwagen in Deutschland.

Abbildung 1 – Die Ergebnisse im Überblick (Stand Juni 2025)

Quelle: Berylls by AlixPartners

Abbildung 2 – Die Top 5 Händler mit der Markenüberschneidung

Quelle: Berylls by AlixPartners

1. Überschneidung mit etablierten Marken: Besonders bei BYD-Händlern fällt auf, dass viele Händler ebenfalls Mercedes und/oder Smart Modelle führen. Bei rund zwei Dritteln der analysierten Händler gibt es hier eine Überschneidung, was auch durch die Beteiligung bzw. Übernahme diverser Autohäuser durch Chinesische Unternehmer zu begründen ist. GWM hingegen ist stark in Mitsubishi-Strukturen integriert, was an der Übernahme des Mitsubishi-Vertriebs durch die Emil Frey Gruppe liegt, die ebenfalls mit GWM zusammenarbeitet.

2. Multimarkenstrategie statt Exklusivität: Die Mehrheit der Händler führt mehrere Marken parallel – durchschnittlich sieben bis acht pro Händler – darunter meist nur eine oder zwei chinesische Marken. Händler, die nur chinesische Autos anbieten sind mit Ausnahme der BYD Flagship Stores, die durch Sternauto betrieben werden, nicht anzutreffen.

3. Geringe Sichtbarkeit auf den Händlerwebseiten: Eine klare Schwäche: chinesische Marken werden häufig nicht prominent auf der Website der Händler präsentiert – teils erscheinen sie gar nicht im Markenportfolio auf der Händlerwebsite, obwohl sie auf der OEM Website als Vertragshändler gelistet sind. Die Bewerbung erfolgt häufig eher dezent oder ausschließlich über Drittplattformen wie mobile.de. Für die chinesischen OEMs bedeutet das: Geringe Markenwahrnehmung trotz physischer Präsenz.

4. Zulassungen und Händlerabdeckung gehen nicht Hand in Hand: Während MG mit einem großem und umfassendem Händlernetzwerk agiert und damit unter den betrachteten Chinesen den meisten Absatz generiert – hat GWM ein ähnlich großes Netz aber bisher kaum nennenswerte Verkäufe generiert.

Abbildung 3 – Private Zulassungen in Deutschland pro Monat

Quelle: Berylls by AlixPartners

Die meisten OEMs setzen beim Markteintritt in Deutschland auf die Infrastruktur etablierter Mehrmarkenhändler, um schnell eine flächendeckende Präsenz aufzubauen. Dieses Modell erlaubt zwar eine kosteneffiziente Markteinführung, birgt aber das Risiko auf die Aktivität und Kooperation der Händler angewiesen zu sein. Diese sind zwar als Investoren offen für Wachstum durch neue Marken, allerdings muss die Rendite im Verhältnis zu den Aufwendungen stimmen. Bleibt das Absatzvolumen gering, bleiben auch die Investitionen der Händler in Markenaufbau und Kundenbindung verhalten. Es entsteht ein Teufelskreis aus begrenztem Engagement, geringem Absatz und fehlender Markenstärkung.

Um über eine reine Marktpräsenz hinauszukommen und tatsächliche Absatzrelevanz zu erzielen, müssen chinesische OEMs konkrete Anreize für den Handel schaffen. Drei strategische Hebel stehen dabei im Fokus:

1. Einen Nachfrage-Sog („Super-Pull“) erzeugen: Durch gezielte, aufmerksamkeitsstarke Marketingkampagnen, sowie ein attraktives Preis-Leistungs-Verhältnis können OEMs einen starken Nachfragesog erzeugen, der sich beim Handel widerspiegelt. Sobald Händler erkennen, dass sie trotz aggressiver Preispunkte solide Margen realisieren können, steigt auch ihre Bereitschaft, in Sichtbarkeit, Verkaufsförderung und Markenbekanntheit zu investieren. Ein gut orchestrierter Super-Pull kann so zum Motor für nachhaltiges Wachstum werden.

2. Überdurchschnittliche Händlerincentives bieten: Der Einstieg in neue Marken ist für Händler in erster Linie ein Business Case. Wenn der natürliche Nachfrage-Sog anfangs nicht ausreicht, um Händler Aktivitäten zu stimulieren, müssen OEMs selbst in Vorleistung gehen: beispielsweise durch Investitionszuschüsse für Showroom-Anpassungen, überdurchschnittliche Boni bei Zielerreichung oder leistungsabhängige Marketingbudgets. Diese Anreize können helfen, die Hürde zur Markenaktivierung zu senken und erste Vertriebsdynamiken zu initiieren.

3. Eigenes Handelsnetz aufbauen: Eine langfristig angelegte Alternative ist der Aufbau eines eigenen Handelsnetzes und Direktinvestition in dieses. Erfolgsentscheidend ist dabei die Zusammenarbeit mit lokalen Partnern, die über Marktkenntnis, regulatorisches Know-how und operatives Geschick verfügen. Ergänzend sollten frühzeitig Kooperationen mit etablierten Servicebetrieben abgeschlossen werden, um ein zuverlässiges Aftersales-Netz sicherzustellen – ein zentraler Aspekt für Vertrauen und Wiederkaufbereitschaft der Kunden.

Unabhängig vom gewählten Ansatz ist klar: Der Aufbau von Markenvertrauen und Vertriebsstruktur in einem reifen und stark kompetitiven Markt wie Deutschland ist weder schnell noch günstig zu realisieren. Wer dauerhaft erfolgreich sein will, braucht einen klaren Plan, tiefes Verständnis für die Handelslogik – und die Bereitschaft, zunächst mehr zu geben als zu nehmen. Ohne initiale Investitionen in Sichtbarkeit, Verfügbarkeit und Vertrauen bleibt chinesischen OEMs als Alternative nur Geduld – und die konsequente Begleitung eines langsamen, händlergetriebenen Markthochlaufs.

Featured Insights

eutschlands Automobilzuliefererindustrie steht unter Druck: Produktionsverlagerungen, hohe Lohn- und Energiekosten sowie schwaches Wirtschaftswachstum gefährden den Standort.

Prognosen zeigen sinkende Fahrzeugproduktion und mangelnde politische Unterstützung. Internationale Wettbewerber bieten attraktivere Bedingungen. Zulieferer müssen ihre Rolle überdenken, während die Politik langfristige Strategien zur Stärkung zukunftsorientierter Technologien entwickeln sollte.

Der Eindruck ist derzeit nahezu unbestritten: Deutschland steht als Automobil- und insbesondere Zulieferstandort unter erheblichem Druck. Dies zeigt sich an den regelmäßigen Ankündigungen von Produktionsverlagerungen, Werksschließungen und umfassenden Kosteneinsparungen an bestehenden Standorten. Selbst familien- und stiftungsgeführte Unternehmen, die bislang solche Maßnahmen gescheut haben, reagieren nun und setzen großflächige Sparprogramme um. Es stellt sich daher die Frage, worauf sich diese Entwicklung zurückführen lässt, welche Indikatoren ihr zugrunde liegen – und ob mittelfristig eine Besserung in Sicht ist.

Derzeit beobachten wir eine Vielzahl an Indikatoren, die eine negative Entwicklung begünstigt haben. Deutschland ist in mehreren Bereichen zurückgefallen, wie sich anhand verschiedener Beispiele belegen lässt. Besonders deutlich wird dies an der Entwicklung des Bruttoinlandsprodukts (BIP): Die Wirtschaft schrumpfte 2024 im zweiten Jahr in Folge um 0,2 %. Für 2025 wird kein Wachstum prognostiziert; erst 2026 wird ein Anstieg von 1,1 % erwartet. Damit zählt Deutschland im EU-Vergleich zu den Schlusslichtern. Zum Vergleich: In den USA wuchs die Wirtschaft 2024 um 2,8 %, und auch die Prognosen für die kommenden Jahre sind dort deutlich positiver.

Mit Blick auf die Automobilzuliefererindustrie ist es jedoch auch erforderlich, neben allgemeinen Indikatoren wie dem BIP auch spezifische Einflussfaktoren für den Standort zu betrachten. Drei zentrale Faktoren lassen sich hier identifizieren, ergänzt durch Anreizsysteme in anderen Ländern: die relevante Automobilproduktion und damit die Nachfrage – insbesondere getrieben durch die inländischen Produktionszahlen –, die Lohnkosten sowie die Energiepreise.

Grafik 1 zeigt die prognostizierte Entwicklung der Fahrzeugproduktion sowie des BIP für ausgewählte Automobilstandorte. Es wird deutlich, dass sich Deutschland in einer sehr prekären Lage befindet, einzig Japan zeigt hier eine noch ungünstigere Entwicklung. Sowohl das Wirtschaftswachstum als auch die Entwicklung der heimischen Fahrzeugproduktion sind im internationalen Vergleich schwach und haben sich seit Anfang 2024 nochmals spürbar verschlechtert. Besonders auffällig: Anfang 2024 lagen die Prognosen für die Fahrzeugproduktion im Jahr 2030 noch bei 5,3 Millionen Einheiten. Im Februar 2025 wurden diese auf 4,2 Millionen Fahrzeuge korrigiert – ein Rückgang von 20 % innerhalb eines Jahres.

Abbildung 1 – Prognose Fahrzeugproduktion und Szenarien für Deutschland

(Prognose Fahrzeugstückzahlen bis 2030, in Millionen Fahrzeugen)

Anmerkung: Länder mit über 1 Mio. Produktionsvolumen

Quelle: S&P Global Mobility (Light Vehicle Production Forecast, February 2025), IMF, Berylls by AlixPartners

Auch bei den Energiekosten ergibt sich ein kritisches Bild. Grafik 2 zeigt die Entwicklung dieser Kosten im internationalen Vergleich am Beispiel der Börsenpreise für Strom. Die strukturellen Unterschiede bei den Energiekosten zwischen Europa und insbesondere den USA bleiben bestehen. Staatliche Entlastungsmechanismen für die Großindustrie, wie sie in einigen europäischen Ländern teilweise eingeführt wurden, können die signifikanten Preisunterschiede bei Strom und Gas, insbesondere aufgrund der hohen Kosten, nicht dauerhaft ausgleichen. Da über 80 % des Energieaufwandes in der Fahrzeugproduktion außerhalb der OEM-Werke anfallen, sind vor allem Zulieferer hier besonders betroffen. Darüber hinaus ist bei den Lohnkosten ebenfalls eine ungünstige Entwicklung erkennbar: Während die Zunahme in Deutschland in den letzten Jahren dem EU-Durchschnitt entsprach, war der Anstieg im Vergleich zu den USA im Mittel um 1,5 % pro Jahr höher. Die politische Debatte bezüglich der Anhebung des Mindestlohns lässt ebenfalls keinen Rückenwind für den Standort erwarten.

Abbildung 2 – Historische Entwicklung Strompreise und Arbeitskosten in ausgewählten Märkten

(Ø 2014 – Ist 2025 in EUR/MWh Day Ahead Base)

Datenpunkte: Mai 2025

Anmerkung Strompreise: Preisdifferenzen aufgrund unterschiedlicher Produkte in den einzelnen Märkten möglich. Repräsentative Region bei mehrere Preiszonen in einem Land. Börsenpreise ohne weitere Abgaben, China inkl. Abgaben jedoch aufgrund Regulatorik beschränkt vergleichbar und keine historische Verfügbarkeit

Anmerkung Arbeitsvollkosten: Die Arbeitskosten beziehen sich auf die durchschnittlichen Arbeitskosten im verarbeitenden Gewerbe je Arbeitsstunde (Arbeitgeberbrutto). Die Werte für China und Japan wurden für das Jahr 2024 über die jeweilige durchschnittliche Wachstumsrate der Arbeitskosten seit 2018 geschätzt.

Quelle: Bloomberg, JEPX, Statistische Veröffentlichungen der Länder, Berylls Strategy Advisors

Weitere Entwicklungen in anderen Ländern setzen den Standort Deutschland zusätzlich unter Druck. Obwohl aktuell viel Staub im internationalen Handel aufgewirbelt wurde, verschärfen Steuererleichterungen und -senkungen, etwa in den USA, sowie wirtschaftsfreundliche Rahmenbedingungen die Situation für Deutschland. Der Inflation Reduction Act kann hier als sehr erfolgreiche Maßnahme in dieser Hinsicht gesehen werden. Weitere relevante Indikatoren sind die durch Bürokratie und staatliche Auflagen verursachten Kosten, die in Deutschland kontinuierlich steigen. Aufgrund des ausbleibenden Bürokratieabbaus lässt die deutsche Wirtschaft beispielsweise jährlich ein Potenzial von rund 146 Milliarden Euro ungenutzt.

Auch von politischer Seite ist keine substanzielle Unterstützung zu erwarten. Die im Koalitionsvertrag angekündigten Maßnahmen zur Förderung der Automobilindustrie lassen keine wesentlichen Verbesserungen erkennen. Konkrete wirksame politische Initiativen fehlen bislang. Der Begriff „Automobil(industrie)“ wird lediglich in allgemeinen Ankündigungen erwähnt, ohne dass spezifische Maßnahmen benannt werden. Es ist daher davon auszugehen, dass sich die negative Entwicklung mittelfristig fortsetzen wird.

Ein weiterer Rückgang der Produktion von Zulieferteilen in Deutschland ist nahezu unausweichlich. Selbst bei stabilen Rahmenbedingungen wird die stagnierende beziehungsweise rückläufige Fahrzeugproduktion zu einem weiteren Abbau der Produktionskapazitäten führen. Verbesserte Rahmenbedingungen bei Energiepreisen und Förderprogrammen können diesen Trend allenfalls abschwächen, jedoch nicht aufhalten. Die Zahl der Zulieferunternehmen, die historisch am Standort Deutschland gewachsen sind und künftig nur noch zentrale Verwaltungsfunktionen hierzulande vorhalten, wird zunehmen. Eine substanzielle Unterstützung durch den Rüstungssektor, wie sie derzeit diskutiert wird, ist nur in begrenztem Umfang zu erwarten.

Zulieferunternehmen müssen sich für ihr aktuelles Kerngeschäft mehr denn je der Frage stellen, welche Funktionen langfristig in Deutschland verbleiben können und sollen. Für die Politik gilt es, den Standort gezielt zu stärken – mit einem klaren Fokus auf Effizienz, Effektivität und Zukunftstechnologien. Maßnahmen, die lediglich eine Produktionsverlagerung um wenige Jahre verzögern, sind solchen unterzuordnen, die den Standort nachhaltig zukunftsfähig machen.

Featured Insights

ie kommerzielle Nachverhandlungen für beide Seiten zur nachhaltigen Stärke führen können

Viele Zulieferer stehen derzeit unter erheblichem wirtschaftlichem Druck. Die operativen Margen, also die Gewinnspannen, sind seit der Corona-Pandemie auf ein ungesundes Niveau von oftmals unter 5 % gesunken. Während die Automobilhersteller (OEMs) ihre Erträge in den Coronajahren steigern konnten, haben die Zulieferer mit stark erhöhten Kosten zu kämpfen. Insbesondere Materialpreise, Energiekosten und Löhne sind durch Inflation und geopolitische Krisen wie den Ukrainekrieg deutlich gestiegen. Hinzu kommen Forderungen von Unterlieferanten, die ebenfalls mit höheren Kosten konfrontiert sind. Zusätzliche Volumenrückgänge, unter anderem bei den seinerzeit vielversprechenden E-Modellen, haben in den letzten zwei Jahren das Fass zum Überlaufen gebracht.

Ein besonderes Problem aber sind Produkte, die vor den Krisenjahren – also rund um 2020 – verhandelt und bepreist wurden, aber erst jetzt in Serie gehen. Damals kalkulierte Preise basieren auf anderen wirtschaftlichen Rahmenbedingungen als heute. In der Folge sind viele dieser Produkte inzwischen stark defizitär. Business Cases, die früher rentabel erschienen, rechnen sich heute nicht mehr.

Um wirtschaftlich handlungsfähig zu bleiben, müssen Zulieferer nun aktiv werden. Der erste Schritt ist die konsequente Überprüfung der Profitabilität auf Produkt- und Auftragsebene. Es reicht nicht, auf die Gesamtrentabilität zu schauen – jedes einzelne Produkt muss für sich selbst tragfähig sein. Verluste eines Produkts durch Gewinne eines anderen auszugleichen (Quersubventionierung), birgt große Risiken und ist langfristig nicht nachhaltig. Deshalb sollten regelmäßig alle relevanten Bereiche wie Vertrieb, Controlling, Einkauf, Qualität und Produktion gemeinsam die Wirtschaftlichkeit einzelner Produkte analysieren.

Sobald intern Klarheit über die Ursachen der Margenverluste besteht, sollte dies dem OEM in der Verhandlung auch konstruktiv transparent gemacht werden. Die Plausibilisierung ist ein Erfolgsfaktor, um gut vorbereitet und mit einer nachvollziehbaren Argumentation in Preisnachverhandlungen mit dem OEM zu gehen. Das notwendige Maß an Offenlegung ist immer fall- und unternehmensspezifisch auszulegen.

Für eine strukturierte und fundierte Herangehensweise empfiehlt sich der Einsatz digitaler Werkzeuge wie dem ClaimCubeSM von AlixPartners. Dieses Tool bietet einen strukturierten Überblick über die aktuelle Kostenlage und stellt sie den ursprünglichen Annahmen aus der Nominierungsphase gegenüber. Der ClaimCubeSM wird mit den sogenannten Preisblättern (Cost Breakdowns, CBD) „gefüttert“, die dem OEM bei Auftragserteilung vorlagen und die Vertragsgrundlage der Lieferbeziehung darstellen, und vergleicht sie mit den realen Kosten beim Serienstart und den heutigen Ist-Kosten. Auch Abweichungen bei Volumina werden berücksichtigt. So lässt sich klar aufzeigen, wo und warum Verluste entstanden sind. Gerade bei vielen Positionen in einem CBD und einer Vielzahl an Produkten und Varianten eignet sich der digitale Ansatz.

Der ClaimCubeSM errechnet das Claim-Potenzial. Für die Definition einer sogenannten Walk-in-Position müssen auch die im Vertrag abgestimmten Zeitpunkte sowie die im CBD hinterlegten Werte sorgfältig berücksichtigt werden. Eine genaue Prüfung der vertraglichen Basis ist hierbei essenziell, um eine tragfähige Argumentation aufzubauen.

Das Ziel der Nachverhandlung ist, entweder bestehende Margen zu schützen (zum Beispiel durch Berücksichtigung inflationsbedingter Mehrkosten) oder stark defizitäre Produkte neu zu bepreisen (Margen-Restrukturierung). Vielfach gibt es keine vertragliche Grundlage hierzu. Die Claim-Kategorien richten sich nach der rechtlichen Auslegung und der Logik der Teilepreis-Zusammensetzung. So gibt es klassische Inflation-Claims (etwa höhere Energie- oder Lohnkosten) sowie Volumen-Claims (beispielsweise geringere Abnahmemengen als geplant) und Struktur-Claims (wie Annahmefehler, schlecht verhandelte Änderungsanträge oder Produktionsverzögerungen).

Abbildung 1 – Typische Claim-Elemente und deren Anteil am Gesamtclaim

Quelle: AlixPartners

In der konkreten Verhandlungssituation ist es wichtig, die Forderung an den Kunden gut vorzubereiten und mit belastbaren Nachweisen zu stützen. Welche Informationen tatsächlich gezeigt werden, sollte strategisch abgewogen werden. In manchen Fällen kann es sinnvoll sein, beispielsweise anonymisierte Lohnabrechnungen oder Maschinendaten vorzulegen, um die Mehrkosten nachzuweisen. Auch gemeinsame Workshops mit dem Kunden vor Ort – etwa zur Validierung von Taktzeiten oder Effizienzkennzahlen – können helfen, Vertrauen in die aufgezeigten Daten zu schaffen. Wichtig ist dabei: Transparenz nur im notwendigen Maß – und gezielt auf sogenannte Schlüsselprodukte beschränkt.

Abbildung 2 – Typische Positionen zur Darlegung von Mehrkosten

Quelle: AlixPartners

Kommt es zu einer Einigung, kann diese in Form nachträglicher Vertragsanpassungen dokumentiert werden. Ziel ist es, neue Teilepreise zu vereinbaren, die beiden Seiten – OEM und Zulieferer – Planungssicherheit geben.

Für wirtschaftlich angeschlagene Zulieferer kann gemeinsam mit dem OEM ein Restrukturierungs- oder Zukunftskonzept aufgestellt werden. Dieses Konzept beinhaltet klare Meilensteine und regelmäßige Berichte, um die Fortschritte transparent zu dokumentieren und eine nachhaltige Sanierung sicherzustellen.

Damit dieser Prozess im Unternehmen reibungslos funktioniert, braucht es eine klare Governance-Struktur. Eine zentrale Rolle übernimmt dabei ein Chief Commercial Officer (CCO), der für die einheitliche Steuerung aller Claims verantwortlich ist. Unterstützt wird er von einem bereichsübergreifenden Team aus Controlling, Einkauf und Vertrieb. Das Controlling sollte zusätzlich ein kontinuierliches Margin-Tracking über den gesamten Produktlebenszyklus hinweg einführen, um wirtschaftliche Risiken frühzeitig zu erkennen. Auch der Einkauf spielt eine wichtige Rolle, indem er regelmäßig aktuelle Inflationsdaten zur Unterstützung der Kalkulation bereitstellt.

Trotz der Herausforderungen bieten die aktuellen Entwicklungen auch Chancen. Die derzeitige Marktdynamik zwingt alle Beteiligten, ihre Prozesse, Verträge und Preislogiken zu überdenken. Dadurch entstehen mittelfristig neue Standards und Spielregeln. Unternehmen, die sich frühzeitig darauf einstellen, können ihre Wettbewerbsfähigkeit verbessern und langfristig gestärkt aus der Krise hervorgehen. Zugleich wird es zu einer Bereinigung des Marktes kommen – nur wirtschaftlich stabile und anpassungsfähige Zulieferer werden bestehen bleiben.

Die Marktteilnehmer sollten diese Chance nutzen, um eine zukunftsfähige und resiliente Lieferbeziehung, die auf einer neuen Partnerschaftlichkeit beruht, zu entwicklen.

Hinweis zum obigen Artikel:

AlixPartners unterstützt aktiv in den Verhandlungen zwischen Lieferanten und OEMs, um eine beidseitig partnerschaftliche Lösung zu erreichen. In diesem Artikel wurde nicht auf wirtschaftlich schwierige Lieferantensituationen im präventiven Risikofall eingegangen.

Featured Insights

he German used car market has become increasingly volatile. Ownership transfers have declined from an all-time high of 7.4 million in 2016 to just 5.6 million in 2022, while vehicle prices increased due to supply shortages during the pandemic and following Russia’s attack on Ukraine.

Furthermore, the first generation of battery electric vehicles (BEVs) have entered the used car market, with large declines in their residual value compared with traditional ICE vehicles due to the constantly evolving technology.

Despite this volatility, the used car market is more important than ever. Rising take rates of leasing and subscription shares have expanded the balance sheets of captives and fleet owners, exposing them to increasing residual value risk in the used car market. For dealers, the importance of the used car business continues to grow: due to fixed margins and BEV quotas, sales and profits need more than ever to be generated in the used car business.

To exploit the full potential of what is now a € 121 billion market in Germany alone, automotive providers need a new playbook. They must rethink the used car business right along the value chain, from OEMs to mobility and service providers, used car platforms and dealers.

Download the full insight now!

Featured Insights

Die gesamte Pressmitteilung ist zum Download verfügbar.

Featured Insights

ie Automobilzuliefererindustrie steht stark unter Druck – das zeigt sich deutlich in der Beschäftigungsentwicklung: Im Jahr 2024 sank die Zahl der Beschäftigten in der deutschen Zuliefererindustrie weiter auf rund 267.000¹.

Europaweit kündigte die Branche im selben Jahr den Abbau von rund 54.000 Arbeitsplätzen an² – wovon voraussichtlich überwiegend deutsche Standorte betroffen sein werden. Gerade jetzt kommt es auf eine strategische Personalplanung an – denn es gehen auch Talente verloren, die es dringend für die Transformation braucht.

Die Automobilzulieferer stehen vor zahlreichen Herausforderungen: eine schwache Nachfrage im Bereich E-Mobilität, hohe Energie- und Rohstoffkosten, geopolitische Risiken und fragile Lieferketten. Unternehmen reagieren mit harten Restrukturierungen; Zugleich meldeten im Jahr 2024 fast 60 Zulieferunternehmen in Deutschland Insolvenz an – das entspricht nahezu der Anzahl an Insolvenzanträgen, die durch die Coronapandemie bedingt waren.³ Neben der Entlassungswelle ist also auch eine Insolvenzwelle zu beobachten. Die Transformation tritt in den Hintergrund, Unternehmen agieren im Krisenmodus – mit drastischen Folgen für die Beschäftigten.

Noch vor wenigen Jahren konkurrierten Automobilzulieferer um die besten Talente. Besonders gefragt waren beispielsweise Fachkräfte mit Expertise in den Bereichen Softwareentwicklung und Künstliche Intelligenz. Trotz anhaltenden Bedarfs fehlen vielen Unternehmen heute Budget und Perspektiven, um diese Talente zu halten. Gleichzeitig locken wachstumsstarke Branchen wie Tech und Energie. Die Zuliefererindustrie steht deshalb vor schwierigen Entscheidungen: Wer muss gehen, wer muss bleiben? Neben kurzfristiger Kostensenkung ist jetzt vor allem Ambidextrie gefragt: die Fähigkeit, Effizienz und Innovation zugleich zu managen. Sie erfordert Personalentscheidungen mit Weitblick und ein klares Verständnis der Fähigkeiten, auf die es jetzt und in Zukunft ankommt.

Die Transformation verlangt sowohl die stabile Weiterentwicklung des aktuellen Geschäfts als auch den Aufbau zukunftsfähiger Geschäftsfelder. Dafür braucht es einerseits operative Exzellenz, andererseits Innovationskraft. Die dafür nötigen Talente bringen unterschiedliche Profile mit, vereinen aber zentrale Fähigkeiten:

Diese Talente zu erkennen, gezielt einzusetzen und entlang des gesamten Wandels zu begleiten, ist Führungsaufgabe. Talente bleiben, wenn Unsicherheit abnimmt. Dafür braucht es konkrete Maßnahmen:

Zielgerichtet führen: Klare Entwicklungspfade, individuelle Weiterentwicklungsangebote und die frühzeitige und transparente Einbindung in strategische Schlüsselprojekte fördern Vertrauen, Motivation und Bindung der Mitarbeitenden.

Individuelle Anreize setzen: Beteiligungsmodelle, Sondervergütungen oder besondere Benefits (zum Beispiel Forschungskooperationen) wirken oft stärker als klassische Gehaltserhöhungen. Schlüsseltalente sollten außerdem für zukünftige Führungsrollen entwickelt werden. Qualifikationsdefizite werden so behoben, Loyalität und Aufgeschlossenheit gegenüber künftigen Wachstumschancen gestärkt.

Flexibilität im Rahmen der betrieblichen Leistungsfähigkeit ermöglichen: Teilzeit, Homeoffice oder geteilte Führungsverantwortung fördern die Work-Life-Integration. Differenzierte Vergütungssysteme und eine agile Unternehmenskultur steigern die Attraktivität des Unternehmens als Arbeitgeber.

Talentbindung scheitert am ehesten an einer schwachen Führung (Entscheidungs- und Konfliktscheu, Duldung von Low Performern), an der fehlenden Konsequenz in der Unternehmenskultur sowie an einem zu engen finanziellen Spielraum. Doch wer Talentbindung priorisiert und Ressourcen intelligent allokiert, kann auch unter schwierigen Bedingungen große Wirkung erzielen.

Talentbindung finanzieren

Angesichts drastischer Sparmaßnahmen wirkt Talentförderung zunächst wie ein Widerspruch. Doch Investitionen in Schlüsseltalente sind ein wichtiges Instrument zur Risikominimierung und Sicherung langfristiger Wettbewerbsfähigkeit. Statt flächendeckender Boni oder Standardfortbildung lohnt sich der Aufbau strategisch-selektiver Programme für genau jene Fachkräfte, die für die künftige Wertschöpfung und Innovationsfähigkeit entscheidend sind. Solche Programme können beispielsweise über die Reinvestition von Effizienzgewinnen in strategische Personalinitiativen erfolgen. Genauso helfen zielführende Kooperationen (zum Beispiel mit Hochschulen zum Aufbau relevanter Fähigkeiten für Zukunftstechnologien) dabei, finanziell schlanke Talententwicklungsprogramme aufzubauen. Wer gezielt investiert, senkt langfristig Kosten – verlorene Talente zurückzugewinnen, ist meist teurer und schwierig. Laut Bundesagentur für Arbeit lagen die durchschnittlichen Vakanzkosten in Deutschland im Jahr 2023 bei rund 49.500 Euro und die durchschnittliche Vakanzzeit bei 138 Tagen.⁴

Der Erfolg der Zulieferer wird in den nächsten Jahren davon abhängen, ob es ihnen gelingt, Effizienz und Zukunftssicherung parallel zu gestalten. Wer jetzt Schlüsselkräfte erkennt, fördert und bindet, verschafft sich einen klaren Vorsprung. Entscheidend ist also nicht nur, wer gehen muss – sondern vor allem, wer auf keinen Fall verloren gehen darf.

Abbildung 1 – Beschäftigte in der Automobilzuliefererindustrie vs. Automobilindustrie gesamt in Deutschland

Anmerkung:

Alle Angaben in Tausend, gerundet. Quelle: Analyse durch Berylls by AlixPartners basierend auf: Statistisches Bundesamt. (14. März, 2025): Anzahl der Beschäftigten in der Automobilzulieferindustrie in Deutschland in den Jahren 2005 bis 2024, sowie Anzahl der Beschäftigten in der Automobilindustrie in Deutschland in den Jahren 2005 bis 2024.

Quelle:

¹ Statistisches Bundesamt. (14.03.2025): Anzahl der Beschäftigten in der Automobilzulieferindustrie in Deutschland in den Jahren 2005 bis 2024.

² European Association of Automotive Suppliers (15.01.2025): Job losses escalate as demand stays below expectation.

³ Statistisches Bundesamt (Abruf 08.05.2025): Insolvenzverfahren (Unternehmen nach ausgewählten Positionen – WZ08-29; WZ08-292; WZ08-293; Jahr 2024).

⁴ Bundesagentur für Arbeit (2023). Arbeitskräftenachfrage: Nachfrage sinkt vor dem Hintergrund der schwachen Wirtschaftsentwicklung merklich.

Featured Insights

trategiearbeit im VUCA‑Zeitalter – warum jetzt handeln?

Volatilität, Unsicherheit, Komplexität, Ambiguität – egal, welchen Buchstaben der VUCA‑Gleichung man herausgreift, das Ergebnis bleibt gleich: Seit Jahresbeginn werden strategische Langfristpläne für Automobilhersteller sowie Zulieferer schneller ausgehebelt, als klassische Planungszyklen reagieren können. Denn hohe Strafzölle binnen weniger Tage, drohende Verbote chinesischer Connectivity‑Bauteile durch ICTS‑Regeln oder aber geopolitische Brandherde zeigen: Die Reaktionszeit schrumpft dramatisch. Gleichzeitig steigt jedoch die Unsicherheit und sie verstärkt sich auf jeder Stufe der Lieferkette.

Für Zulieferer steht daher fest: Noch nie war der Preis für verpasste Marktsignale und lange Reaktionszeiten höher. Die Gretchenfrage ist daher: Wie können Zulieferer-Strategieabteilungen ihr Marktumfeld effektiv scannen und zügig die richtigen Schlüsse aus einer Vielzahl paralleler Entwicklungen ziehen?

Unsere Projekte und Beobachtungen geben dabei Einblicke in eine vielversprechende Antwort: Zulieferer beginnen den „traditionellen Weg“ zu verlassen und schrittweise auf die Intelligenz großer Sprachmodelle (LLMs) zu setzen – in der Hoffnung, Veränderungen früher erkennen und dann entschlossen handeln zu können, um das Geschäft abzusichern. Diese LLMs beherrschen dabei – sofern richtig eingesetzt – deutlich mehr als die wohlbekannte Texterstellung, ‑zusammenfassung oder Bildgenerierung.

In der Praxis werden LLMs als „Thought Partner“ und autonome Analysten Strategieleitern zur Seite gestellt. Dies kann beispielsweise Fragestellungen zur Anfälligkeit des eigenen Absatzmarktes, zu Investitionsbedarfen oder auch Verhandlungsstrategien mit Zulieferern oder Kunden umfassen. Für den erfolgreichen Einsatz der Modelle bei derartigen Fragen kommt es zum einen auf die Modellqualität an – frei verfügbare Modelle verfehlen nicht nur die benötigte Präzision, sie bergen dazu auch noch Risiken beim Einsatz im Geschäftsumfeld; zum anderen muss ein Modell durch den richtigen Befehl (Prompt) angesteuert werden.

Mit den richtigen Daten, Fragestellungen und Nutzern ausgestattet, arbeitet agentische KI mit schnellen Rückkopplungsschleifen, bis das gesetzte Ziel erreicht ist – sie sucht eigenständig nach Antworten, bewertet Quellen, schließt Wissenslücken und erledigt Folgeaufgaben. So werden Szenarioanalysen, die manuell Tage dauern könnten, mitunter so weit beschleunigt, dass eine Entscheidungsempfehlung verfügbar wird, bevor der sprichwörtliche Kaffee aufgebrüht ist.

Das beschriebene Konzept ist das eines „Strategic AI Seismographs“ – einem Netz autonomer Agenten, das öffentliche und proprietäre Datenströme durchgehend abtastet, Relevanz quantifiziert und nur jene „Erschütterungen“ meldet, die tatsächlich relevant für die Erfolgsaussichten eines Zulieferers sind. Dabei gilt es, auf ein sauberes Fundament zu achten, das Zulieferern den erfolgreichen Einsatz ermöglicht, ohne sich in technologische Abhängigkeiten zu begeben. Gleichzeitig darf Freiheit für KI-Agenten keinen Freibrief darstellen. Drei zentrale Leitplanken zeichnen sich daher für die praktische Akzeptanz und Compliance ab:

Abbildung 1 – „STRATEGIC AI SEISMOGRAPH“-BLUEPRINT

(Erlaubt Anpassung an kundenspezifische Situation sowie schrittweise Umsetzung)

Quelle: Berylls by AlixPartners

Featured Insights

ie Top-100-Automobilzulieferer werden aktuell mit einem sich zuspitzenden Mix aus kurzfristigem Druck und strukturellem Gegenwind konfrontiert.

Die jüngsten protektionistischen Maßnahmen der USA – insbesondere die Erhöhung von Zöllen auf Fahrzeugkomponenten und Fahrzeuge – treffen eine Branche, die bereits durch fragile Lieferketten und hohe geopolitische Unsicherheiten belastet ist. Parallel verschärfen sich die Marktbedingungen in China: Internationale OEMs verlieren zunehmend an Boden gegenüber schnell wachsenden, innovationsstarken lokalen Herstellern.

Diese Entwicklungen treffen die Branche in einer finanziell angespannten Lage. Viele Zulieferer haben in den vergangenen Jahren ihren Fremdkapitalanteil deutlich erhöht, während die Profitabilität unter steigenden Inputkosten, hoher Investitionslast und rückläufigem Absatzvolumen gelitten hat.

Folglich steigt der Druck auf die etablierten Zulieferer, sich an die neuen Marktgegebenheiten anzupassen.

Als Krisenursachen lassen sich folgende Faktoren identifizieren:

Technologischer Wandel. Die Entwicklung hin zum elektrischen Fahrzeug weist in den großen Märkten USA, Europa und China erhebliche Unterschiede auf. In Europa führt ein deutlich geringerer Absatz von Elektrofahrzeugen entgegen der Planung der OEMs und Zulieferer zu Überkapazitäten, fehlender Kostendeckung und zunehmender Planungsunsicherheit. In China erfolgt die Entwicklung komplett konträr, wobei vor allem lokale OEMs und Zulieferer vom steigenden Absatz profitieren. Weitere Megatrends wie automatisiertes Fahren und vernetzte Fahrzeuge belasten die Zulieferer durch hohe Investitionsbedarfe, deren Finanzierung zu einer wachsenden Herausforderung wird.

Höhere Faktorkosten und Kostendruck. Die im Zuge von Corona- und Ukraine-Krise stark gestiegenen Faktorkosten führten vor allem bei europäischen Zulieferern zu einem Margenrückgang, da aufgrund langfristiger Preisvereinbarungen eine Weitergabe an die OEMs nur zum Teil möglich war. Mittlerweile zeigt sich zwar eine teilweise Normalisierung variabler Kosten, jedoch auf einem nach wie vor höheren Niveau als vor der Coronapandemie.

Geopolitische Risiken und Volumenverschiebungen. Die aktuelle Zollpolitik der US-Regierung gefährdet den US-Automobilmarkt substanziell durch steigende Fahrzeugpreise. Zölle auf importierte Fahrzeuge und Fahrzeugkomponenten werden sich auch auf das Produktionsvolumen in Europa auswirken. Hinzu kommen potenzielle Verwerfungen der Lieferketten zwischen Kanada, USA und Mexiko – mit der Folge steigender Kosten. Diese Risiken treffen auf eine Industrie, die seit der Coronapandemie ohnehin unter einem deutlich geschwächten Markt leidet. Den nordamerikanischen und europäischen Märkten war es nicht möglich, wieder das Vorkrisenniveau zu erreichen, und selbst der einstige Wachstumsgarant China verharrt deutlich unter dem Niveau vor der Pandemie. Hinzu kommen aufstrebende chinesische OEMs, die zunehmend ihren Heimatmarkt dominieren. Innerhalb weniger Jahre konnten sie ihren Marktanteil von unter 50 % (2021) auf circa 65 % (2024) erhöhen, wobei von einer Fortsetzung dieses Trends auszugehen ist.

Steigender Wettbewerbsdruck. Neue Zulieferer, insbesondere aus China, drängen auf den Markt und heben sich durch neue Technologien, verkürzte Entwicklungszeiten und kompetitive Kostenstrukturen von ihren Mitbewerbern ab. Die chinesischen Zulieferer unter den Global Top 100 konnten von 2018 bis 2024 ihren Umsatz mehr als verdoppeln und ihre Marge deutlich erhöhen, während etablierte Player lediglich um rund 16 % gewachsen sind und leicht rückläufige Margen verzeichnen (vergleiche Abbildung 1).

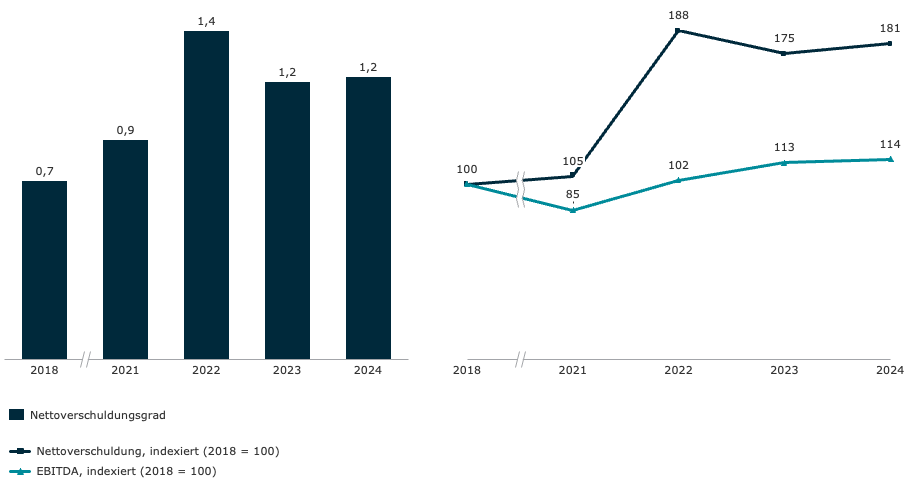

Steigende Kapitalkosten. Aufgrund des Margenrückgangs und der trüben Marktaussichten reduzieren viele Finanzierer ihr Kreditvolumen in der Automobilbranche was den Zugang zu Finanzierungen erschwert und verteuert. Hohe Investitionen in die Transformation der Geschäftsmodelle sowie geringere Gewinne führten fast zu einer Verdopplung des Nettoverschuldungsgrads bei den etablierten Zulieferern (vergleiche Abbildung 2). Über 40 % der Top-100-Zulieferer mit einem Kreditrating bei S&P haben Stand April 2025 im Vergleich zur Vor-Corona-Zeit eine schlechtere Bonitätseinstufung.

Eine Trendwende ist in absehbarer Zukunft nicht zu erwarten. Aufgrund angekündigter Produktionsverlagerungen der Hersteller und weiterer Exportbeschränkungen könnte die Fahrzeugproduktion in Deutschland bis 2030 um weitere 20 % zurückgehen. Die ohnehin geringe Auslastung der deutschen Werke von etwa 70 % würde sich dadurch weiter verschärfen, mit schwerwiegenden Folgen für den Standort Deutschland und die hiesige Zuliefererindustrie.

Strukturelle Anpassungen und Flexibilität bleiben daher auch künftig unerlässlich für die Zuliefererbranche. Die bereits angekündigten Streichungen von über 20.000 Arbeitsplätzen in Deutschland dürften nur die Spitze des Eisbergs sein. Angesichts dieser Entwicklung überrascht es kaum, dass Zulieferer gezwungen sind, ihr Geschäftsmodell und ihre strategische Ausrichtung zu überdenken. Immer mehr Unternehmen wenden sich von ihrer ursprünglichen Branche ab, tätigen Zukäufe in anderen Industriezweigen und diversifizieren so ihr Geschäftsmodell. Zahlen belegen diesen Trend: Seit 2023 ist der Umsatzanteil der Zulieferer im traditionellen Automobilgeschäft um über 6 % gesunken.

Die gute Nachricht ist, dass die Wichtigkeit und Tragweite der aktuellen Situation in den Etagen von Geschäftsführung und Vorstand frühzeitig erkannt worden ist. Die Erfahrungen im Umgang mit den vielfältigen Krisen seit Beginn der Pandemie zahlen sich nun für die Zuliefererindustrie aus. Welche weiteren Herausforderungen und Unwägbarkeiten in den kommenden Monaten auf die Branche zukommen werden, ist ungewiss. Dass sie kommen werden, steht jedoch außer Frage. Die weitere konsequente Umsetzung der bereits gestarteten Effizienzprogramme in Kombination mit einer ergebnisoffenen Strategiekontroverse werden über den Erfolg oder Misserfolg der Zulieferer im Umgang mit diesen Krisen entscheiden

Abbildung 1 – EBITDA-Marge TOP 100 Zulieferer

Anmerkung: N=64 Zulieferer: Konzernfinanzkennzahlen der Top 100 Zulieferer mit veröffentlichtem Finanzbericht Geschäftsjahr 2024

Quelle: Capital IQ, AlixPartners Analysis

Auf die oben genannten Herausforderungen gibt es keine allgemeingültige Antwort. Etablierte Zulieferer sollten die für sie richtige Vorgehensweise ausarbeiten und umsetzen. Dennoch lassen sich einige allgemeingültige Erfolgsfaktoren für effektive und effiziente Restrukturierungsprogramme identifizieren:

Frühzeitiges Erkennen und Anerkennung des Handlungsbedarfs. Viele Restrukturierungen scheitern, weil die betroffenen Akteure Krisen zu spät erkennen und zu spät handeln. Hoffnung, dass der Markt schon wieder anziehen wird, ist selten ein guter Ratgeber. Krisenursachen müssen offen adressiert und angegangen werden.

Rechtzeitige Einbeziehung der wesentlichen Stakeholder. Im Krisenfall erfordert eine erfolgreiche Restrukturierung die Unterstützung und Beiträge vieler wesentlicher Stakeholdergruppen, insbesondere der Kunden, Finanzierer, Warenkreditversicherer, Eigentümer und Mitarbeiter. Rechtzeitige Information und Transparenz sind entscheidend, um Vertrauen bei den wichtigen Stakeholdern zu bilden.

Restrukturierungsexpertise auf Unternehmensseite. Häufig fehlt die erforderliche Krisenerfahrung im Unternehmen, während aufseiten der externen Stakeholder erfahrene Restrukturierungsmanager die Führung übernehmen. Gleichzeitig muss das bestehende Management gerade auch in der Krise das operative Tagesgeschäft aufrechterhalten. Krisenerprobte Experten, gegebenenfalls auch im Management als Chief Restructuring Officer (CRO) eingesetzt, können diese Lücken schließen, das Management entlasten und eine konsequente Umsetzung sicherstellen.

Starker Fokus auf Liquidität. In schwierigen Zeiten und akuten Krisen ist Transparenz über die verfügbare Liquidität lebenswichtig. Kurzfristig wirkende Liquiditätsmaßnahmen sind essenziell, um die erforderliche Zeit für die Restrukturierung zu gewinnen – etwa in Form von Working-Capital-Maßnahmen, Ausgabenstopps und CAPEX-Optimierungen.

Anpassung und Flexibilisierung der Kostenstrukturen. Für die meisten Zulieferer ist es unumgänglich, Kostenstrukturen zu optimieren und zu flexibilisieren. Hierfür ist meist die Anpassung von Produktionskapazitäten und des Produktionsnetzwerks notwendig. Die Unsicherheiten in der Branche erfordern hohe Flexibilität und kurze Reaktionszeiten sowohl in der eigenen Organisation als auch über die gesamte Lieferkette hinweg.

Klare Strategie und zukünftiges Geschäftsmodell. Die Sicherstellung der langfristigen Wettbewerbsfähigkeit im globalen Wettbewerbsumfeld erfordert eine klare Fokussierung auf strategische Kernfelder (unter anderem Produkte, Technologien und Märkte). Hierzu müssen Zulieferer ihr aktuelles Geschäftsmodell kritisch hinterfragen und sich konsequent von strategisch nicht relevanten Geschäftsfeldern und Aktivitäten trennen („fix, sell or close“).

Konsequente Umsetzung der Restrukturierungsmaßnahmen. Die Maßnahmen müssen weit genug gefasst sein, um die langfristige Wettbewerbsfähigkeit nachhaltig wiederherstellen zu können – sowohl kostenseitig als auch technologisch und strategisch. Die konsequente Umsetzung der Maßnahmen ist hierbei ausschlaggebend.

Keine Vernachlässigung des Tagesgeschäfts. Gerade in länger verlaufenden Krisen besteht das Risiko, dass das operative Tagesgeschäft vernachlässigt wird, wodurch die bestehenden Krisenursachen noch verstärkt werden. Zur Wiedergewinnung der Wettbewerbsfähigkeit müssen Technologien und Produkte weiter vorangetrieben werden. Vertriebserfolge und die erfolgreiche Akquise neuer Aufträge sind zentral für den langfristigen Restrukturierungserfolg.

Abbildung 2 – Nettoverschuldungsgrad (Nettoverschuldung/EBITDA) und Nettoverschuldung

Anmerkung: N=53 Zulieferer: Konzern-Finanzkennzahlen Top 100 Zulieferer exkl. China mit veröffentlichtem Finanzbericht Geschäftsjahr 2024

Quelle: Capital IQ, AlixPartners Analysis

Der Handlungs- und Transformationsbedarf ist enorm hoch. Nach einigen bereits schwierigen Jahren steht die Branche zusätzlich durch veränderte Marktbedingungen in China, wachsende chinesische Konkurrenz, erschwerte Finanzierungsbedingungen, geopolitische Unsicherheiten und nicht zuletzt durch die US-Zollpolitik unter Handlungsdruck. Es ist entscheidend, erforderliche Transformationen und Restrukturierungen frühzeitig und konsequent anzugehen. Die rechtzeitige Einbeziehung der wesentlichen Stakeholder ist ein zentraler Erfolgsfaktor.

Featured Insights

an hört sie überall auf den Gängen der Automobilzulieferer: Die Schlagwörter sind die gleichen, nur die Reihenfolge mag sich in Abhängigkeit von der strategischen Relevanz geringfügig ändern. Richtig – die Rede ist von Überkapazitäten, Zöllen, Stellenabbau und Diversifikation des Geschäftsmodells.

Dabei war der Ausblick für den deutschen Standort, insbesondere im Hinblick auf die Fahrzeugproduktion, bereits vor den Verwerfungen im Frühjahr deutlich eingetrübt. Diese Entwicklung muss wieder als Top-Priorität betrachtet werden, um rechtzeitig die richtigen strategischen Entscheidungen treffen zu können.

Die Anzahl der Beschäftigten in der deutschen Zuliefererindustrie ist stark rückläufig. Stand heute zählt die Branche 267.000 Beschäftigte. Das sind 14 % weniger als noch 2019. Damit verdeutlicht der Beschäftigtenstand in der Zuliefererindustrie sinnbildlich die Situation der Automobilnation Deutschland. Wurden hierzulande 2019 noch 4,9 Millionen Fahrzeuge produziert, waren es 2024 nur noch 4,2 Millionen – 14 % weniger.

Eine Trendwende ist in absehbarer Zukunft nicht zu erwarten. Aufgrund angekündigter Produktionsverlagerungen der Hersteller und weiterer Exportbeschränkungen könnte die Fahrzeugproduktion in Deutschland bis 2030 um weitere 20 % zurückgehen. Die ohnehin geringe Auslastung der deutschen Werke von etwa 70 % würde sich dadurch weiter verschärfen, mit schwerwiegenden Folgen für den Standort Deutschland und die hiesige Zuliefererindustrie.

Strukturelle Anpassungen und Flexibilität bleiben daher auch künftig unerlässlich für die Zuliefererbranche. Die bereits angekündigten Streichungen von über 20.000 Arbeitsplätzen in Deutschland dürften nur die Spitze des Eisbergs sein. Angesichts dieser Entwicklung überrascht es kaum, dass Zulieferer gezwungen sind, ihr Geschäftsmodell und ihre strategische Ausrichtung zu überdenken. Immer mehr Unternehmen wenden sich von ihrer ursprünglichen Branche ab, tätigen Zukäufe in anderen Industriezweigen und diversifizieren so ihr Geschäftsmodell. Zahlen belegen diesen Trend: Seit 2023 ist der Umsatzanteil der Zulieferer im traditionellen Automobilgeschäft um über 6 % gesunken.

Die gute Nachricht ist, dass die Wichtigkeit und Tragweite der aktuellen Situation in den Etagen von Geschäftsführung und Vorstand frühzeitig erkannt worden ist. Die Erfahrungen im Umgang mit den vielfältigen Krisen seit Beginn der Pandemie zahlen sich nun für die Zuliefererindustrie aus. Welche weiteren Herausforderungen und Unwägbarkeiten in den kommenden Monaten auf die Branche zukommen werden, ist ungewiss. Dass sie kommen werden, steht jedoch außer Frage. Die weitere konsequente Umsetzung der bereits gestarteten Effizienzprogramme in Kombination mit einer ergebnisoffenen Strategiekontroverse werden über den Erfolg oder Misserfolg der Zulieferer im Umgang mit diesen Krisen entscheiden