y some estimates, metaverse activity will generate more than $1 trillion in annual revenues. But why and how should carmakers get involved?

Facebook renaming itself Meta in late 2021 kickstarted a significant amount of hype and often misinformed discussion around the metaverse. Even the notion of a single metaverse is – at least for now – misleading. We define a metaverse as an open virtual world with 3D graphics, in which users can roam and interact with one another as well as the structures within it.

You are right. Metaverses are nothing new per se: gamers have long been used to meeting and interacting with virtual personas in online worlds. Second Life, arguably the first pure metaverse, serves as a warning – it was launched in 2003 but never gained mainstream traction. However, two decades on, accelerated by Covid-19, the virtual world is now far more closely intertwined with the real world, VR and AR hardware is more financially attainable. Even more dramatically, what has changed in recent months is that companies have had an epiphany regarding the commercial potential of these virtual spaces.

Global brands including Nike are making bets on the metaverse, where young consumers are already congregating. The sportswear giant is launching “Nikeland”, a virtual brand experience within the Roblox metaverse, which is frequented by an estimated two-thirds of tomorrows car buyers in the US. At the end of 2021, Every Realm, a metaverse investor, had purchased $4.3 million of virtual land. However, this could potentially be dwarfed by the estimated $1 trillion of revenue that analysts at Greyscale Investments, a digital currency asset manager, estimate may be created each year in metaverse spaces. Some $25bn will be spent on virtual luxury goods and collectibles alone by 2030, Morgan Stanley forecasts.

We believe it is now safe to say: the metaverse matters and this time it is different.

Investing in the metaverse is similar to investing in the early days of the internet – the risks are undeniable, but so is the scale of the potential opportunity. In our view, the car industry has even more to gain from embracing the metaverse than many other sectors.

OEMs have an opportunity to increase their toplines by selling virtual vehicles or merchandise, as well as by positioning their brands in the virtual spaces that the car buyers of today and tomorrow are actively flocking to.

There is also an opportunity to reduce costs by improving operations. The key benefit of using the metaverse as an operational play is the ability to accelerate the planning process, with increasing precision and efficiency. By using the data produced by a virtual twin to anticipate how production operations will work in reality, OEMs can plan, test and optimize production lines before and during a model’s production cycle.

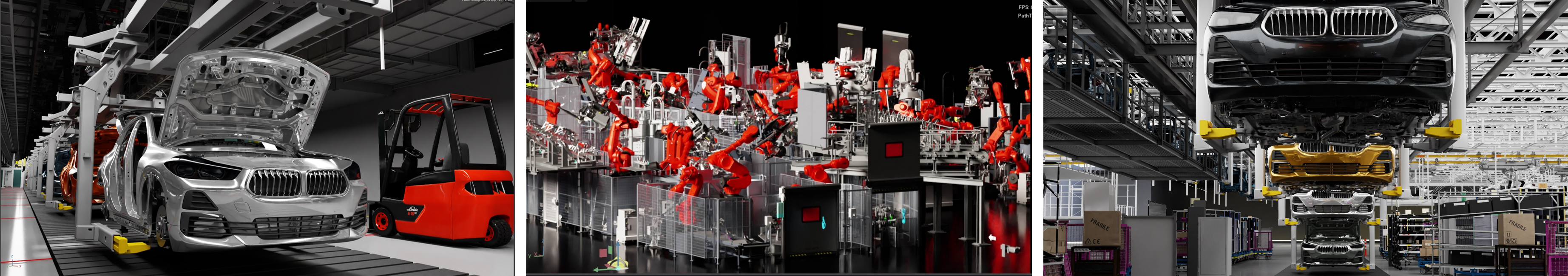

This is not science fiction. OEMs have already begun moving into the metaverse pursuing different strategies: Hyundai and Cupra, for example, have created virtual brand experiences in the metaverse, displaying their visions of the future of mobility as well as their new vehicles. BMW has teamed up with Nvidia to create a virtual twin of its Regensburg factory on Nvidia’s Omniverse platform, to plan, test and optimize production operations.

Metaverse: BMW Virtual Twin Production Line

We have assessed OEMs’ metaverse activities to date and grouped them in the illustration below. The result shows that carmakers have seen the visual branding value in metaverses, ranging from Ferrari creating a virtual twin for car configurations, to the creation of proprietary metaverses to advertise new vehicles.

At the same time, a small group of innovators are setting themselves apart: like BMW, Hyundai is also building a “meta-factory” at the company’s innovation center in Singapore. The aim is to learn how to maximize the use of robots in production by virtualizing robot-controlled processes, using experts with VR headsets to operate the robots remotely.

Merging the real and the virtual, Audi is currently working on a hybrid in-car experience, combining the sensation of a moving vehicle with travelling through a virtual metaverse, experienced via a VR headset while sitting in the real car.

What is more, Chinese OEM IM Motors is developing a hybrid sales experience in which users can earn points redeemable for parts and accessories through their driving behaviors.

As more carmakers enter the space, waiting could be costly. What actions can OEMs take now to stay ahead of the wave?

First: win acceptance from top management. Agreed, metaverse as an abstract topic may be neglected and shunned on OEMs top floors. Bringing tangible examples of how other established companies including OEMs are engaging in the Metaverse can create the urgency to act.

Second: Decide on a metaverse strategy to pursue. Should the strategic focus be on branding, sales, operational improvements, hybrid virtual-real customer experiences, or a combination of these? A decision is needed here: OEMs risk losing touch with the generation of brand-obsessed, digital-native car buyers who have grown up living in virtual spaces. These customers expect to interact with their chosen brands in both the physical and virtual world.

Third: Decide on how to enter the metaverse. Depending on OEM endowment and willingness to engage, a decision must be made whether to invest in a footprint in an established metaverse or to rent a space within it. On the other side of the spectrum, OEMs may opt to build a proprietary metaverse capturing full freedom and influence over the virtual space.

Fourth: Decide which metaverse to enter. Community size, growth, composition, and engagement differ across metaverses. Making sure these parameters match with the metaverse strategy is key. What is more: Depending on the metaverse, just as with real-world real estate, the amount of virtual land in a specific metaverse can be capped, and plots that are close to users’ favored spots are the most sought after. This creates scarcity and drives virtual land values higher. Swift action is needed to pre-empt exploding virtual real estate prices.

Last: Decide on key partners. OEMs will likely not have the capabilities for a metaverse strategy in-house. Partnerships are key. Depending on the level of metaverse engagement, different types of partners should be considered. These may range from freelance designers, useful, for example, for the creation of brand experiences in existing metaverses, all the way to tech companies that may serve the OEM in its full spectrum metaverse strategy.

Investing in a footprint in the metaverse is a high-risk, high-reward opportunity. Done right, OEMs can secure the attention of future car buyers, position their brands as innovative and optimize their operations. We believe that, as with the internet itself, joining the metaverse is not a question of when, but if.

Stay tuned: In upcoming posts, we will lift the curtain and deep dive on selected OEM metaverse strategies.

Timo Kronen (1979) is partner at Berylls Group with focus on operations. He brings 17 years of industry and consulting experience in the automotive industry. His focus is on production, development and purchasing as well as supplier task forces. Some of his recent projects include:

Restructuring of the Procurement Function (German Sports Car OEM), Supplier Task Force for an Onboard Charger (German Premium OEM), Strategy Development for the Component Production (German Premium OEM)

Before joining Berylls, Timo Kronen worked at PwC Strategy&, Porsche Consulting Group and Dr. Ing. h.c. F. Porsche AG. He holds a diploma degree in industrial engineering from the Karlsruhe Institute of Technology (KIT).