NO TIME TO READ THIS WEBSITE?

WANT TO DISCOVER MORE?

SEARCH

WANT TO DISCOVER MORE?

SEARCH

fter three years of recovery, the global supplier industry faced another setback in 2024. Declining vehicle production figures, sluggish electric vehicle sales, and mounting pressure on automotive manufacturers have brought the upward trend of recent years to a halt.

Although many suppliers are managing to keep their margins stable, the 4.6% revenue decrease to 1,085 billion euros shows how tense the situation is. This becomes especially noticeable at the upper end of the rankings, as only one of the 20 largest supplier companies reported any growth at all in 2024.

The year marked a period of crisis for the automotive industry worldwide. At the end of 2024, 69 of the world’s 100 largest automotive suppliers recorded lower revenue in their annual financial statements. Overall, the revenue of the Top 100 companies fell by 4.6% from 1,135 billion euros to 1,085 billion euros, ending the post-coronavirus growth phase that had recently seen new records set every year. The main reason for the difficulties faced by automotive suppliers is the lack of revenue generated by their customers. As a result, the ten largest OEMs also recorded a revenue downturn in 2024. Their total revenue fell from 1,770 billion euros to 1,731 billion euros, a drop of 2.2%. Above all, the lack of demand for electric vehicles led to revenue shortfalls right along the supply chain. Whereas battery manufacturers had consistently posted the highest growth rates in recent years, they trailed behind in 2024 with revenue declines of 12.7% (CATL), 28.3% (LG), and 41.5% (Samsung SDI). The situation is also highlighted by looking at the Top 100 companies excluding battery manufacturers, which showed a downswing of only 3.1% instead of 4.6%.

A year-on-year comparison of the revenue-weighted margin shows only a slight drop from 5.9% to 5.8%, which is more than remarkable given the significant decrease in revenue and demonstrates the effectiveness of the cost-cutting measures implemented. While many companies actually managed to expand their margins, around half saw them fall year on year. The front-runners of recent years (from the semiconductor industry) in particular showed signs of weakness in 2024. The Top 10 OEMs also saw their margins come under pressure. While the revenue-weighted margin was still at 8.5% in 2023, it fell by 20% to 6.8% in 2024. This presented a very mixed picture among OEMs: at VW, the margin fell by 16.2%, at BMW by 32.0%, at Mercedes by 27.6%, and at Stellantis by as much as 80.1%. GM and Honda, on the other hand, were able to increase their margins by 26.0% and 14.7% respectively.

Altogether, three trends defined the year 2024 for the automotive industry: a slump in demand for electric vehicles, poor financial performance by the former front-runners in batteries and semiconductors, and the extremely fraught financial situation among automotive manufacturers, particularly in Germany.

Moreover, international competition intensified, driven by a combination of lower-cost production sites and protectionist trends. European suppliers in particular were under twofold pressure, as falling demand in the domestic market was compounded by structurally weaker local conditions.

The year 2024 was a difficult one for the automotive industry worldwide, with a palpable effect on OEMs and suppliers alike. This was particularly evident in the lower vehicle production figures, which decreased globally by 2.2% from 90.5 to 88.5 million units. Europe was particularly impacted by the downturn. Overall, 5% fewer vehicles were produced on the continent year on year, equivalent to the pre-pandemic level of 2019. The three largest German OEMs, i.e., Volkswagen, BMW, and Mercedes-Benz, also suffered an overall production decline of around 4.7% worldwide.

Figure 1 – Annual vehicle production of OEMs by region

(in million vehicles, 2019–2024)

Source: SP Mobility

However, this drop in production volumes merely masks a deeper structural problem, i.e. the underutilization of manufacturing capacity. In Germany, average plant capacity utilization in 2024 was only 68% – well below the threshold of around 85% considered economically viable. To compare: prior to the coronavirus pandemic in 2019, capacity utilization still stood at 73%. Ongoing pressure on production volumes is forcing both OEMs and suppliers to fundamentally rethink their site and manufacturing strategies, as factor costs are rising due to low capacity utilization, thus intensifying competition.

Figure 2 – Capacity utilization of German OEM plants

(in %)

Source: S&P Global Mobility LV Production (11/24), Inovev, Berylls by AlixPartners Analysis

These structural challenges are also reflected in the economic performance of suppliers, particularly in Europe. Of the 34 European suppliers in the Top 100 ranking, 27 reported a year-on-year revenue decline. Nonetheless, the average contraction of around 1.5% was far more moderate than the global average decline of 4.6%.

An international comparison also shows that suppliers in traditional automotive manufacturing nations are struggling considerably to adapt. Between 2019 and 2024, Japan, the US, and Germany recorded the greatest losses of companies in the Top 100 ranking – Japan lost five, while the US and Germany each lost three listed suppliers. Although Germany’s GDP has grown by 19% since 2019, the country’s suppliers have been unable to reflect this growth to the same extent, as their cumulative revenue growth was only 8%. This is a clear indication that the traditional strength of German suppliers in global competition is coming under increasing pressure.

The situation in Japan is even more serious, where nominal GDP fell by 20% between 2019 and 2024. The revenue share of the Top 100 suppliers based in Japan fell by 7% during the same period. These figures illustrate how deeply the Japanese supplier industry has been impacted by economic stagnation and structural challenges. In a shrinking economic environment, companies have only a limited amount of scope to take countermeasures.

In the US, on the other hand, GDP grew by an impressive 35% between 2019 and 2024, although here too, suppliers were unable to keep pace. The revenue share of the country’s automotive suppliers rose by only 15%. This gap between overall economic growth and the performance of the supplier sector shows that the automotive industry is no longer an economic driver in many countries. It also points to structural problems such as tougher international competition, particularly from Asian rivals, and the accelerated pace of technological change in the global automotive market.

However, the picture is different in countries that have managed to better position their suppliers. In Korea, China, France, Ireland, Sweden, Spain, India, Switzerland, and the Netherlands, revenue among the Top 100 suppliers grew faster than GDP between 2019 and 2024. These countries benefit greatly from their specialization in high-growth technology sectors and from consistent industrial policies that promote innovation and internationalization. Prominent companies include Autoliv from Sweden, Aptiv and Adient based in Ireland, NXP Semiconductors from the Netherlands, and Motherson in India.

China stands out in particular. While only three new Chinese suppliers were listed in the global Top 100 ranking between 2018 and 2023, four new companies were added in 2024 alone. These are Huizhou Desay, a supplier of cockpit electronics and infotainment systems; Ningbo Tuopu, which specializes in chassis and NVH components; Huawei, a technology group that is particularly active in the automotive sector with connectivity and software solutions; and NBHX, an interior equipment and decorative components group. These recent additions have contributed greatly to Chinese Top 100 suppliers surpassing their national GDP growth of 27% between 2019 and 2024, with a remarkable 139% jump in revenue. Their rapid rise underlines the dynamism of the Chinese automotive industry and the growing influence of Chinese technology companies at a global level.

Overall, it is evident that the lower volume of vehicle production and the sluggish economic climate are weighing heavily on large parts of the global supplier industry, particularly in the traditional European automotive manufacturing countries and Japan. While Japan and Germany still occupy the top two rankings in terms of revenue, their lead over Chinese suppliers is rapidly shrinking. At the same time, new fields of technology and high-growth regions are opening up opportunities for those suppliers who have focused early on innovation, specialization, and global presence.

Figure 3 – Development of TOP 100 revenue and nominal gross domestic product per country

(cumulative in %, 2019–2024)

Source: Berylls by AlixPartners, IMF

The postponed payment of fines originally due for 2025 by three years as part of the EU’s “Fit for 55” initiative will have come as a considerable relief to many boardrooms. The ruling, which would have imposed heavy fines on manufacturers for exceeding fleet CO₂ limits, would have been an extremely tough test for high-volume manufacturers. Based on current estimates, Volkswagen would have had to pay the largest fine of some 1.92 billion euros, followed by Stellantis with 1.09 billion euros, and Ford with 749 million euros. BMW and Mercedes show that a different approach is possible, as the fleet emissions of both premium manufacturers are below the future limits and would have been exempt from sanctions even if the timetable had remained unchanged.

Figure 4 – Selected OEMs: Expected EU emissions fine payments in 2025

(fine in millions of euros)

Source: Bloomberg EU CO2 Emission Calculator

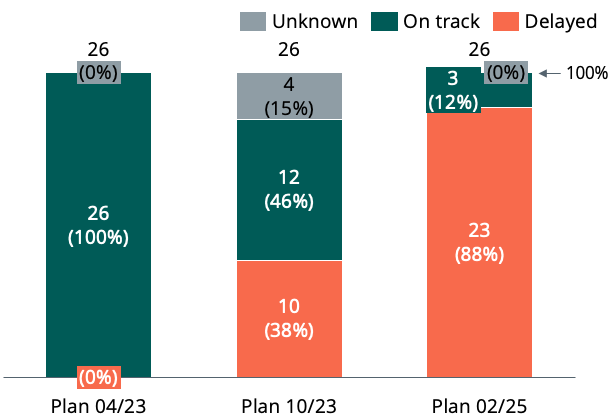

However, despite this regulatory reprieve, pressure on the industry remains high – particularly in view of the slow ramp-up of electric mobility. Project delays in the BEV segment are increasing significantly and causing more operational uncertainty. Of the 26 all-electric vehicle programs offered by German OEMs in the ranking that were originally scheduled to launch between January 2024 and December 2025, 88% had already been postponed to early 2025. The average delay has more than quadrupled to 245 days, compared to 53 days at the end of 2023. One particularly prominent example is the Volkswagen ID.2, whose SOP at the Martorell plant has now been postponed from October 2025 to June 2026.

For automotive suppliers, delays of this kind are far more than just an operational inconvenience. They result in delayed call-offs of production volumes, postponed cash flows, and major planning uncertainty for investments in tools, production equipment, and capacities. Medium-sized suppliers in particular, operating in an environment of rising interest rates, tight budgets, and restrictive lending, are thus coming under increasing pressure. Although the deferred payment of fines will give the industry some financial breathing space in the short term, the structural challenges involved in the transformation process remain.

Figure 5 – TOP 3 German OEMs: BEV programs with an SOP between 2024 and 20251

(Number of programs, (% of programs))

Figure 6 – TOP 3 German OEMs: Average delay of BEV programs with SOP between 2024 and 20251

(Delay in days)

¹ Only programs with SOP date in 2024 and 2025 (as of 04/2023) and only programs with complete data in 04/2023 and 02/2025. Matching of dates versus planned SOP from S&P mobility from 04/2023

Source: S&P global mobility LV production (02/25), (10/23), (04/23); Only programs with SOP date in 2024 and 2025 (as of 04/2023) and only programs with complete data in 04/2023 and 02/2025

Producer prices, on the other hand, are showing a positive trend. In Germany, the US, and China, prices for key production factors such as electricity, natural gas, steel, and aluminum fell significantly, providing some short-term relief in the cost structures of manufacturing companies. The fall in gas prices was particularly pronounced in the US, while electricity and base metals became cheaper in Germany.

However, the cost trend also has a downside, as China is benefiting greatly from lower input costs and thus becoming a more attractive production location. Furthermore, Chinese suppliers are increasingly exploiting their favorable cost structure aggressively on global markets, particularly in the fields of electric mobility and battery technology. The outcome is tougher price competition, placing European suppliers under even greater pressure.

Figure 7 – Evolution of producer prices since 2021

(in %)

Source: Berylls by AlixPartners

A key factor in the poor profitability of many German suppliers is the considerable rise in interest expenses in their domestic market. While the debt ratio of the Top 10 automotive suppliers remained stable overall between 2019 and 2024, with no structurally higher debt apparent, there are significant differences in interest expenses. At Bosch, Continental, and ZF, interest expenses have more than doubled since 2019 and now account for over 1% of revenue – a high figure by international standards. To compare: the Asian competitors Aisin, Denso, and Hyundai Mobis have average interest expenses of only 0.2% of revenue, despite recording double-digit growth rates in some cases. Within the Top 10, only French suppliers FORVIA (2.2%) and Michelin (1.1%) reported figures either higher than or similar to their German counterparts. The increased cost of capital is limiting investment headroom, particularly in an environment where spending on transformation would be a necessity.

Figure 8 – Interest expenses in relation to revenue

(in %)

Source: Company statements, Berylls by AlixPartners Analysis

In addition to the pressure from high interest rates, exchange rate fluctuations are also affecting the strategic positioning of suppliers, albeit with a time lag. The euro lost value against the Chinese yuan, making Chinese suppliers more competitive on the global market.

In this already tense environment, many companies have resorted to restructuring measures to reduce their cost base and boost operational efficiency. The question of whether the job cuts and performance programs initiated at the end of 2023 are already having an effect can only be answered to a limited extent. Although the number of people employed by the Top 100 suppliers rose by more than 6,000 in total in 2024, the growth hides significant regional differences. In the US, net growth of over 5,700 jobs was announced, most likely attributable, among other things, to protectionist measures such as punitive tariffs and a nationally focused industrial policy. Companies are increasing their production capacities there in order to adapt to new trade conditions.

However, the situation in Germany is quite different. Over 20,000 job losses have been announced, with almost 17,000 of these due to plant closures – for example at ZF, which alone intends to lay off 14,000 employees in Germany. Alongside other German companies such as Bosch and Continental, foreign companies are also shedding jobs at their German branches. Adient, Michelin, and Toyo Tire Corp., for example, plan to lay off around 1,600 workers in total, which led to an overall drop in employment of around 2%. One of the reasons is that plants are operating at an average capacity 5% lower than prior to the coronavirus pandemic. To optimize their cost base, many companies are opting for significantly tighter schedules in their performance programs, with the aim of completing their restructuring measures within around 18 months. However, it remains to be seen whether these ambitious targets can actually be met in practice. Especially in Germany, stringent labor laws and strong employee representation make rapid implementation a challenging prospect.

The market in India is a positive offsetting factor for developments in Europe, as more than 11,000 new jobs were created there during the same period. Companies such as ZF, Michelin, Renesas, Panasonic, and BorgWarner are investing heavily in local production facilities, emphasizing India’s growing importance as a cost-effective and strategically relevant manufacturing location for the global supplier industry.

Figure 9 – Announced staff increases and layoffs at the Top 100 suppliers by specific locations

(in FTEs 2024)

Source: Berylls by AlixPartners

In the face of contracting margins and stagnating sales markets, many suppliers are focusing on strategic diversification. The share of revenue generated outside the core automotive business rose to 17.5% in 2024, up from 16.8% in the previous year. Future-oriented industries with steady demand and high technological integration are particularly sought after.

The preferred target sectors are heating and air conditioning, industrial automation and robotics, medical technology, and sustainable construction methods. The expansion is frequently achieved via acquisitions, here are two prime examples from the Top 100: Bosch acquired Johnson Controls’ heating and air conditioning business for 7.4 billion euros – the largest takeover in the company’s history. Saint-Gobain is expanding its portfolio with the acquisition of Australian construction materials manufacturer CSR for 2.7 billion euros.

The strategic message is loud and clear: suppliers not only want to, but need to, become less dependent on the traditional automotive market. In an environment where production volumes fluctuate and technology paths are uncertain, resilience is best achieved through diversification.

2024 was a challenging year that once again demonstrated how sensitive the supplier industry is to external shocks. However, it also revealed how great the differences between business models are and how strong the dependence on technological developments such as the transformation to e-mobility is.

No fundamental easing of the situation is expected for 2025. Electric mobility will continue to develop, but the breakthrough (such as by achieving ultra-fast charging with cycles of less than 5 minutes) will be a long time coming. At the same time, the overall environment remains challenging, with geopolitical tensions, growing protectionism, increasing financing costs, and global competition for technological leadership and talent.

Suppliers who proactively adapt their strategy now, diversify their portfolios, and expand their regional presence will be among the winners. In an environment that is becoming increasingly unforgiving, adaptability is becoming the most important asset. The automotive suppliers of the future will not be distinguished by their size or tradition, but by their agility, technological relevance, and ability to make resilient decisions in uncertain times.

NO TIME TO READ THIS WEBSITE?