or over a century the auto industry has operated a B2B2C model with car makers (OEMs) wholesaling vehicles and parts to dealers who then retail these goods, packaged with additional services to customers, both private individuals and other businesses. This model has by and large been applied globally, with local variations due to industry structure and, importantly, regulation.

At least over the last several decades various tweaks have been made to mitigate structural weaknesses and cater to evolving markets and customer preferences. OEMs established direct sales channels, at first limited to government and large fleets, eg. rental car companies – and have expanded their coverage over the years, often in collaboration with their captive finance companies. There have also been some exceptions from the general rule, for example, (mostly) French and German OEMs owning retail outlets referred to as ‘succursale’ or ‘Niederlassung’ across European and some global markets. The retail networks also went through a continuous consolidation, reducing the number of outlets and more dramatically the number of owners/investors across most markets. We saw the birth of mega-dealer groups with several hundred stores retailing a wide portfolio of brands. And we have numerous international retail groups today. But the underlying ‘proven concept’ has not changed a lot.

In the meantime, the emergence of eCommerce has turned many other retail industries upside down. In automotive we are mostly still talking about it. Yes, prospects and customers have moved a large part of their pre-purchase research and a similar part of their post-purchase discussions online, but very few customers have so far been able to acquire a new car online. Nevertheless, eCommerce and the digitalization has triggered an intense discussion about the future of auto retail. And the very foundation of the current retail network is being questioned: the franchised new automobile dealer.

‘Going direct’ has become a buzzword, not least because Tesla has been ‘going direct’ from the start and by now owns and operates a global retail network that combines physical outlets with a comprehensive digital offering. Several other new players have ‘gone direct’ in more or less pure ways – take Polestar with their mostly digital and direct sales approach, backed by a physical service network, in the form of ‘old-fashioned’ Volvo dealers. The newly (SPAC-)funded US EV start-ups Lucid, Rivian and Faraday are in various stages of announcing and building their exclusive direct channels – with owned glitzy showrooms and versatile digital front ends.

This ‘fully direct’ approach is not an easily available option for incumbent OEMs with their existing dealer networks. But ‘direct sales’ does not have to mean owning your front-end – several OEMs are either testing or implementing (and many more are considering) a significant contractual change in their networks by converting their dealers to agents. New car sales will then be made directly by the OEM to consumers, while the agent may assist the customer in the process. Swedes and Austrians can now buy Mercedes-Benz cars this way, as can VW ID and Volvo BEV buyers in Europe.

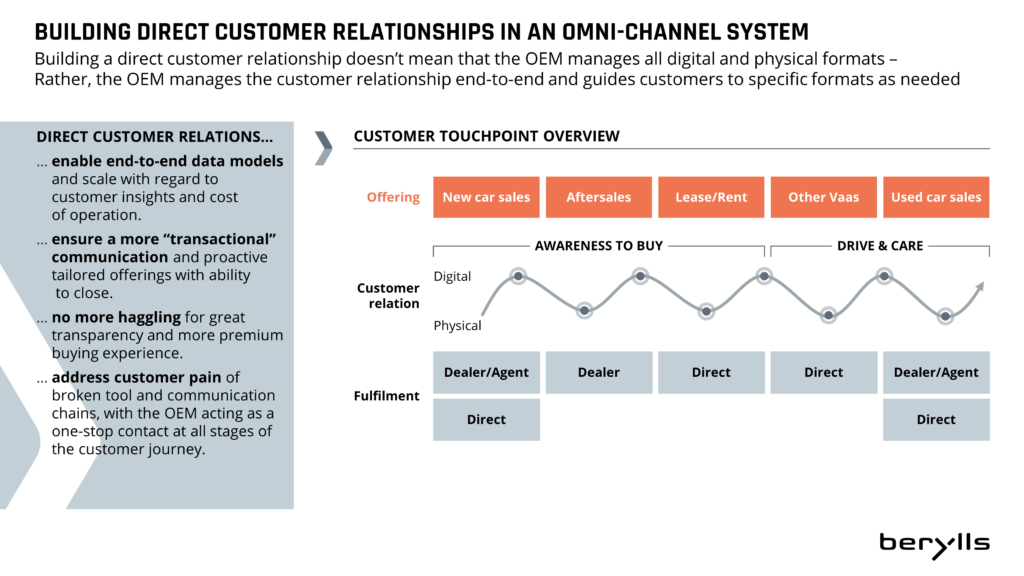

These direct sales approaches certainly have tempting advantages: an ever more digitalized customer journey and the supporting digital performance and lead management activities ideally require a fully integrated tri-party-relationship between OEMs, retailers and customers so each can conduct their activities and meet their specific needs at each step. It is entirely clear that operationally direct sales can make digitalization easier. But the OEMs motivations go beyond gaining operational benefits: better price realisation and lower retailing cost are important objectives of any such strategy. The underlying drivers are also undisputed: direct sales can all but eliminate intra-brand competition (ie. dealers of the same brand competing mostly based on price) and a more efficiently managed direct channel can reduce cost.

However, the devil as so often is in the detail and the alternative – improving the dealer system – also deserves consideration. To stimulate your thinking, we are pitching the two systems against each other in a little competition.

How easy will it be for the agent system to eliminate intra-brand competition and to move up transaction prices? The key is rigid enforcement of sales territories. Compensation must uniquely be paid to the agent who has the assigned responsibility for the home location of the customer, even if another agent entered the customer order in the OEM’s front-end system. There cannot be a work around, otherwise agents will simply give away parts of their commission to lure customers from other territories. Fortunately, the legal frameworks behind such ‘true agent’ systems in many markets allow such full territory protection. Realistically speaking an OEM should not expect to increase transaction prices by more than one percentage point, especially not when key competitors of a brand still work with a traditional dealer model. And they should not forget that intrabrand discounts come out of the retail margin – and clawing them back from retailers is not a given when switching them over to agent status.

The alternative solutions for dealer networks have limited potential left towards this objective: Intra-brand competition was initially fueled by over-crowded dealer networks with highly fragmented ownership – the old pop’n’mom dealerships ‘wherever there is a post office’. Continuous and persistent network restructuring by OEMs has reduced this problem, but the internet’s price transparency and digital disruptors like Carwow have limited the effects of network streamlining. Even a handful dealers in a given market have an incentive to out-price each other especially when stair-step and other volume incentives disproportionally reward the last few cars sold.

for the direct model

How about cost reduction? Since CI and standard-driven facility costs depend only on the network approach of a brand, we can keep them out of this consideration, leaving us with the operating and people cost in showrooms, the cost of inventory and the cost of processes and systems.

Almost all benefits of a highly digitally enabled selling process can also be realized in a traditional dealer channel. Car buyers have for years reduced the number of visits to dealerships – and therefore the cost of taking care of them in the showrooms. The remaining need for product demos and test drives is rather independent of the contractual scheme. However, removing the ‘deal stacking & closing’ elements from the sales process allows to replace the highly sought after and therefore highly paid sales consultants with lower paid product experts. Needless to point out that customer satisfaction will generally increase with the ‘haggling’ removed from the car buying process.

Agents in the new system will obviously no longer hold any new car inventories. They will simply transfer to the OEM, who then can work to reduce their level and cost. However, the resulting cost reduction by pooling stocks (and more production discipline) could also be achieved in a dealer model.

On the other hand, a transition to direct sales will also add cost. The required digital front-end systems don’t exist today and have to be built and maintained (by the OEM). Making direct transactions with end users will also require costly modifications to OEMs’ back-end systems and processes. Also, additional personnel will be required in the National or Regional Sales Companies to manage the new car inventory, to determine transaction prices and to handle customer inquiries – all tasks so far handled by dealer staff. And as with customer discounts it is not a given that the cost savings on the dealer level can be clawed back easily by the OEM in the contract switch. The required investments will have substantial pay-back times for the OEM.

Overall, more of a draw on cost reduction

All coins have two sides – and the other side of the ‘intrabrand competition’ coin is market penetration: dealers in intense competition with each other have every incentive to pursue any lead and sell vehicles to whoever they can. This ensures that local weaknesses in a network are often compensated by other dealers selling remotely into the weak dealer’s home territory, overall raising the brands national market share.

An agent, who will draw commission only from sales in his territory will make no such effort. And the formerly weak dealer will not suddenly become a strong agent – as a consequence the brand will inevitably lose market share to competitors in his territory, reducing the national average. It is not easy to envision ways how a direct selling NSC can compensate such localised weaknesses.

Looking at the agents’ own territories a lack of motivation cannot be completely ruled out: the commission is guaranteed for every sale the OEM makes in the territory – selling, after all, is now the NSC’s task. It is quite easy to imagine how the status change can impact morale, ambition, and motivation in what is in essence still a people business. “Why try hard and go the extra mile, for example to provide a test drive to a prospect at an inconvenient time?” Or why follow up the third time with an indecisive prospect? Why keep your showroom well maintained and equipped with state-of-the-art amenities? Let the NSC’s website do the job – and make money in aftersales.

On market penetration, the ‘old’ dealer system wins

1. Switching national networks on a fixed date – and staggering regional markets along a longish transition period.

A market-by-market switch makes the inevitable financial consequences easier to shoulder. The revenue lost during the sell-out of existing dealer stock is spread over several years, as is the parallel extension of the OEM’s balance sheet with retail stock. Therefore, the length of the required transition period only depends on the OEM’s financial and change capacity. For a specific dealer, however, the switch is a one-time event that can be properly prepared to minimize negative effects – in our opinion the easier to manage approach.

2. Introducing the new system with new models – a new BEV-subbrand for example. This transitions a whole region at the same time but leaves both systems at work under one and the same rooftop.

Approach #2 reverses the pros and cons – but puts yet another layer of challenge on the already difficult transition to electric vehicles. The transition itself is bound to span the better part of the decade, raising the change management challenge. Also, there are not many – if any – examples where two different retail systems could be successfully co-operated in the same channel over a longer time. The resulting conflicts of interest make daily showroom operations more difficult – and reduce the OEMs ability to ‘steer’ sales efforts.

While a switch to agents requires a risky change effort, an existing dealer system still needs continuous improvement

For any senior sales executive the dealer-or-agent question is very pertinent today. With an even score in our brief review the decision is certainly not easy to make. We therefore recommend making a decision only after thorough consideration of all factors and implications of both solutions for your specific brand’s situation.

Don’t get seduced by easy cost savings and straight-to-the-bottomline price increases – they might come with expensive side effects like high investments, increased running cost and a loss of market share.

Also, don’t forget in your considerations that some or even many of your competitors will continue to operate the traditional system, but substantially improve it with structural reforms and behavioral changes, reaping certain benefits without all the expense of a switch.

Therefore, plan realistically and do not overestimate potential benefits of the agent system while discounting the required change efforts.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.