How AI and marketing automation are reorganizing the automotive industry

How AI and marketing automation are reorganizing the automotive industry Munich, January 2026 A utomotive Marketing Under Pressure — Competing

WANT TO DISCOVER MORE?

SEARCH

utomotive Marketing Under Pressure — Competing in an Era of Shrinking Budgets and Rising Expectations

The European automotive industry is under extraordinary pressure. Electrification costs, tariff challenges, and escalating competition are forcing OEMs to deliver more output with fewer resources. Marketing, once a creative playground, has become a strategic battleground where efficiency, speed, and scalability determine competitive advantage. Yet most OEMs are confronted with long-established structures and lack of speed. Everyday marketing operations are fragmented across regions and channels, consuming excessive time and budget while limiting change and innovation. Redundant processes, manual processes, overlapping agency networks, and inconsistent brand and sales experiences are common symptoms. To hold up against internal and external pressures while pushing competitiveness, OEMs must fundamentally rethink how they plan, produce, and distribute marketing across all touchpoints.

Download the full insight now!

lectric mobility is expanding globally, but along divergent paths. In Europe and the United States, BEV adoption follows a top-down model, concentrated in higher-priced premium segments (D-E) under the automotive A-F segmentation, which classifies vehicles by size, price, and comfort, with F representing the highest luxury tier.

China, in contrast, is electrifying from the bottom up: entry-level segments (A-B) account for 38.1% of BEV sales, supported by electrification rates of 71.1% in the A-segment and 70.3% in the B-segment. This focus on affordability and scale enables broad adoption, faster learning curves, and rapid volume growth.

Figure 1 – BEV sales share by region within respective sales segment across the United States, Europe and China, 2025.

¹ Only sales share depicted from 0-100%, no absolute sales figures shown.

² Entry-level segments in China are almost entirely Chinese-origin (Seg. A: 100%, Seg. B: 95%).

Source: Berylls by AlixPartners analysis based on S&P global LV sales

This difference is no longer a marginal observation. It is shaping market dynamics, cost structures, and long-term competitiveness in the global automotive industry. At its core lies a simple question: are electric vehicles becoming a mass-market solution, or do they remain a premium product for a narrow customer base?

In the United States and Europe, BEV demand is concentrated in mid-size and premium segments, mainly larger sedans and SUVs. Both regions show the highest EV shares in the D segment, with 15% and 25%, respectively. This is economically rational for manufacturers, as higher-priced vehicles better absorb battery and technology costs and protect margins. This leads to a distortion of the market towards more premium vehicles among BEVs: The share of the D-segment among BEVs is 8%p (Europe) and 14%p (US) higher compared to a total market view, also including combustion engine vehicles.

The downside however is weak penetration in smaller, high-volume segments. The U.S. illustrates this clearly: electrification lags not due to technology limits, but because affordable entry-level BEVs are scarce and consumer preferences strongly favor pickups and large SUVs. Due to this, the A- and B-segments are traditionally small in the US (combined market share of 5% in 2025). However, lagging electrification is showing also in the large C-segment (38% of total market), highlighting problems with entry-level BEVs on this market.

Europe reaches a similar outcome for different reasons. While small segments matter more than in the U.S. (combined market share of 34%), BEV demand is heavily influenced by company car taxation. In markets such as Germany, company cars represent over 53% of new BEV registrations, reinforcing demand for larger, better-equipped vehicles and skewing the BEV mix toward premium segments.

China follows a fundamentally different electrification path. Small and compact electric vehicles dominate everyday mobility, supported by dense cities, short driving distances, and a well-developed charging network that makes entry-level BEVs practical and economical. Electrification has therefore advanced fastest in smaller vehicle segments, where BEV penetration is already very high and electric powertrains dominate in some categories. This shows especially in the A&B segment. With a combined market share of 14% across all propulsion types, these segments are not the most attractive from an OEM perspective, at least on first look. However, these segments make up over 38% of the BEV market, driven by a high BEV sales share of 70%+ in both segments (see figure 1).

This scale-driven approach has accelerated learning and cost reduction, turning BEVs into a mainstream mobility solution rather than a premium niche. Structural cost advantages – an integrated domestic supply chain, strong battery manufacturing, and widespread use of cost-efficient LFP chemistry – enable Chinese OEMs to price BEVs aggressively while sustaining scale.

The divergence between China and Western markets is structural, shaped by market design, incentives, and policy. High upfront investments have pushed Western OEMs toward premium vehicles to protect margins, slowing mass-market electrification. Policy frameworks reinforce this: Europe’s 2035 target offers long-term direction but weak near-term pressure, while U.S. incentives are constrained by price caps and sourcing rules.

China, in contrast, has consistently driven mass-market electrification through stable policy, infrastructure investment, and industrial coordination – making small vehicle segments the core of large-scale adoption.

Looking ahead, global BEV adoption will become more balanced, but regional differences will persist.

Figure 2 – BEV sales share¹ by region within respective sales segment, 2025 vs. 2030

¹ Only sales share depicted from 0-100%, no absolute sales figures shown.

² Entry-level segments in China are almost entirely Chinese-origin (Seg. A: 100%, Seg. B: 94%).

Source: Berylls by AlixPartners analysis based on S&P global LV sales

The United States is likely to remain the slowest major BEV market, with adoption polarized between premium models and a limited set of lower-end offerings due to affordability, infrastructure, and segment constraints. In the largest market segments (C/D/E), the BEV sales share growth is at 6&p or lower until 2030.

Europe, on the other hand, is on a broader electrification trajectory. BEV adoption is expanding across all segments by 2030 and driving a gradual shift toward near-complete fleet electrification within the next decade. In every segment except for the E-segment, the BEV share will grow by double-digit percentage points until 2030.

Lastly, China is entering a new phase: Having almost entirely electrified lower segments by 2025, Chinese fleet electrification is moving upmarket, intensifying competition in mid-size and premium segments domestically and internationally. Even though the electrification growth in the C-/D- and E-segments are comparable to Europe over the next five years, the continent will still be ahead based on higher BEV shares from the get-go (except for the D-segment).

The global shift to electric mobility is becoming structurally asymmetric: Europe is slowly advancing toward full-fleet electrification, China is moving up the automotive value chain, and the United States risks falling further behind.

For Western OEMs, the question is no longer whether to electrify, but how. Long-term competitiveness depends on closing the affordability gap in lower segments while defending premium positions against increasingly capable Chinese competitors. At the same time, China remains a critical strategic market – both as the world’s largest BEV ecosystem and as the primary source of competitive pressure as Chinese OEMs expand into Western markets.

The window remains open but is narrowing. Without a credible path to mass-market electrification, the democratization of electric mobility in the West will remain incomplete, with lasting competitive consequences.

n our annual analysis, we engaged with senior executives from 49 European automotive suppliers across a broad range of segments (including powertrain, E/E, interior, exterior, body, and software) and company sizes, among them multiple TOP 100 suppliers.

Most European suppliers continue to depend heavily on internal combustion engine (ICE) business, with little reduction expected before 2030. Expectations for revenue growth from e-mobility have weakened, while margin expectations remain mixed. Platform delays, underutilized BEV production capacities, and heightened competition (especially from China) reinforce a sense of strategic stagnation.

Despite these challenges, suppliers continue to diagnose themselves as strategically well prepared. This discrepancy between perceived readiness and market realities highlights a growing strategic dilemma at the heart of the transformation. This report presents the results of the 2025 survey, interprets the implications for suppliers, and outlines strategic recommendations for the years ahead.

Download the full insight now!

ES has clearly moved beyond consumer gadgets. It is now a technology and strategy forum where AI, robotics, and autonomy are reshaping how companies design products, run operations, and compete.

The overarching message this year was straightforward: Intelligence is becoming embedded everywhere, autonomy is moving into real deployments, and the line between digital and physical systems is disappearing. The winners will be those that can translate rapid technology progress into scalable, economic outcomes.

AI at CES shifted from experimentation to integration. It is no longer a set of features—it is becoming the core operating layer across vehicles, appliances, factories, and healthcare systems. The conversation moved from “agentic AI” toward physical AI—AI that not only reasons, but also acts in the real world.

What this signals

What leadership teams need to address

Where AlixPartners can help

Robotics crossed an important threshold at CES. Humanoid, service, and industrial robots are increasingly positioned as workforce solutions, not experiments—particularly in logistics, healthcare, hospitality, and manufacturing.

What this signals

What leadership teams need to address

Where AlixPartners can help

Autonomous driving messaging became notably more grounded, from bold L4/L5 timelines to scalable ADAS, software-defined vehicles, and incremental autonomy that can deliver near-term value.

What this signals

What leadership teams need to address

Where AlixPartners can help

CES made one point unmistakable: Winning companies won’t just be the best technologists—they’ll be the ones that translate intelligence and autonomy into scalable business models. Competitive advantage will go to companies that:

CES was not about the future arriving—it was about navigating the messy middle between breakthrough and scale. That is where AlixPartners play a critical role: bridging vision and execution, pressure-testing economics, and helping leadership teams move decisively from experimentation to impact.

ow are automotive marketing and sales evolving? And how to navigate growing electrification, digitalization and shifting customer expectations?

Main topics of this episode:

This Podcastepisode was recorded and published in December 2025 by Insights On Air, a Podcast by Berylls by Alix Partners

ulieferer sind erstmalig profitabler als OEMs, obwohl gleichzeitig beide Gruppen rückläufige Umsatzzahlen zu verzeichnen haben. Was lässt sich daraus für 2025/26 ableiten? Die Ergebnisse unserer TOP 25

Diese Ausgabe gibt es ebenfalls im Videoformat auf unserem YouTube Kanal:

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

Auf unserem YouTube Kanal findet ihr weitere Videoinhalte zum Thema:

This Podcastepisode was recorded and published in December 2025 by Insights On Air, a Podcast by Berylls by Alix Partners

fter-sales demand for HVBs could become an unprecedented issue for the Electric Vehicle (EV) automotive industry.

The EV battery is an auto part like any other and thus has a natural after-sales demand. Degradation over time below a certain level of SOH (state of health) – typically around 70% – would require replacements, on warranty or otherwise, depending on its mileage and the number of years driven. Recalls, accidents, and unexpected failures all add to the after-sales demand, similar to other parts in a vehicle.

However, the high prices of EV batteries and the massive investment required to produce them bring unprecedented challenges to the industry. These are further compounded by the rapid evolution of battery technology, which makes a battery outdated within a decade, as well as the difficulty in transporting and storing them, making conventional after-sales procedures unsuitable.

Download the full EV battery insight now!

How AI and marketing automation are reorganizing the automotive industry Munich, January 2026 A utomotive Marketing Under Pressure — Competing

EV democratization is fading in the West: Is the race already lost? Munich, January 2026 E lectric mobility is expanding

E-Mobility Supplier Survey 2025 Munich, January 2026 I n our annual analysis, we engaged with senior executives from 49 European

urope's and North America's automotive sectors are under increasing pressure as Chinese OEMs rapidly produce high-quality vehicles at significantly lower costs, especially in markets where price sensitivity is rising. How to leverage AI for Automotive Manufacturing?

In manufacturing alone, cost gaps can reach 60–75%, with direct labor being a major driver. Labor costs in Europe are eight to ten times higher than in Asia, yet the output per worker is falling behind. While China recorded a 4% increase in labor productivity between 2023 and 2024, Germany saw a 4.3% decline from 2024 to 2025. However, a significant portion of the cost gap is controllable through automation, tooling, facilities, and equipment choices.

Figure 1 – Manufacturing cost gap – Europe & North America vs. China

Source: Berylls by AlixPartners

Furthermore, the shift to EVs has eroded traditional advantages of established OEMs. EV designs are typically less complex than ICE designs, enabling more streamlined assembly and higher levels of automation. However, many legacy OEMs operate out of brownfield plants and rely on production systems originally designed for ICE vehicles. While these legacy setups once represented operational excellence, they now often come with rigid layouts, outdated tooling and equipment, and limited digital integration. These structural constraints limit attempts to modernize brownfield environments because they typically cause high costs and operational disruption. Implementing automation or reconfiguring lines for EV-specific purposes is not only technically challenging but also financially demanding. Consequently, legacy OEMs are less efficient than purpose-built greenfield plants, which further widens the productivity and cost gap. These dynamics also extend to automotive suppliers, who face similar challenges.

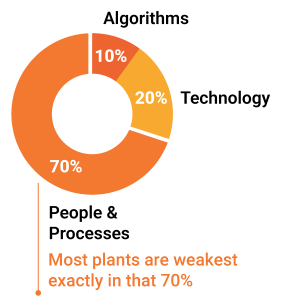

Advanced manufacturing, including the use of AI, can help close the gap. However, these solutions are not plug-and-play. Value depends heavily on solid foundations, such as clean data, redesigned processes, and personnel who have been upskilled. A useful rule of thumb is that in AI programs, roughly 10% of the benefit stems from the algorithm, 20% from technology and data, and 70% from people applying insights to day-to-day decisions. This ratio underscores a critical truth: the applicability and success of AI depend heavily on organizational capabilities and employee AI literacy. Although AI has evolved from a buzzword to a necessity due to its increasing application, upskilling the workforce remains limited. The question is no longer whether AI is helpful, but rather, how to quickly deliver pragmatic, measurable impact.

Figure 2 – Where AI value in manufacturing comes from

Source: Berylls by AlixPartners

In automotive plants, the largest portion of controllable losses occurs during the “make” phase of the supply chain due to process instability, scrap, micro-stops, and cycle time variance. These issues directly impact profit and loss. AI improvements directly translate into cost savings and increased throughput per vehicle without requiring new platforms or supplier renegotiations. The impact is tangible: reductions in scrap of 10-30%, improvements in first-pass yield of 5-10%, and reductions in unplanned downtime of up to 50% – often within a single quarter. By reducing breakdowns and rework, AI maximizes output from existing assets, defers capital expenditures, and unlocks capacity before new equipment is needed. These improvements have a fast time to value because the necessary data – from MES, PLC, vision systems, and quality records – is already available in most plants. AI solutions are designed to support existing operations rather than disrupt them.

Instead of invasive line rebuilds, manufacturers benefit from tools like AI-powered set-point guidance, which are systems that continuously analyze production data to recommend the optimal machine settings for quality, speed, and efficiency. These tools support human operators and automated systems, helping them make better, faster decisions and improve performance without interrupting workflows. Predictive maintenance builds on this foundation to take operational efficiency a step further. Leveraging AI and Internet of Things (IoT) technologies, manufacturers can anticipate equipment failures before they occur. Machine learning algorithms detect patterns in historical and real-time data that indicate early signs of wear or malfunction, and anomaly detection models flag unusual behavior. This approach is particularly valuable for rate-limiting assets, helping manufacturers avoid unplanned downtime, maintain consistent throughput, and extend equipment life. Another predictive use case is AI-driven material ordering, which forecasts subcomponent shortages by analyzing production schedules and supplier lead times. This helps minimize bottlenecks and maintain a steady flow of materials for uninterrupted assembly.

These manufacturing advancements improve not just plant-level performance but also have a ripple effect across the entire supply chain. More stable production enables better forecasting, more reliable delivery schedules, and fewer returns. Thus, AI-driven optimization of manufacturing processes becomes a strategic lever for driving systemic improvements, transforming not just operations, but also the broader ecosystem they support.

The transition from concept to impact is difficult, not because AI models are inadequate, but because most automotive plants are designed for launches, firefighting, and cost reductions, rather than data-driven operations. Systems, processes, and structures were never designed with AI in mind. To identify these gaps, we apply two sequential lenses:

The Operations Maturity Assessment identifies structural bottlenecks in current performance, such as chronic bottlenecks, scrap hotspots, and launch instability, and prioritizes areas where AI can have the greatest impact. The second is the AI Readiness Assessment, which evaluates seven capabilities across more than 100 criteria to determine whether a plant can reliably scale those use cases beyond a single line or program.

Figure 3 – Our two-phased approach

Source: Berylls by AlixPartners

1. Data readiness is limited by fragmented legacy systems. Shop-floor data is static and is only collected at the start and end of processes. Resource analysis focuses on past states and requires significant manual effort. Poor quality, limited accessibility, and minimal external integration further hinder data readiness, creating a major barrier in AI projects.

2. Automotive plants typically run on a patchwork of technical infrastructure, including outdated PLCs and aging MES releases locked into vendor contracts. Any change to a line recipe, interface, or dashboard requires weekend downtime and long validation cycles. Cloud adoption is often blocked by corporate security or cost concerns. Consequently, promising AI pilots reside on “shadow IT” laptops and local servers, while the official production stack cannot absorb or operate them at scale.

3. Process integration is rigid and fragmented. Decision-making is rarely digitized, interoperability is weak, and KPI tracking inconsistent. Scaling AI from pilot to production is slow due to the lack of templates and limited flexibility.

4. Operational technology and machine connectivity in manufacturing are often fragmented, especially in brownfield environments. Production equipment is rarely fully integrated, and inconsistent machine data limits visibility into cycle times or process parameters. Quality systems are siloed, making end-to-end traceability and automated documentation difficult. Sensor and IoT coverage is often incomplete, and real-time data transmission rarely in place. Furthermore, logistics data integration is minimal, leaving gaps in material movement tracking and predictive analytics for inventory optimization. These shortcomings create a serious bottleneck to achieving seamless connectivity and AI-driven efficiency.

5. Core IT capabilities are often geared toward transactional stability, not analytics and AI. Even when business cases are strong, IT lacks the tools and skills to operate AI models like any other critical service – with monitoring, versioning, rollback, and standardized deployment patterns.

6. AI in manufacturing is not just a technical line upgrade but a cultural shift within the organization. Many firms lack a clear AI strategy, defined roles, and sufficient budgets. Workforce upskilling and change management remain major gaps.

7. Cost optimization in brownfield plants faces structural challenges. Retrofitting legacy systems often drives high upfront costs and consumes scarce engineering capacity. These investments compete for capital with pressing operational priorities – such as new tooling for OEM launches, mandatory safety upgrades, and overdue equipment replacements. Adding sensors and connectivity to older equipment is expensive and requires significant capital investment. The expense is hard to justify without a clear business case that demonstrates measurable production benefits – fewer line stops, lower scrap rates on critical parts, faster ramp-up for new launches, or reduced warranty risks. Without these outcomes, projects are often viewed as discretionary “IT spend” and become easy targets for budget cuts.

The challenges are real – fragmented data, legacy systems, unclear strategy – but so are the opportunities. Many plants already have valuable data sources, experienced teams and proven technologies in place. Often, it is a matter of connecting the dots and aligning efforts. Our structured approach combines the Operations Maturity Assessment and AI Readiness Assessment. While the Operations Maturity Assessment identifies gaps and prioritizes high-value areas, the AI Readiness Assessment evaluates each plant and its processes across seven key capabilities using a 1-5 scale. Together, these frameworks provide transparency on both current maturity and future opportunities. The result is a clear path forward:

If you want to understand where you stand today, which levers will improve performance the fastest, and how AI can make that happen, let’s get in touch.

How AI and marketing automation are reorganizing the automotive industry Munich, January 2026 A utomotive Marketing Under Pressure — Competing

EV democratization is fading in the West: Is the race already lost? Munich, January 2026 E lectric mobility is expanding

E-Mobility Supplier Survey 2025 Munich, January 2026 I n our annual analysis, we engaged with senior executives from 49 European

hina kontrolliert nicht nur Magnetmaterialien, sondern auch das Nadelöhr der Batteriewertschöpfungskette, was die europäische Produktion von Automobilkomponenten ins Wanken bringt.

Seit Monaten drosselt China den Export seltener Erden, was die europäische Produktion von Automobilkomponenten ins Wanken bringt. Bereits im Frühjahr führten Exportbeschränkungen zu Produktionsausfällen bei der E‑Motoren-Herstellung einiger OEMs, nun gibt es erneut Ausfälle. Doch das eigentliche Risiko liegt tiefer: China kontrolliert nicht nur Magnetmaterialien, sondern auch das Nadelöhr der Batteriewertschöpfungskette. Wer glaubt, die aktuelle Krise sei auf seltene Erden begrenzt, irrt – die nächste Stufe der Eskalation betrifft Lithium, Kobalt und Co.

Gleich das Insight zu seltenen Erden in voller Länge downloaden!

Zur Podcastseite: Podcast: Rare Earths: Supply Chain Shortages & Supply Chain Risks in Automotive

Oder direkt hier hören:

How AI and marketing automation are reorganizing the automotive industry Munich, January 2026 A utomotive Marketing Under Pressure — Competing

EV democratization is fading in the West: Is the race already lost? Munich, January 2026 E lectric mobility is expanding

E-Mobility Supplier Survey 2025 Munich, January 2026 I n our annual analysis, we engaged with senior executives from 49 European

NO TIME TO READ THIS WEBSITE?