Die gesamte Pressmitteilung ist zum Download verfügbar.

ie Automobilzuliefererindustrie steht stark unter Druck – das zeigt sich deutlich in der Beschäftigungsentwicklung: Im Jahr 2024 sank die Zahl der Beschäftigten in der deutschen Zuliefererindustrie weiter auf rund 267.000¹.

Europaweit kündigte die Branche im selben Jahr den Abbau von rund 54.000 Arbeitsplätzen an² – wovon voraussichtlich überwiegend deutsche Standorte betroffen sein werden. Gerade jetzt kommt es auf eine strategische Personalplanung an – denn es gehen auch Talente verloren, die es dringend für die Transformation braucht.

Die Automobilzulieferer stehen vor zahlreichen Herausforderungen: eine schwache Nachfrage im Bereich E-Mobilität, hohe Energie- und Rohstoffkosten, geopolitische Risiken und fragile Lieferketten. Unternehmen reagieren mit harten Restrukturierungen; Zugleich meldeten im Jahr 2024 fast 60 Zulieferunternehmen in Deutschland Insolvenz an – das entspricht nahezu der Anzahl an Insolvenzanträgen, die durch die Coronapandemie bedingt waren.³ Neben der Entlassungswelle ist also auch eine Insolvenzwelle zu beobachten. Die Transformation tritt in den Hintergrund, Unternehmen agieren im Krisenmodus – mit drastischen Folgen für die Beschäftigten.

Noch vor wenigen Jahren konkurrierten Automobilzulieferer um die besten Talente. Besonders gefragt waren beispielsweise Fachkräfte mit Expertise in den Bereichen Softwareentwicklung und Künstliche Intelligenz. Trotz anhaltenden Bedarfs fehlen vielen Unternehmen heute Budget und Perspektiven, um diese Talente zu halten. Gleichzeitig locken wachstumsstarke Branchen wie Tech und Energie. Die Zuliefererindustrie steht deshalb vor schwierigen Entscheidungen: Wer muss gehen, wer muss bleiben? Neben kurzfristiger Kostensenkung ist jetzt vor allem Ambidextrie gefragt: die Fähigkeit, Effizienz und Innovation zugleich zu managen. Sie erfordert Personalentscheidungen mit Weitblick und ein klares Verständnis der Fähigkeiten, auf die es jetzt und in Zukunft ankommt.

Die Transformation verlangt sowohl die stabile Weiterentwicklung des aktuellen Geschäfts als auch den Aufbau zukunftsfähiger Geschäftsfelder. Dafür braucht es einerseits operative Exzellenz, andererseits Innovationskraft. Die dafür nötigen Talente bringen unterschiedliche Profile mit, vereinen aber zentrale Fähigkeiten:

Diese Talente zu erkennen, gezielt einzusetzen und entlang des gesamten Wandels zu begleiten, ist Führungsaufgabe. Talente bleiben, wenn Unsicherheit abnimmt. Dafür braucht es konkrete Maßnahmen:

Zielgerichtet führen: Klare Entwicklungspfade, individuelle Weiterentwicklungsangebote und die frühzeitige und transparente Einbindung in strategische Schlüsselprojekte fördern Vertrauen, Motivation und Bindung der Mitarbeitenden.

Individuelle Anreize setzen: Beteiligungsmodelle, Sondervergütungen oder besondere Benefits (zum Beispiel Forschungskooperationen) wirken oft stärker als klassische Gehaltserhöhungen. Schlüsseltalente sollten außerdem für zukünftige Führungsrollen entwickelt werden. Qualifikationsdefizite werden so behoben, Loyalität und Aufgeschlossenheit gegenüber künftigen Wachstumschancen gestärkt.

Flexibilität im Rahmen der betrieblichen Leistungsfähigkeit ermöglichen: Teilzeit, Homeoffice oder geteilte Führungsverantwortung fördern die Work-Life-Integration. Differenzierte Vergütungssysteme und eine agile Unternehmenskultur steigern die Attraktivität des Unternehmens als Arbeitgeber.

Talentbindung scheitert am ehesten an einer schwachen Führung (Entscheidungs- und Konfliktscheu, Duldung von Low Performern), an der fehlenden Konsequenz in der Unternehmenskultur sowie an einem zu engen finanziellen Spielraum. Doch wer Talentbindung priorisiert und Ressourcen intelligent allokiert, kann auch unter schwierigen Bedingungen große Wirkung erzielen.

Talentbindung finanzieren

Angesichts drastischer Sparmaßnahmen wirkt Talentförderung zunächst wie ein Widerspruch. Doch Investitionen in Schlüsseltalente sind ein wichtiges Instrument zur Risikominimierung und Sicherung langfristiger Wettbewerbsfähigkeit. Statt flächendeckender Boni oder Standardfortbildung lohnt sich der Aufbau strategisch-selektiver Programme für genau jene Fachkräfte, die für die künftige Wertschöpfung und Innovationsfähigkeit entscheidend sind. Solche Programme können beispielsweise über die Reinvestition von Effizienzgewinnen in strategische Personalinitiativen erfolgen. Genauso helfen zielführende Kooperationen (zum Beispiel mit Hochschulen zum Aufbau relevanter Fähigkeiten für Zukunftstechnologien) dabei, finanziell schlanke Talententwicklungsprogramme aufzubauen. Wer gezielt investiert, senkt langfristig Kosten – verlorene Talente zurückzugewinnen, ist meist teurer und schwierig. Laut Bundesagentur für Arbeit lagen die durchschnittlichen Vakanzkosten in Deutschland im Jahr 2023 bei rund 49.500 Euro und die durchschnittliche Vakanzzeit bei 138 Tagen.⁴

Der Erfolg der Zulieferer wird in den nächsten Jahren davon abhängen, ob es ihnen gelingt, Effizienz und Zukunftssicherung parallel zu gestalten. Wer jetzt Schlüsselkräfte erkennt, fördert und bindet, verschafft sich einen klaren Vorsprung. Entscheidend ist also nicht nur, wer gehen muss – sondern vor allem, wer auf keinen Fall verloren gehen darf.

Abbildung 1 – Beschäftigte in der Automobilzuliefererindustrie vs. Automobilindustrie gesamt in Deutschland

Anmerkung:

Alle Angaben in Tausend, gerundet. Quelle: Analyse durch Berylls by AlixPartners basierend auf: Statistisches Bundesamt. (14. März, 2025): Anzahl der Beschäftigten in der Automobilzulieferindustrie in Deutschland in den Jahren 2005 bis 2024, sowie Anzahl der Beschäftigten in der Automobilindustrie in Deutschland in den Jahren 2005 bis 2024.

Quelle:

¹ European Association of Automotive Suppliers (15.01.2025): Job losses escalate as demand stays below expectation.

² European Association of Automotive Suppliers (15.01.2025): Job losses escalate as demand stays below expectation.

³ Statistisches Bundesamt (Abruf 08.05.2025): Insolvenzverfahren (Unternehmen nach ausgewählten Positionen – WZ08-29; WZ08-292; WZ08-293; Jahr 2024).

⁴ Bundesagentur für Arbeit (2023). Arbeitskräftenachfrage: Nachfrage sinkt vor dem Hintergrund der schwachen Wirtschaftsentwicklung merklich.

trategiearbeit im VUCA‑Zeitalter – warum jetzt handeln?

Volatilität, Unsicherheit, Komplexität, Ambiguität – egal, welchen Buchstaben der VUCA‑Gleichung man herausgreift, das Ergebnis bleibt gleich: Seit Jahresbeginn werden strategische Langfristpläne für Automobilhersteller sowie Zulieferer schneller ausgehebelt, als klassische Planungszyklen reagieren können. Denn hohe Strafzölle binnen weniger Tage, drohende Verbote chinesischer Connectivity‑Bauteile durch ICTS‑Regeln oder aber geopolitische Brandherde zeigen: Die Reaktionszeit schrumpft dramatisch. Gleichzeitig steigt jedoch die Unsicherheit und sie verstärkt sich auf jeder Stufe der Lieferkette.

Für Zulieferer steht daher fest: Noch nie war der Preis für verpasste Marktsignale und lange Reaktionszeiten höher. Die Gretchenfrage ist daher: Wie können Zulieferer-Strategieabteilungen ihr Marktumfeld effektiv scannen und zügig die richtigen Schlüsse aus einer Vielzahl paralleler Entwicklungen ziehen?

Unsere Projekte und Beobachtungen geben dabei Einblicke in eine vielversprechende Antwort: Zulieferer beginnen den „traditionellen Weg“ zu verlassen und schrittweise auf die Intelligenz großer Sprachmodelle (LLMs) zu setzen – in der Hoffnung, Veränderungen früher erkennen und dann entschlossen handeln zu können, um das Geschäft abzusichern. Diese LLMs beherrschen dabei – sofern richtig eingesetzt – deutlich mehr als die wohlbekannte Texterstellung, ‑zusammenfassung oder Bildgenerierung.

In der Praxis werden LLMs als „Thought Partner“ und autonome Analysten Strategieleitern zur Seite gestellt. Dies kann beispielsweise Fragestellungen zur Anfälligkeit des eigenen Absatzmarktes, zu Investitionsbedarfen oder auch Verhandlungsstrategien mit Zulieferern oder Kunden umfassen. Für den erfolgreichen Einsatz der Modelle bei derartigen Fragen kommt es zum einen auf die Modellqualität an – frei verfügbare Modelle verfehlen nicht nur die benötigte Präzision, sie bergen dazu auch noch Risiken beim Einsatz im Geschäftsumfeld; zum anderen muss ein Modell durch den richtigen Befehl (Prompt) angesteuert werden.

Mit den richtigen Daten, Fragestellungen und Nutzern ausgestattet, arbeitet agentische KI mit schnellen Rückkopplungsschleifen, bis das gesetzte Ziel erreicht ist – sie sucht eigenständig nach Antworten, bewertet Quellen, schließt Wissenslücken und erledigt Folgeaufgaben. So werden Szenarioanalysen, die manuell Tage dauern könnten, mitunter so weit beschleunigt, dass eine Entscheidungsempfehlung verfügbar wird, bevor der sprichwörtliche Kaffee aufgebrüht ist.

Das beschriebene Konzept ist das eines „Strategic AI Seismographs“ – einem Netz autonomer Agenten, das öffentliche und proprietäre Datenströme durchgehend abtastet, Relevanz quantifiziert und nur jene „Erschütterungen“ meldet, die tatsächlich relevant für die Erfolgsaussichten eines Zulieferers sind. Dabei gilt es, auf ein sauberes Fundament zu achten, das Zulieferern den erfolgreichen Einsatz ermöglicht, ohne sich in technologische Abhängigkeiten zu begeben. Gleichzeitig darf Freiheit für KI-Agenten keinen Freibrief darstellen. Drei zentrale Leitplanken zeichnen sich daher für die praktische Akzeptanz und Compliance ab:

Abbildung 1 – „STRATEGIC AI SEISMOGRAPH“-BLUEPRINT

(Erlaubt Anpassung an kundenspezifische Situation sowie schrittweise Umsetzung)

Quelle: Berylls by AlixPartners

ie Top-100-Automobilzulieferer werden aktuell mit einem sich zuspitzenden Mix aus kurzfristigem Druck und strukturellem Gegenwind konfrontiert.

Die jüngsten protektionistischen Maßnahmen der USA – insbesondere die Erhöhung von Zöllen auf Fahrzeugkomponenten und Fahrzeuge – treffen eine Branche, die bereits durch fragile Lieferketten und hohe geopolitische Unsicherheiten belastet ist. Parallel verschärfen sich die Marktbedingungen in China: Internationale OEMs verlieren zunehmend an Boden gegenüber schnell wachsenden, innovationsstarken lokalen Herstellern.

Diese Entwicklungen treffen die Branche in einer finanziell angespannten Lage. Viele Zulieferer haben in den vergangenen Jahren ihren Fremdkapitalanteil deutlich erhöht, während die Profitabilität unter steigenden Inputkosten, hoher Investitionslast und rückläufigem Absatzvolumen gelitten hat.

Folglich steigt der Druck auf die etablierten Zulieferer, sich an die neuen Marktgegebenheiten anzupassen.

Als Krisenursachen lassen sich folgende Faktoren identifizieren:

Technologischer Wandel. Die Entwicklung hin zum elektrischen Fahrzeug weist in den großen Märkten USA, Europa und China erhebliche Unterschiede auf. In Europa führt ein deutlich geringerer Absatz von Elektrofahrzeugen entgegen der Planung der OEMs und Zulieferer zu Überkapazitäten, fehlender Kostendeckung und zunehmender Planungsunsicherheit. In China erfolgt die Entwicklung komplett konträr, wobei vor allem lokale OEMs und Zulieferer vom steigenden Absatz profitieren. Weitere Megatrends wie automatisiertes Fahren und vernetzte Fahrzeuge belasten die Zulieferer durch hohe Investitionsbedarfe, deren Finanzierung zu einer wachsenden Herausforderung wird.

Höhere Faktorkosten und Kostendruck. Die im Zuge von Corona- und Ukraine-Krise stark gestiegenen Faktorkosten führten vor allem bei europäischen Zulieferern zu einem Margenrückgang, da aufgrund langfristiger Preisvereinbarungen eine Weitergabe an die OEMs nur zum Teil möglich war. Mittlerweile zeigt sich zwar eine teilweise Normalisierung variabler Kosten, jedoch auf einem nach wie vor höheren Niveau als vor der Coronapandemie.

Geopolitische Risiken und Volumenverschiebungen. Die aktuelle Zollpolitik der US-Regierung gefährdet den US-Automobilmarkt substanziell durch steigende Fahrzeugpreise. Zölle auf importierte Fahrzeuge und Fahrzeugkomponenten werden sich auch auf das Produktionsvolumen in Europa auswirken. Hinzu kommen potenzielle Verwerfungen der Lieferketten zwischen Kanada, USA und Mexiko – mit der Folge steigender Kosten. Diese Risiken treffen auf eine Industrie, die seit der Coronapandemie ohnehin unter einem deutlich geschwächten Markt leidet. Den nordamerikanischen und europäischen Märkten war es nicht möglich, wieder das Vorkrisenniveau zu erreichen, und selbst der einstige Wachstumsgarant China verharrt deutlich unter dem Niveau vor der Pandemie. Hinzu kommen aufstrebende chinesische OEMs, die zunehmend ihren Heimatmarkt dominieren. Innerhalb weniger Jahre konnten sie ihren Marktanteil von unter 50 % (2021) auf circa 65 % (2024) erhöhen, wobei von einer Fortsetzung dieses Trends auszugehen ist.

Steigender Wettbewerbsdruck. Neue Zulieferer, insbesondere aus China, drängen auf den Markt und heben sich durch neue Technologien, verkürzte Entwicklungszeiten und kompetitive Kostenstrukturen von ihren Mitbewerbern ab. Die chinesischen Zulieferer unter den Global Top 100 konnten von 2018 bis 2024 ihren Umsatz mehr als verdoppeln und ihre Marge deutlich erhöhen, während etablierte Player lediglich um rund 16 % gewachsen sind und leicht rückläufige Margen verzeichnen (vergleiche Abbildung 1).

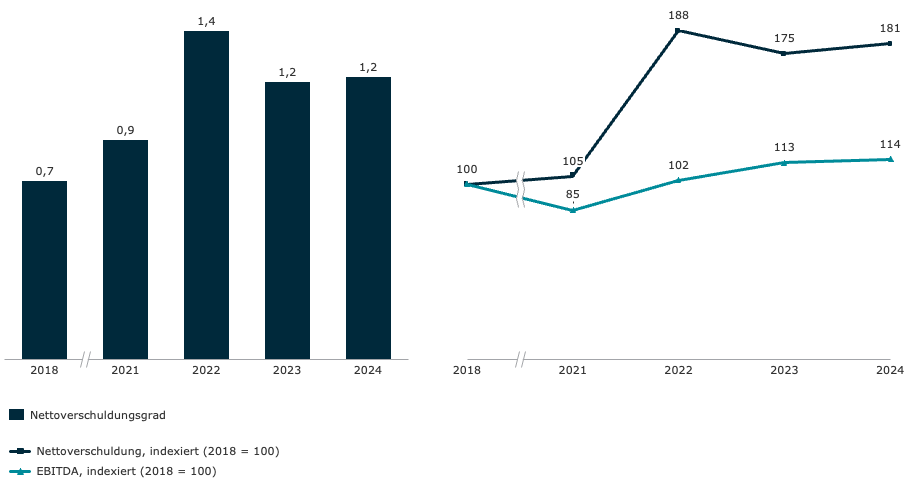

Steigende Kapitalkosten. Aufgrund des Margenrückgangs und der trüben Marktaussichten reduzieren viele Finanzierer ihr Kreditvolumen in der Automobilbranche was den Zugang zu Finanzierungen erschwert und verteuert. Hohe Investitionen in die Transformation der Geschäftsmodelle sowie geringere Gewinne führten fast zu einer Verdopplung des Nettoverschuldungsgrads bei den etablierten Zulieferern (vergleiche Abbildung 2). Über 40 % der Top-100-Zulieferer mit einem Kreditrating bei S&P haben Stand April 2025 im Vergleich zur Vor-Corona-Zeit eine schlechtere Bonitätseinstufung.

Eine Trendwende ist in absehbarer Zukunft nicht zu erwarten. Aufgrund angekündigter Produktionsverlagerungen der Hersteller und weiterer Exportbeschränkungen könnte die Fahrzeugproduktion in Deutschland bis 2030 um weitere 20 % zurückgehen. Die ohnehin geringe Auslastung der deutschen Werke von etwa 70 % würde sich dadurch weiter verschärfen, mit schwerwiegenden Folgen für den Standort Deutschland und die hiesige Zuliefererindustrie.

Strukturelle Anpassungen und Flexibilität bleiben daher auch künftig unerlässlich für die Zuliefererbranche. Die bereits angekündigten Streichungen von über 20.000 Arbeitsplätzen in Deutschland dürften nur die Spitze des Eisbergs sein. Angesichts dieser Entwicklung überrascht es kaum, dass Zulieferer gezwungen sind, ihr Geschäftsmodell und ihre strategische Ausrichtung zu überdenken. Immer mehr Unternehmen wenden sich von ihrer ursprünglichen Branche ab, tätigen Zukäufe in anderen Industriezweigen und diversifizieren so ihr Geschäftsmodell. Zahlen belegen diesen Trend: Seit 2023 ist der Umsatzanteil der Zulieferer im traditionellen Automobilgeschäft um über 6 % gesunken.

Die gute Nachricht ist, dass die Wichtigkeit und Tragweite der aktuellen Situation in den Etagen von Geschäftsführung und Vorstand frühzeitig erkannt worden ist. Die Erfahrungen im Umgang mit den vielfältigen Krisen seit Beginn der Pandemie zahlen sich nun für die Zuliefererindustrie aus. Welche weiteren Herausforderungen und Unwägbarkeiten in den kommenden Monaten auf die Branche zukommen werden, ist ungewiss. Dass sie kommen werden, steht jedoch außer Frage. Die weitere konsequente Umsetzung der bereits gestarteten Effizienzprogramme in Kombination mit einer ergebnisoffenen Strategiekontroverse werden über den Erfolg oder Misserfolg der Zulieferer im Umgang mit diesen Krisen entscheiden

Abbildung 1 – EBITDA-Marge TOP 100 Zulieferer

Anmerkung: N=64 Zulieferer: Konzernfinanzkennzahlen der Top 100 Zulieferer mit veröffentlichtem Finanzbericht Geschäftsjahr 2024

Quelle: Capital IQ, AlixPartners Analysis

Auf die oben genannten Herausforderungen gibt es keine allgemeingültige Antwort. Etablierte Zulieferer sollten die für sie richtige Vorgehensweise ausarbeiten und umsetzen. Dennoch lassen sich einige allgemeingültige Erfolgsfaktoren für effektive und effiziente Restrukturierungsprogramme identifizieren:

Frühzeitiges Erkennen und Anerkennung des Handlungsbedarfs. Viele Restrukturierungen scheitern, weil die betroffenen Akteure Krisen zu spät erkennen und zu spät handeln. Hoffnung, dass der Markt schon wieder anziehen wird, ist selten ein guter Ratgeber. Krisenursachen müssen offen adressiert und angegangen werden.

Rechtzeitige Einbeziehung der wesentlichen Stakeholder. Im Krisenfall erfordert eine erfolgreiche Restrukturierung die Unterstützung und Beiträge vieler wesentlicher Stakeholdergruppen, insbesondere der Kunden, Finanzierer, Warenkreditversicherer, Eigentümer und Mitarbeiter. Rechtzeitige Information und Transparenz sind entscheidend, um Vertrauen bei den wichtigen Stakeholdern zu bilden.

Restrukturierungsexpertise auf Unternehmensseite. Häufig fehlt die erforderliche Krisenerfahrung im Unternehmen, während aufseiten der externen Stakeholder erfahrene Restrukturierungsmanager die Führung übernehmen. Gleichzeitig muss das bestehende Management gerade auch in der Krise das operative Tagesgeschäft aufrechterhalten. Krisenerprobte Experten, gegebenenfalls auch im Management als Chief Restructuring Officer (CRO) eingesetzt, können diese Lücken schließen, das Management entlasten und eine konsequente Umsetzung sicherstellen.

Starker Fokus auf Liquidität. In schwierigen Zeiten und akuten Krisen ist Transparenz über die verfügbare Liquidität lebenswichtig. Kurzfristig wirkende Liquiditätsmaßnahmen sind essenziell, um die erforderliche Zeit für die Restrukturierung zu gewinnen – etwa in Form von Working-Capital-Maßnahmen, Ausgabenstopps und CAPEX-Optimierungen.

Anpassung und Flexibilisierung der Kostenstrukturen. Für die meisten Zulieferer ist es unumgänglich, Kostenstrukturen zu optimieren und zu flexibilisieren. Hierfür ist meist die Anpassung von Produktionskapazitäten und des Produktionsnetzwerks notwendig. Die Unsicherheiten in der Branche erfordern hohe Flexibilität und kurze Reaktionszeiten sowohl in der eigenen Organisation als auch über die gesamte Lieferkette hinweg.

Klare Strategie und zukünftiges Geschäftsmodell. Die Sicherstellung der langfristigen Wettbewerbsfähigkeit im globalen Wettbewerbsumfeld erfordert eine klare Fokussierung auf strategische Kernfelder (unter anderem Produkte, Technologien und Märkte). Hierzu müssen Zulieferer ihr aktuelles Geschäftsmodell kritisch hinterfragen und sich konsequent von strategisch nicht relevanten Geschäftsfeldern und Aktivitäten trennen („fix, sell or close“).

Konsequente Umsetzung der Restrukturierungsmaßnahmen. Die Maßnahmen müssen weit genug gefasst sein, um die langfristige Wettbewerbsfähigkeit nachhaltig wiederherstellen zu können – sowohl kostenseitig als auch technologisch und strategisch. Die konsequente Umsetzung der Maßnahmen ist hierbei ausschlaggebend.

Keine Vernachlässigung des Tagesgeschäfts. Gerade in länger verlaufenden Krisen besteht das Risiko, dass das operative Tagesgeschäft vernachlässigt wird, wodurch die bestehenden Krisenursachen noch verstärkt werden. Zur Wiedergewinnung der Wettbewerbsfähigkeit müssen Technologien und Produkte weiter vorangetrieben werden. Vertriebserfolge und die erfolgreiche Akquise neuer Aufträge sind zentral für den langfristigen Restrukturierungserfolg.

Abbildung 2 – Nettoverschuldungsgrad (Nettoverschuldung/EBITDA) und Nettoverschuldung

Anmerkung: N=53 Zulieferer: Konzern-Finanzkennzahlen Top 100 Zulieferer exkl. China mit veröffentlichtem Finanzbericht Geschäftsjahr 2024

Quelle: Capital IQ, AlixPartners Analysis

Der Handlungs- und Transformationsbedarf ist enorm hoch. Nach einigen bereits schwierigen Jahren steht die Branche zusätzlich durch veränderte Marktbedingungen in China, wachsende chinesische Konkurrenz, erschwerte Finanzierungsbedingungen, geopolitische Unsicherheiten und nicht zuletzt durch die US-Zollpolitik unter Handlungsdruck. Es ist entscheidend, erforderliche Transformationen und Restrukturierungen frühzeitig und konsequent anzugehen. Die rechtzeitige Einbeziehung der wesentlichen Stakeholder ist ein zentraler Erfolgsfaktor.

an hört sie überall auf den Gängen der Automobilzulieferer: Die Schlagwörter sind die gleichen, nur die Reihenfolge mag sich in Abhängigkeit von der strategischen Relevanz geringfügig ändern. Richtig – die Rede ist von Überkapazitäten, Zöllen, Stellenabbau und Diversifikation des Geschäftsmodells.

Dabei war der Ausblick für den deutschen Standort, insbesondere im Hinblick auf die Fahrzeugproduktion, bereits vor den Verwerfungen im Frühjahr deutlich eingetrübt. Diese Entwicklung muss wieder als Top-Priorität betrachtet werden, um rechtzeitig die richtigen strategischen Entscheidungen treffen zu können.

Die Anzahl der Beschäftigten in der deutschen Zuliefererindustrie ist stark rückläufig. Stand heute zählt die Branche 267.000 Beschäftigte. Das sind 14 % weniger als noch 2019. Damit verdeutlicht der Beschäftigtenstand in der Zuliefererindustrie sinnbildlich die Situation der Automobilnation Deutschland. Wurden hierzulande 2019 noch 4,9 Millionen Fahrzeuge produziert, waren es 2024 nur noch 4,2 Millionen – 14 % weniger.

Eine Trendwende ist in absehbarer Zukunft nicht zu erwarten. Aufgrund angekündigter Produktionsverlagerungen der Hersteller und weiterer Exportbeschränkungen könnte die Fahrzeugproduktion in Deutschland bis 2030 um weitere 20 % zurückgehen. Die ohnehin geringe Auslastung der deutschen Werke von etwa 70 % würde sich dadurch weiter verschärfen, mit schwerwiegenden Folgen für den Standort Deutschland und die hiesige Zuliefererindustrie.

Strukturelle Anpassungen und Flexibilität bleiben daher auch künftig unerlässlich für die Zuliefererbranche. Die bereits angekündigten Streichungen von über 20.000 Arbeitsplätzen in Deutschland dürften nur die Spitze des Eisbergs sein. Angesichts dieser Entwicklung überrascht es kaum, dass Zulieferer gezwungen sind, ihr Geschäftsmodell und ihre strategische Ausrichtung zu überdenken. Immer mehr Unternehmen wenden sich von ihrer ursprünglichen Branche ab, tätigen Zukäufe in anderen Industriezweigen und diversifizieren so ihr Geschäftsmodell. Zahlen belegen diesen Trend: Seit 2023 ist der Umsatzanteil der Zulieferer im traditionellen Automobilgeschäft um über 6 % gesunken.

Die gute Nachricht ist, dass die Wichtigkeit und Tragweite der aktuellen Situation in den Etagen von Geschäftsführung und Vorstand frühzeitig erkannt worden ist. Die Erfahrungen im Umgang mit den vielfältigen Krisen seit Beginn der Pandemie zahlen sich nun für die Zuliefererindustrie aus. Welche weiteren Herausforderungen und Unwägbarkeiten in den kommenden Monaten auf die Branche zukommen werden, ist ungewiss. Dass sie kommen werden, steht jedoch außer Frage. Die weitere konsequente Umsetzung der bereits gestarteten Effizienzprogramme in Kombination mit einer ergebnisoffenen Strategiekontroverse werden über den Erfolg oder Misserfolg der Zulieferer im Umgang mit diesen Krisen entscheiden

he AlixPartners Global Automotive Outlook 2025: Europa steht zum Verkauf

Die gesamte Pressmitteilung ist zum Download verfügbar.

he road ahead calls for action now. Faster distribution models such as direct sales are creating new responsibilities for companies, with marketing departments required to set up tactical campaigns in hours rather than days.

In this environment, it is imperative for marketing employees to generate powerful content at pace by improving their internal processes and tools, to drive sales more efficiently.

Raising the pressure further, companies across industries face growing demand for content that appeals to different stakeholders, from customers and suppliers to partners and employees. To meet these needs, companies are increasingly reliant on online platforms to engage with customers, streamline operations, and drive growth.

The implementation of generative artificial intelligence (GenAI) to create highly realistic, complex digital content is disrupting all industries and revolutionizing the global marketing landscape. GenAI offers a once-in-a-lifetime opportunity to supercharge companies marketing content supply chains to drive innovation and efficiency. Berylls by AlixPartners analysis shows that there is still tremendous untapped GenAI potential that companies can exploit to optimize content supply chains for a rapidly evolving, increasingly digitalized market.

Personalized, scalable content, often created using GenAI tools, is crucial for building customer loyalty and lifetime value in today’s evolving market landscape. This content must be scalable across various products, countries, sales and marketing channels, and audiences. However, marketers face bottlenecks throughout the content supply chain, with time-intensive and repetitive steps during the planning and development, review and approval, and distribution and management phases. In the past two years alone, content requirements have nearly doubled, according to 88% of customer experience and marketing experts. Furthermore, two-thirds of these experts anticipate a rise in demand over the next two years, ranging from five to twenty times the current levels. To effectively navigate these challenges and harness the power of GenAI, it is essential to implement strategic goals.

Download the full Insight now!

eflections from the 2025 Women Automotive Network Detroit Summit

On June 3the Women Automotive Network hosted its second Detroit Summit in Novi, Michigan. With over 500 in-person attendees and more than 200 virtual participants, representing in total more than 14 countries, the event brought together a vibrant community of leaders, allies, and innovators to explore the future of mobility, leadership, and resilience in an era of constant disruption.

I was honored to return to the stage this year to share insights on the topic: “Understanding Global Industry Trends and How to Remain Competitive.” Drawing from the 2025 AlixPartners Disruption Index, I highlighted that—for the first time in the six-year history of the Index—the automotive industry was ranked as the most-disrupted sector. This conclusion was based on a survey of 3,200 CEOs and other senior executives across 11 countries and 10 industries.

What’s striking is that disruption is up verses our survey of a year earlier across the entire automotive value chain: automakers, suppliers, dealers, aftermarket players, service providers, and even shared-mobility companies–who were once considered disruptors themselves.

Adding to the complexity, evolving tariff policies are introducing significant uncertainty and financial risk— in the U.S. alone, approximately $250 billion in vehicles and $140 billion in auto parts are now exposed to shifting tariff regulations.

Yet, disruption also brings opportunity. As I pointed out at the event in metro Detroit, also according to the 2025 AlixPartners Disruption Index 75% of executives industry-wide see auto-industry growth potential in materials innovation, 72% see it in connected-technology infrastructure, and another 72% see it in software-defined vehicles.

In lieu of a typical Q&A at the end of my speech, I was also privileged to host on stage by two remarkable leaders who shared their perspectives on disruption, tariffs, and staying competitive:

Beyond the panels and presentations, the recent summit was a celebration of connection inside the auto industry. It was a space to catch up with fellow industry aficionados, exchange ideas, and support one another—personally and professionally.

Despite the many disruptions the auto industry faces today, we lovers of this great industry continue to grow stronger, more resilient, and more committed to shaping the future of mobility. And all that was certainly on display in metro Detroit recently.

andels- und geopolitische Ereignisse senden kontinuierlich Schockwellen durch die Automobilindustrie. Kurzfristige Reaktionen stehen dabei im Vordergrund, wodurch mittel- und langfristige Perspektiven zu wenig Beachtung finden.

Dabei war der Ausblick für den deutschen Standort, insbesondere im Hinblick auf die Fahrzeugproduktion, bereits vor den Verwerfungen im Frühjahr deutlich eingetrübt. Diese Entwicklung muss wieder als Top-Priorität betrachtet werden, um rechtzeitig die richtigen strategischen Entscheidungen treffen zu können.

Die durch US-Zölle ausgelösten internationalen Turbulenzen sowie der Regierungswechsel in Deutschland haben viel „Staub aufgewirbelt“ in dem sie erhebliche Unsicherheit und Ablenkung in der Industrie verursacht haben. Trotz der Notwendigkeit einer schnellen Anpassungsgabe aller Industrieakteuren bleibt dennoch die zentrale Frage bestehen: Wie wird sich die deutsche Automobilindustrie – insbesondere die OEM-Produktion von Fahrzeugen – entwickeln, wenn sich die Lage wieder stabilisiert und sich der Staub gelegt hat?

Anfang 2024 sagten etablierte Industrieprognosen ein Produktionsvolumen für Deutschland von 5,3 Millionen Fahrzeugen im Jahr 2030 voraus, was einem Wachstum von 24 % gegenüber dem Stand von 2023 entsprochen hätte. Unser optimistisches Szenario ging sogar von einem noch höheren Wachstum aus. Gleichzeitig sahen unsere Risikoanalysen jedoch bereits, dass ein Produktionsvolumen in Deutschland von bis zu 2,9 Millionen Fahrzeugen in unterschiedlichem Maße gefährdet sein könnte.

Im Februar 2025, dem letzten Monat vor der Eskalation politischer und wirtschaftlicher Unsicherheiten, wurde die Prognose für 2030 bereits auf 4,2 Millionen Fahrzeuge nach unten korrigiert, wie in Grafik 1 dargestellt. Ein Rückgang des erwarteten Produktionsvolumens um 1,3 Millionen Fahrzeuge (mehr als 20%) ist nahezu einmalig. Dies resultiert in einer stagnierenden Entwicklung in Deutschland, während weltweit weiterhin ein jährliches Produktionswachstum von 1,3 % bis 2030 erwartet wird. Selbst unser pessimistisches Szenario aus dem Jahr 2024 ging noch von 4,6 Millionen produzierten Fahrzeugen in Deutschland im Jahr 2030 aus. Besonders kritisch ist die starke Abhängigkeit der deutschen Produktionsprognosen von der Produktionssteigerung bei Tesla – ein Risiko, das sich zunehmend als strukturell herausstellt.

Auf Basis dieser Prognosen wird das Wachstum der Fahrzeugproduktion in Deutschland künftig sogar unter dem ohnehin schwachen Wachstum des realen BIP liegen. Das bedeutet einen relativen Bedeutungsverlust der Automobilindustrie für die deutsche Volkswirtschaft. Grafik 2 zeigt diesen Abstieg im Vergleich zu wesentlichen Produktionsstandorten in der Automobilindustrie. Noch im Jahr 2024 zählte Deutschland zu den wenigen Ländern, in denen das Produktionswachstum der Automobilbranche über dem BIP-Wachstum lag.

Ein Produktionsniveau von lediglich 4,2 Millionen Fahrzeugen hätte gravierende negative Auswirkungen auf die deutsche Industrie. Doch selbst dieses Niveau ist angesichts der aktuellen Entwicklungen nicht gesichert. Unsere aktualisierten Modelle zeigen ein mögliches Produktionsspektrum von nur noch 3,2 bis 4,0 Millionen Fahrzeugen im Jahr 2030 – abhängig vom weiteren Verlauf der politischen und wirtschaftlichen Rahmenbedingungen.

Grafik 1 – Prognose Fahrzeugproduktion und Szenarien für Deutschland

(Prognose Fahrzeugstückzahlen bis 2030, in Millionen Fahrzeugen)

Quelle: S&P Global Mobility (Light Vehicle Production Forecast, February 2025), Berylls by AlixPartners

Grafik 2 – Entwicklung reales Bruttoinlandprodult und Fahrzeugproduktion

(Prognosen reales BIP und Fahrzeugstückzahlen 2024-2030, kumulativ in %)

Anmerkung: Länder mit über 1 Mio. Fahrzeugeinheiten Produktionsvolumen

Quelle: S&P Global Mobility (Light Vehicle Production Forecast, February 2025), IMF, Berylls by AlixPartners

Im Jahr 2019, also vor der Corona-Krise, lag der Anteil Deutschlands an der weltweiten Fahrzeugproduktion bei 5,5 %. Laut aktuellen Prognosen könnte dieser Anteil bis 2030 auf unter 4,0 % sinken. Diese Zahlen verdeutlichen die Dramatik der aktuellen Lage. Besonders kritisch ist dies vor dem Hintergrund, dass die Fahrzeugproduktion durch OEMs historisch ein zentraler Treiber für die Ansiedlung von Zulieferern entlang der gesamten Wertschöpfungskette war.

Deutschland kann es sich nicht leisten, weitere Marktanteile im globalen Wettbewerb zu verlieren. Es ist entscheidend, das Umfeld für bestehende Akteure – OEMs wie Zulieferer – attraktiv zu halten und gleichzeitig neue Marktteilnehmer aktiv anzuziehen. Nur durch neue Player kann langfristig ein relevanter Marktanteil an der globalen Fahrzeugproduktion gesichert werden, wodurch in Summe alle Akteure im deutschen Automobil-Ökosystem profitieren werden.