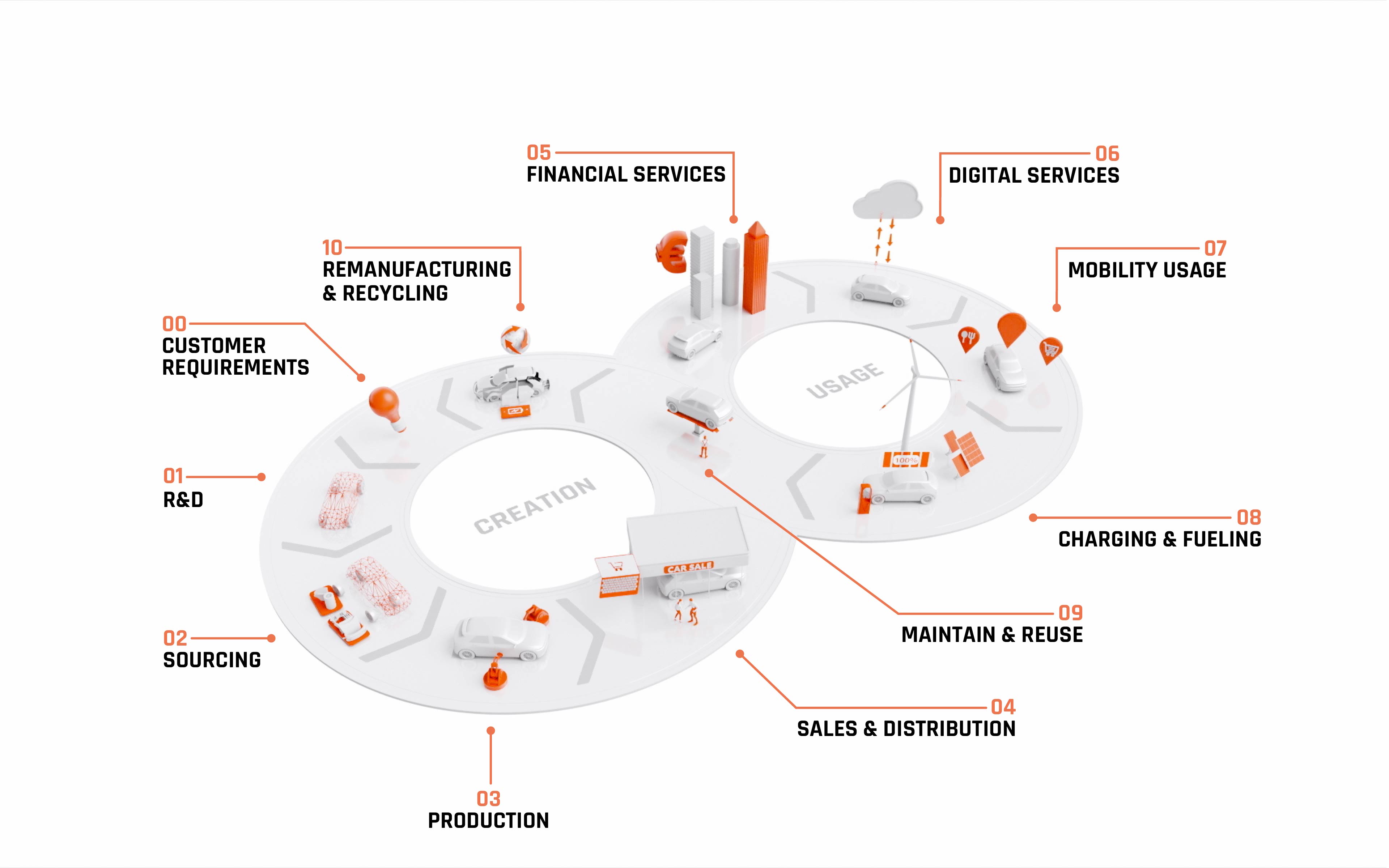

Our mission is to create a sustainable as well as economically viable future for the global automobility industry by thinking automobility end-to-end.

Our approach to accomplishing this we call the Berylls Loop. It covers the entire automotive value chain end-to-end and is at the heart of everything we do.