ccelerating EV adoption is now a US government priority, but will the battery production, charging points and customer demand be there to make it happen?

After 11 months in office, President Biden has kick-started a long overdue drive to increase

electric vehicle (EV) adoption in the world’s largest economy. In contrast to his predecessor

in office, he has declared himself an advocate of e-mobility, saying electric vehicles are “a

vision of the future that is now beginning to happen”, and adding “there’s no turning back“.

The bipartisan infrastructure bill signed into law last month covers $1.2 trillion of federal spending. However, only $7.5 billion of the total will be invested in expanding the country’s charging infrastructure, compared with $110 billion for improving US roads and bridges.

“There’s a vision of the future that is now beginning to happen, a future of the automobile industry that is electric, […] The question is whether we’ll lead or fall behind in the future.”

The Biden administration is also seeking to increase subsidies for battery electric vehicles (BEVs) to $12,500 per vehicle. However, that measure is part of the even larger $1.75 trillion Build Back Better act, which is still being debated in the Senate. The aim is to increase the share of BEVs and plug-in hybrid vehicles (PHEVs) among new car registrations to 50 per cent by 2030. This is a very ambitious target for the remainder of the decade, given the share of electric cars among new registrations in 2021 was 3 percent.

Far greater EV adoption is vital for the US to meet its emissions reductions targets, and the country is playing catch-up with China and Europe. We believe there are three elements that must be in place to enable change at scale, and they must happen simultaneously:

There must be a wide and attractive enough range of xEVs from different vehicle manufacturers to meet the various requirements of US buyers, from market- leading pickup trucks to affordable city runarounds.

Charging Stations about to build nationwide across the u.s.

Skilled workers will be “building a nationwide network of 500,000 charging stations. Creating good-paying jobs by leading the world in the manufacturing and export of clean electric cars and trucks,” Biden said in a speech in Pittsburgh. “We’re going to provide tax incentives and point of sale rebates to help all American families afford clean vehicles of the future.”

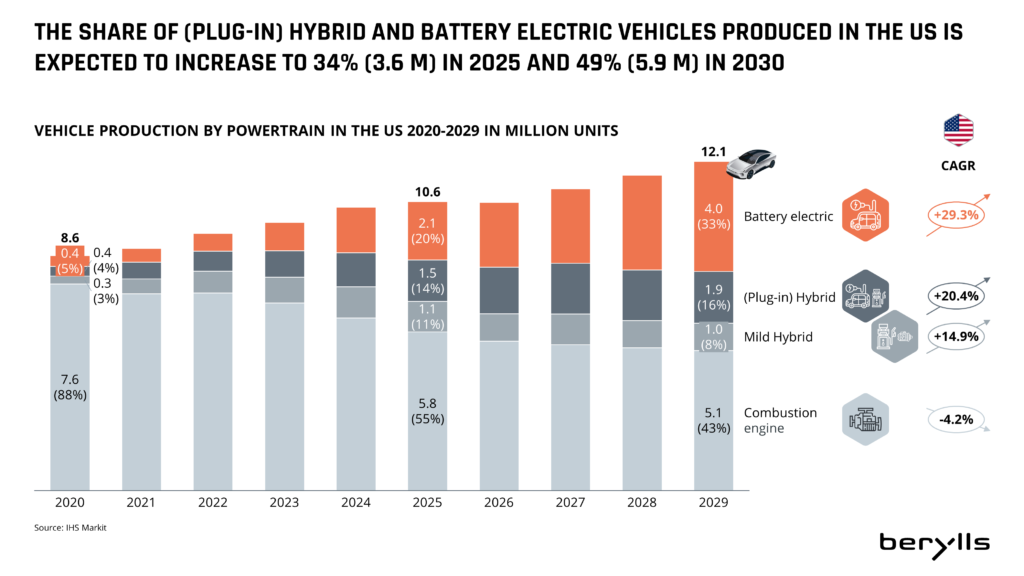

We assume that the share of PHEVs and BEVs produced in the US will increase to 34% (3.6 million vehicles) of all vehicles made by 2025 and 49% (5.9 million vehicles) in 2030 to reach the targets mentioned above (see Chart 1).

(Chart 1)

The act has not yet passed the Senate, but if it does so in its current form, the range of sEVs eligible for the maximum $12,500 subsidy would be limited considerably. Tesla and European OEMs that manufacture in the US, but whose workforce are not represented by the United Auto Workers union, are excluded. This creates a barrier to reaching the Biden administration’s target of xEVs making up 50 percent of new car registrations by 2030.

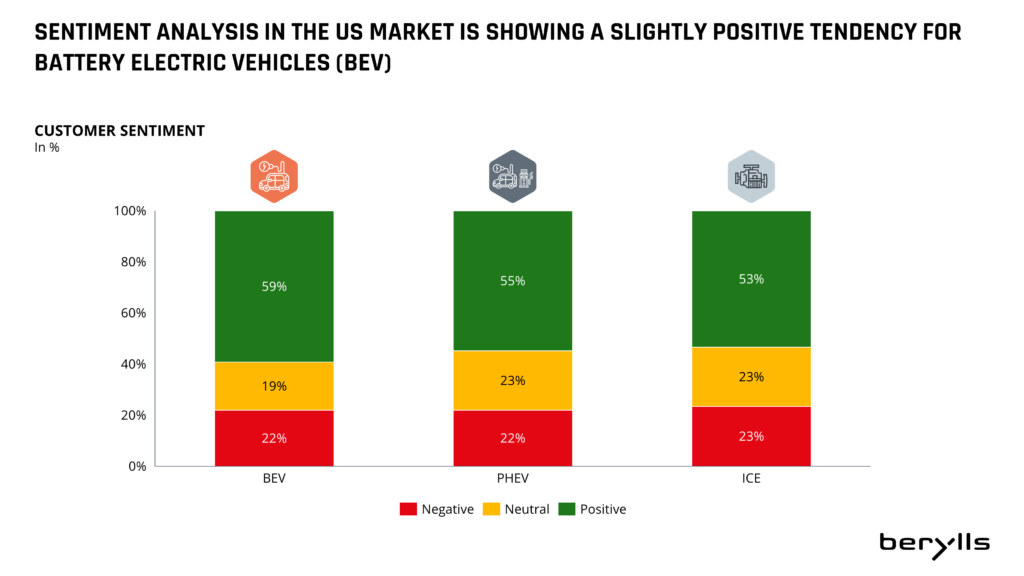

To better understand the extent to which xEVs appeal to US consumers, we conducted a sentiment analysis on a range of vehicle and engine types. The results showed surprisingly positive perceptions from customers. Among a selection of BEV and PHEV vehicles, the proportion of positive perceptions (59%) was slightly higher than for conventionally powered cars (53%) (see Chart 2).

(Chart 2)

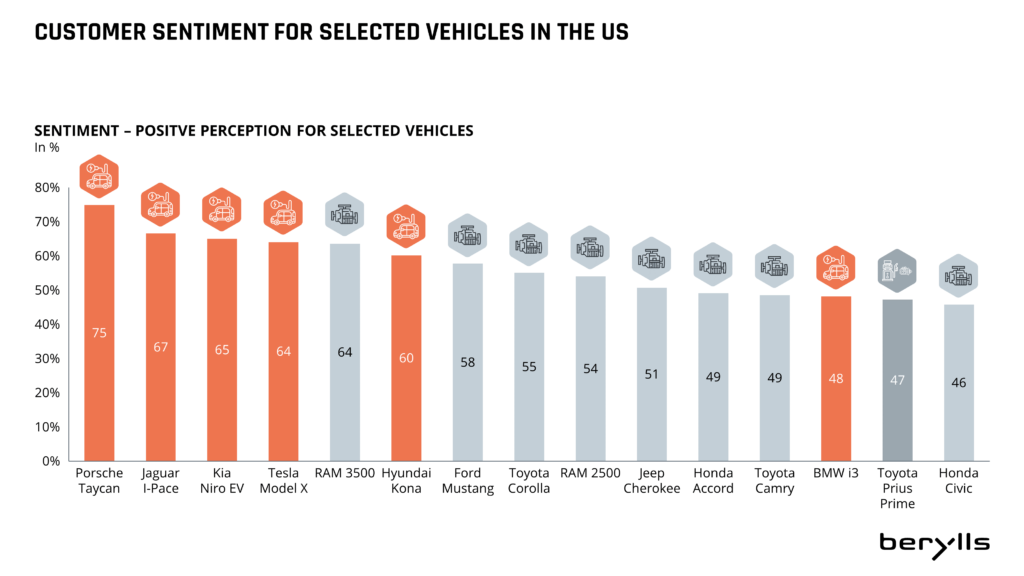

For example, a fully electric Tesla Model X was perceived as positively among our survey group as a Dodge Ram 3500, with 64% having a positive opinion. Of all the vehicles considered (ICE, PHEV and BEV), the top four were all-electric: the Porsche Taycan came out top (75% positive feedback), followed by the Jaguar I Pace, Kia’s Niro EV and Tesla’s Model X (see Chart 3). The Build Back Better act would exclude these models from the maximum possible subsidy for the reasons described above.

(Chart 3)

SUV and pickup models are particularly in demand among US customers, and the three major US OEMs have traditionally been strong in these two segments, with models such as the GMC Sierra, the RAM 1500 and the Ford F150. BEV or PHEV models made by these manufacturers have a good chance of receiving the maximum tax credit, and as a result, the widespread introduction of e-mobility in the US is likely to come via electric SUVs and pickups with powerful but costly batteries.

To scale up xEV production in the US in line with the government’s ambitious targets, battery production must also be greatly increased. The transport cost of importing batteries from Asia adds to their already-high cost, and continuing to reply on imports will also impact the EV subsidy available to drivers (of the $12,500 on offer, $500 is for US-made batteries).

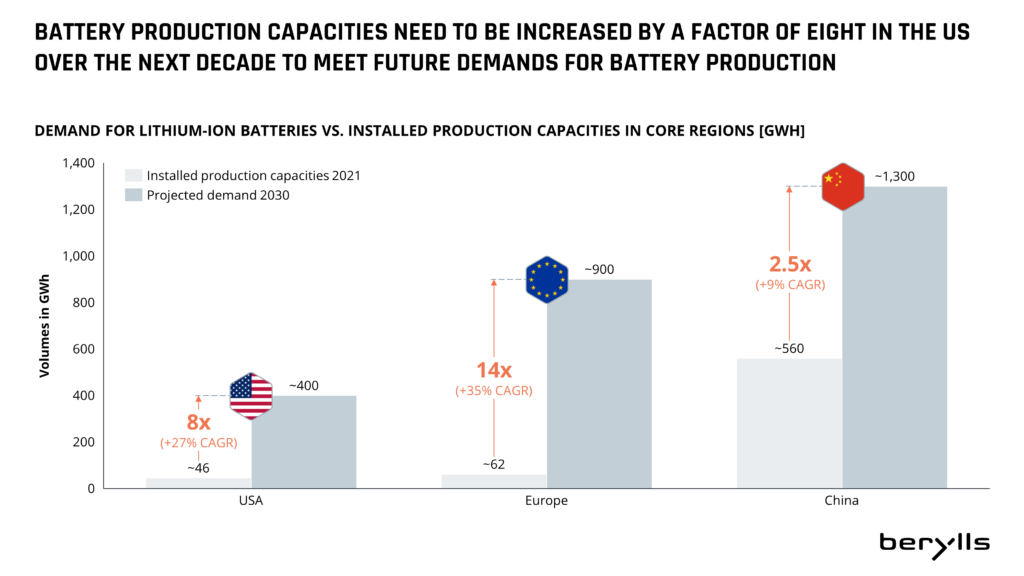

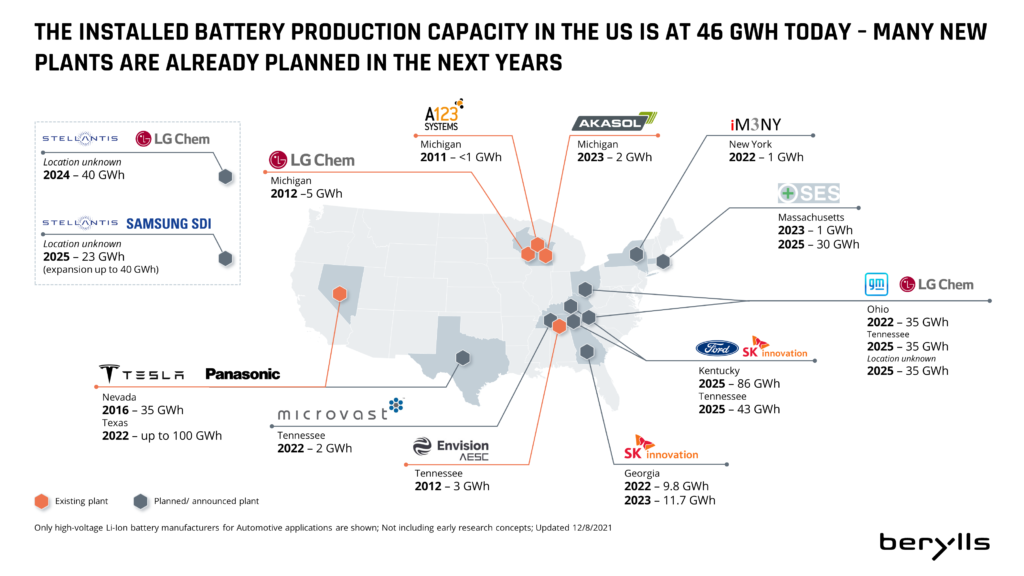

At present, the US has 46 gigawatt hours (GWh) of battery cell production capacity, of which 76 percent comes from the Tesla and Panasonic Gigafactory in the state of Nevada. By comparison, Europe currently has 62 GWh and China a staggering 560 GWh of production capacity (see Chart 4).

(Chart 4)

However, we expect the US to grow at a significantly faster rate in the next few years to catch up. Battery cell production capacity will expand by around 27 per cent a year to reach about 400 GWh per year by 2030, to meet pent-up demand. This would be enough to supply batteries for the 4 million BEVs that are expected to be produced in the US each year by 2030. To secure supply, US OEMs have started joint ventures with cell manufacturers (see Chart 5).

(Chart 5)

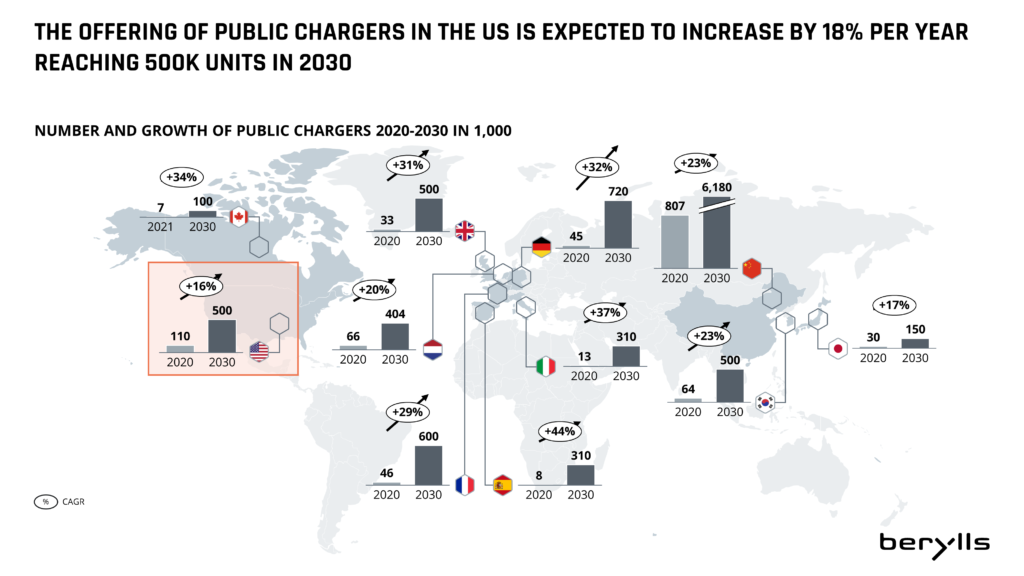

Making the EV transition a reality is highly dependent on having the right charging infrastructure in place. Currently, there are 110,000 public charging stations in the US, which are largely concentrated in wealthy east and west coast states including California. The middle of the country is still poorly equipped, particularly in states such as Idaho, Wyoming and Montana. The Biden administration’s goal is to create a national network, installing 500,000 public charging stations by 2030, which equates to about 18 percent annual growth (see Chart 6).

However, for a country the size of the US, these are not ambitious numbers. The UK, which is a fraction of the size, also wants to install 500,000 charging points by 2030. France is planning 600,000, Germany 720,000 and China 6.2 million.

(Chart 6)

We assume that in 2030 there will be 57 million fully electric cars on the roads in Europe and 24 million BEVs in the US. This means that, statistically speaking, approximately 20 electric cars would share one charging station in Europe, whereas in the US there would be 48 per charging station. An optimal ratio would be around 10 to 15 cars per charging station.

Also Germany faces a challenge in scaling up infrastructure quickly enough – 2,000 public charging points would have to be installed per week to meet the optimal cars per-charging-station ratio, but in reality, only 200 are currently being installed.

The US’s challenge is even greater: to reach the same charging ratio as Germany, we estimate the pace of installation would have to be twice as fast, at 4,000 charging points per week. As a result, we regard this infrastructure gap as the issue most likely to slow down widespread xEV adoption the US.

In Germany, EV infrastructure has been repeatedly put on the back burner. However, in the US, the Biden administration has the chance to take action. By recognizing the need to catch up with China and Europe, the government can start investing and incentivizing on the right scale now.

Dr. Alexander Timmer (1981) joined the Berylls Group, an international strategy consultancy specializing in the automotive industry, as a partner in May 2021. He is an expert in innovation and market entry strategies and can look back on many years of experience in the operations environment. Dr. Alexander Timmer has been advising automotive manufacturers and suppliers in a global context since 2012. He has in-depth expert knowledge in the areas of portfolio planning, development, and production. His other areas of expertise include digitalization and the complex of topics surrounding electromobility.